In today’s fast-paced digital economy, businesses are constantly seeking ways to optimize their operations and enhance customer experience. One area that often poses challenges is payment reconciliation, especially when it comes to direct bank transfers via NEFT, RTGS, IMPS, or UPI. These methods, while widely used, are prone to manual errors, time-consuming processes, and delays in payment confirmations. Enter RazorpayX Smart Collect 2.0, a revolutionary solution designed to automate reconciliation, provide real-time payment confirmations, and streamline collections for businesses of all sizes.

What is Smart Collect 2.0?

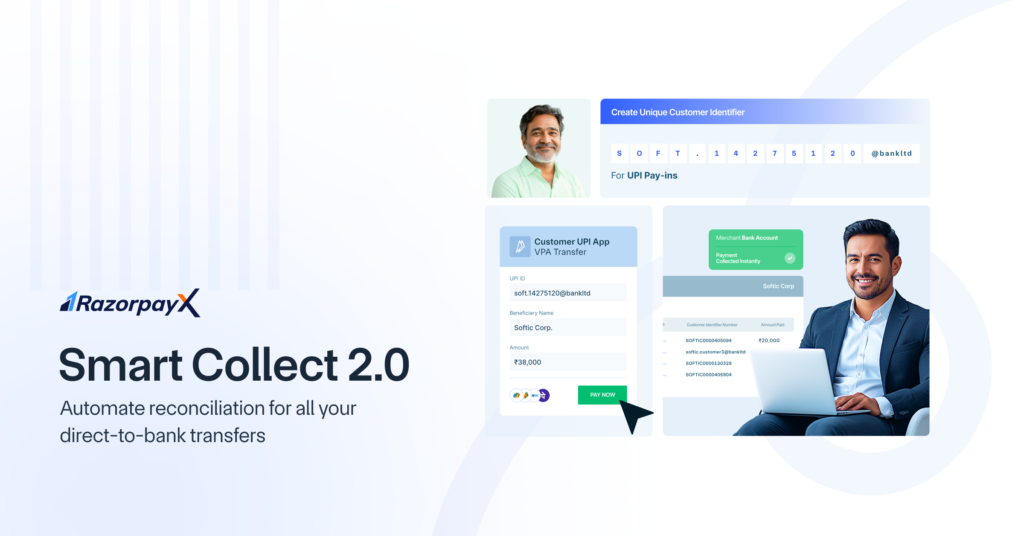

Smart Collect 2.0 is an advanced tool offered by RazorpayX that simplifies the process of receiving and reconciling direct bank transfers. It allows merchants to generate unique Customer Identifiers and Virtual UPI IDs for each customer – directly on top of their Current/Escrow Accounts – ensuring that every payment can be easily tracked, attributed to the correct source, and collected instantly. This eliminates the need for manual intervention, reduces errors, and enhances operational efficiency.

The product integrates seamlessly with a merchant’s current or escrow account, enabling them to accept payments via NEFT, RTGS, IMPS, and UPI. Once a payment is made, RazorpayX notifies the merchant instantly through webhooks, providing detailed information such as the customer’s details, the mode of payment, the exact amount paid, and the payer’s bank account or VPA (Virtual Payment Address). This level of transparency ensures accurate accounting and improves cash flow management.

Key Features and Benefits

Smart Collect 2.0 is packed with features that make it a game-changer for businesses:

- Automated Reconciliation: By assigning unique identifiers to each customer, the product automates the reconciliation process, saving merchants over 60 man-hours per week.

- Real-Time Notifications: Instant webhook notifications ensure that merchants are immediately aware of incoming payments, allowing them to send timely confirmations to customers.

- Third-Party Verification (TPV): This feature allows merchants to restrict payments to verified bank accounts, adding an extra layer of security.

- API and Dashboard Integration: Merchants can create and manage identifiers effortlessly through APIs or a user-friendly dashboard. The dashboard also provides transaction-level insights, helping businesses track performance and make data-driven decisions.

- One-click Refunds: In cases where payments fail or identifiers are closed, Smart Collect 2.0 enables seamless refunds, ensuring a hassle-free experience for both merchants and customers.

Use Cases Across Industries

Smart Collect 2.0 is versatile and caters to a wide range of industries:

- Financial Services: Broking companies, AIFs, and B2B marketplaces benefit from instant notifications and automated reconciliation for high-value transactions.

- Healthcare and Education: Hospitals, schools, and universities can track department-wise collections seamlessly, improving transparency and accountability.

- Retail and Franchises: Restaurants, travel agencies, and retail chains can monitor branch-wise sales in real-time, enabling better resource allocation and decision-making.

Conclusion

RazorpayX Smart Collect 2.0 is more than just a payment solution – it’s a catalyst for operational efficiency and customer satisfaction. By automating reconciliation, offering instant collections, and providing unparalleled transparency, it empowers businesses to focus on growth rather than administrative tasks. Whether you’re a small business or a large enterprise, Smart Collect 2.0 is your partner in streamlining payments and driving success in the digital age.