Table of Contents

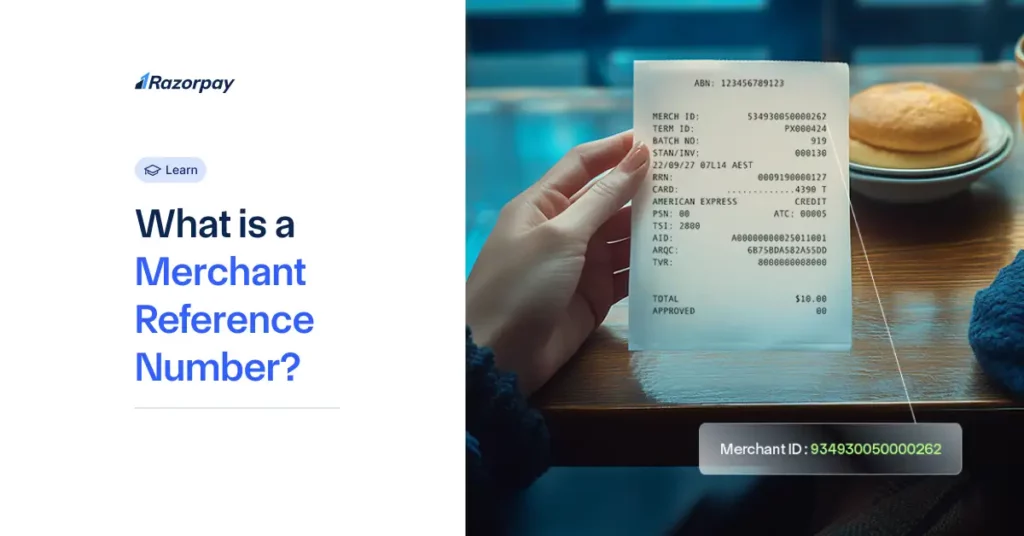

What is a Merchant Reference Number (MRN)?

A merchant reference number, also known as a transaction merchant reference number or merchant reference code, is a unique identifier assigned to each transaction processed by a merchant’s payment system. It plays a crucial role in tracking individual payments, ensuring proper reconciliation, and facilitating smooth transaction management.

The MRN acts as a distinct “tracking number” that links a customer’s payment to the merchant’s records and ultimate bank deposits. It flows through the entire payment cycle, from the initial transaction to the final settlement, allowing for end-to-end traceability.

Here are some key points about MRNs:

-

Generated automatically by the merchant’s payment processing system at the time of the transaction

-

Attached to the transaction details shared between the merchant, customer, payment processor, issuing bank, and acquiring bank

-

Essential for tracking and reconciling individual transactions

-

Helps handle refunds, chargebacks, or payment disputes by identifying the specific transaction

-

Vital for auditing, record-keeping, and maintaining detailed transaction histories

-

Enables granular reporting and data analysis of payments and revenue

Example of Merchant Reference Number (MRN)

To better understand what a merchant reference number looks like, let’s explore some real-world examples:

-

Alphanumeric format: MRN-45TY78-29Z

-

Numeric code: 98532147

-

Combination of merchant ID and transaction ID: XYZ001-78945612

MRNs can vary in format depending on the payment system or merchant platform. They may appear on:

-

Payment confirmation emails

-

Merchant transaction reports

-

Payment system records and dashboards

-

Customer credit card or bank statements

Why MRN is Essential for Businesses?

-

Streamlined Reconciliation

-

Match sales to deposits and financial reports using MRNs.

-

Identify and correct discrepancies quickly. Dispute Resolution

-

Locate and provide detailed records of a disputed transaction using the MRN.

-

Respond promptly to chargebacks and customer inquiries.

-

Efficient Refund Processing

-

Reference the exact original transaction using the MRN.

-

Process refunds smoothly and accurately.

-

Granular Reporting and Analysis

-

Use MRNs to identify and sort payments for detailed insights.

-

Gain visibility into transaction trends and patterns.

-

Enhanced Record-Keeping

-

Maintain clean and auditable records with distinct MRNs for each payment.

-

Simplify accounting and audit processes.

How Does Merchant Reference Number Work? A Step-By-Step Guide

-

Generation of MRN

- The payment system automatically creates a unique MRN for each transaction.

- Ensures no duplicate MRNs exist within the system.

-

Linking the MRN to the Transaction

-

MRN is associated with the specific transaction details.

-

Captures information like amount, date, customer details, etc.

-

Transmission of MRN

-

MRN is included in the transaction data sent to the payment processor.

-

Flows through the authorisation and settlement process.

-

Real-Time Tracking

-

Merchants can track the status of the transaction using the MRN.

-

Provides visibility into the payment lifecycle.

-

Payment Reconciliation

-

MRN is used to match the transaction to the corresponding settlement and deposit.

-

Enables accurate reconciliation of funds.

-

Security and Fraud Prevention

-

MRN helps identify and investigate suspicious or fraudulent transactions.

-

Supports chargeback and dispute resolution processes.

-

Customer Communication

-

MRN is shared with the customer on receipts, invoices, or payment confirmations.

-

Serves as a reference for customer inquiries or issues.

How to Generate a Merchant Reference Number?

-

Set Up a Payment System or Gateway

-

Choose a reliable payment processing solution.

-

Ensure it supports automatic MRN generation.

-

Determine the MRN Format

-

Decide on a consistent format for your MRNs (e.g., alphanumeric, numeric).

-

Consider including identifiers like merchant ID or transaction type.

-

Set Up Automatic MRN Generation

-

Configure your payment system to generate unique MRNs for each transaction.

-

Test the setup to ensure MRNs are generated correctly.

-

Generate MRN During Transaction Initiation

-

When a transaction is initiated, the payment system automatically creates the MRN.

-

Associate the MRN with the transaction details.

-

Send MRN to Customer and Merchant

-

Include the MRN in customer-facing communication (e.g., receipts, invoices).

-

Store the MRN in the merchant’s transaction records.

-

Manual MRN Generation (If Applicable)

-

In some cases, merchants may need to assign MRNs manually.

-

Follow a consistent format and avoid duplication.

-

Verify MRN Generation

-

Regularly check transaction records to ensure MRNs are generated correctly.

-

Address any issues promptly to maintain data integrity.

-

Reconciliation and Reporting

-

Use MRNs to reconcile transactions and generate accurate reports.

-

Monitor for any discrepancies or anomalies in MRN usage.

Using Merchant Reference Numbers in Payment Gateways

Merchant reference numbers play a vital role in payment gateways, enabling merchants to process and track transactions efficiently. Let’s explore how MRNs are used in popular payment gateways such as PayPal, Razorpay, and Stripe:

-

PayPal:

-

When a transaction is processed through PayPal, a unique merchant reference number is generated and associated with that transaction.

-

Merchants can access and view the MRN within their PayPal account, along with other transaction details such as customer information, payment amount, and status.

-

PayPal’s transaction search functionality allows merchants to quickly locate specific transactions using the corresponding MRN, making it easier to track and manage payments.

-

-

Razorpay:

-

Razorpay, a popular payment gateway in India, generates a merchant reference number for each transaction processed through its platform.

-

The MRN is included in the transaction response sent to the merchant, along with other relevant details such as the payment ID, amount, and status.

-

Merchants can use the MRN to track the status of transactions in real-time, whether they are pending, successful, or failed, enabling them to take appropriate actions and keep customers informed.

-

-

Stripe:

-

Stripe, a widely used payment gateway, assigns a unique merchant reference number to each transaction processed through its platform.

-

The MRN is referred to as the “Idempotency Key” in Stripe’s terminology and is used to ensure that each transaction is processed only once, even if the same request is sent multiple times.

-

Merchants can include the MRN in their API requests to Stripe, allowing them to track and manage transactions programmatically.

-

Stripe’s dashboard also provides a user-friendly interface for merchants to search and filter transactions based on their MRNs, facilitating easy reconciliation and dispute resolution.

-

Regardless of the specific payment gateway used, merchant reference numbers serve as a crucial tool for transaction tracking and reconciliation. By leveraging MRNs, payment gateways can:

-

Provide real-time transaction status updates to merchants, enabling them to monitor the progress of payments and take necessary actions.

-

Facilitate efficient dispute resolution by allowing merchants to quickly locate and reference specific transactions using the associated MRNs.

-

Enable seamless integration with merchants’ financial systems and reporting tools, making it easier to reconcile transactions and generate accurate financial reports.

-

Enhance security measures by using MRNs to detect and prevent duplicate or fraudulent transactions.

Merchants should familiarise themselves with the specific MRN implementation and usage guidelines provided by their chosen payment gateway. By effectively utilising merchant reference numbers within their payment gateway workflows, merchants can streamline payment processing, improve transaction visibility, and deliver a superior customer experience.

Best Practices for Managing Merchant Reference Numbers

-

Secure Storage:

-

Store MRNs securely in encrypted databases to protect sensitive transaction information.

-

Implement access controls to limit unauthorised access to MRN data.

-

-

Consistency and Uniqueness:

-

Maintain a consistent format for generating MRNs across all transactions.

-

Ensure each MRN is unique to avoid duplication and confusion.

-

-

Regular Audits:

-

Conduct regular audits of your MRN system to identify any discrepancies or anomalies.

-

Verify the accuracy and completeness of MRN data and resolve any issues promptly.

-

-

Clear Documentation:

-

Develop clear documentation and guidelines for MRN usage within your organisation.

-

Train relevant staff members on the proper handling and management of MRNs.

-

-

Integration with Other Systems:

-

Ensure seamless integration of your MRN system with other relevant platforms, such as your accounting software or CRM.

-

This enables smooth data flow and reduces manual efforts in reconciliation and reporting.

-

Common Problems with Merchant Reference Numbers and How to Fix Them

-

Duplicate MRNs:

-

Problem: Multiple transactions are assigned the same MRN, leading to confusion and reconciliation errors.

-

Solution: Implement checks in your payment system to prevent the generation of duplicate MRNs.

-

-

Missing MRNs:

-

Problem: Some transactions lack an MRN, making it difficult to track and reconcile them.

-

Solution: Ensure your payment system generates MRNs for all transactions and investigate any instances of missing MRNs.

-

-

Incorrect MRNs:

-

Problem: MRNs are incorrectly associated with transactions, causing discrepancies in records.

-

Solution: Regularly audit your MRN data and implement validation mechanisms to catch and correct errors.

-

-

Inconsistent Formatting:

-

Problem: MRNs are generated in different formats, making it challenging to process and analyse data.

-

Solution: Establish and enforce a consistent MRN format across all transactions and systems.

-

To address these issues, consider:

-

Implementing automated validation and error-checking mechanisms in your payment system.

-

Conducting regular data audits and reconciliations to identify and rectify discrepancies.

-

Utilising tools or services specifically designed to detect and resolve MRN-related problems.

Conclusion

A merchant reference number is a unique identifier assigned to each transaction processed by a merchant’s payment system, essential for tracking payments and facilitating reconciliation. It ensures end-to-end traceability from transaction initiation to settlement, aiding in dispute resolution and reporting. MRNs are automatically generated, linked to specific transaction details, and can vary in format. Proper management of MRNs enhances operational efficiency and improves customer service by streamlining processes like refunds and chargebacks.

Frequently Asked Questions (FAQs):

1. Can the same Merchant Reference Number be used for multiple transactions?

No, each merchant reference number should be unique to a single transaction. Reusing MRNs can lead to confusion and reconciliation issues.

2. Where can I find the Merchant Reference Number in a transaction?

The merchant reference number can typically be found on invoices, receipts, payment confirmation emails, and within the merchant’s payment system records or dashboards.

3. Is the Merchant Reference Number the same as a Transaction ID?

While both serve as unique identifiers, a merchant reference number is specifically assigned by the merchant’s payment system, whereas a Transaction ID may be generated by the payment processor or gateway.

4. How does a Merchant Reference Number help with payment tracking?

A merchant reference number acts as a unique tracking number that links a customer’s payment to the merchant’s records and bank deposits, allowing for end-to-end traceability and reconciliation of transactions.

5. What should I do if I can’t find the Merchant Reference Number for a transaction?

If you cannot locate the MRN, contact your payment service provider or review your transaction records within your payment system. They should be able to assist you in retrieving the missing information.

6. Can I manually create a Merchant Reference Number?

In most cases, MRNs are automatically generated by the payment system. However, some merchants may have the option to manually assign MRNs, following a consistent format and ensuring uniqueness.

7. How secure is the Merchant Reference Number?

MRNs themselves do not contain sensitive information. However, they are often associated with transaction details that may be confidential. It’s crucial to store MRNs securely and control access to prevent unauthorised use.

8. What happens if the Merchant Reference Number is incorrect?

An incorrect MRN can lead to issues in tracking, reconciling, or resolving disputes related to the transaction. It’s essential to ensure the accuracy of MRNs during the generation and assignment process.

9. How do I use the Merchant Reference Number in case of a dispute or chargeback?

In the event of a dispute or chargeback, provide the relevant merchant reference number to your payment service provider or the issuing bank. This helps them identify the specific transaction and investigate the issue more efficiently.

10. Are Merchant Reference Numbers the same across all payment gateways?

While the concept of MRNs is consistent, the specific format and generation process may vary across different payment gateways. It’s important to familiarise yourself with the MRN standards used by your chosen payment gateway.

11. How can I automate the process of generating Merchant Reference Numbers?

Most payment systems and gateways offer automatic MRN generation functionality. By configuring your payment setup correctly and integrating it with your existing systems, you can streamline the MRN creation process and ensure uniqueness and consistency.