Table of Contents

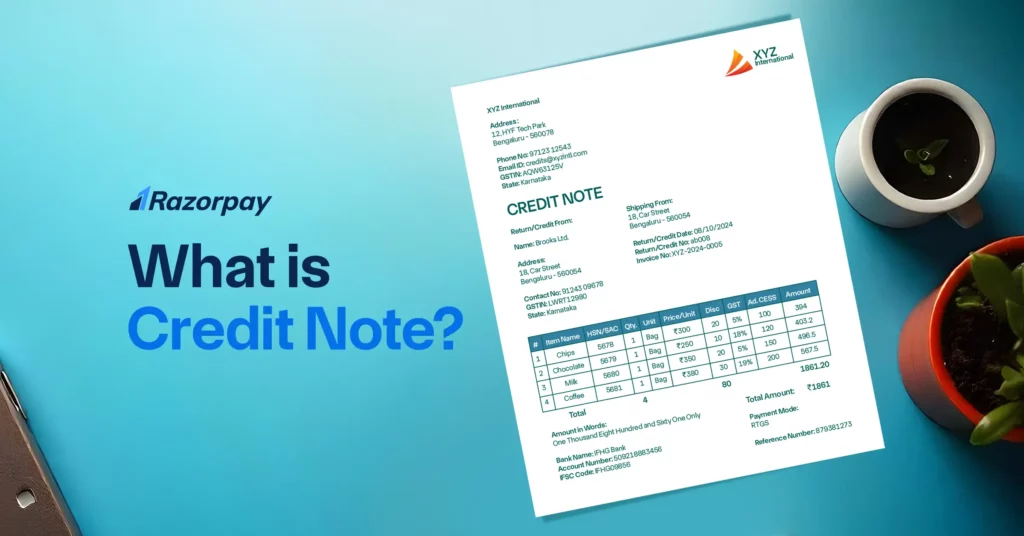

What Is a Credit Note?

A credit note, also known as a credit memo, is a document issued by a seller to a buyer to reduce the amount owed on an invoice. It is typically used when goods are returned, overcharged, or discounted after the invoice has been issued. A credit note serves as an adjustment, refund, or compensation, ensuring accurate financial records.

Use Case of Credit Note

Imagine you’ve purchased goods worth ₹50,000, but upon reviewing the invoice, you realise you were charged ₹5,000 extra due to an error. To correct this, the seller issues a credit note for ₹5,000. This credit note or CR note adjusts the invoice by reducing the amount you owe from ₹50,000 to ₹45,000.

1) Situation with an Invoice Error

In this scenario, the invoice error led to an overcharge. The seller acknowledged the mistake and issued a credit note to rectify it.

2) How the Credit Note Adjusts the Amount Due

The credit note effectively reduces your outstanding balance, ensuring that you are only responsible for paying ₹45,000 instead of ₹50,000.

3) Next Steps for Both Buyer and Seller

-

Seller:

They update their accounting records to reflect a decrease in accounts receivable by ₹5,000.

-

For You (the Buyer):

You adjust your accounts payable accordingly. If you’ve already paid the full ₹50,000, the seller may either refund the ₹5,000 or apply it as credit toward future purchases.

This process ensures that both parties maintain accurate financial records and uphold trust in their business relationship.

Essential Elements of a Credit Note

1) Essential elements

-

Credit Note Number:

A unique identifier, typically a serial number, that helps track the transaction. This should not exceed 16 characters.

-

Date of Issue:

The date a credit note is issued is critical for maintaining accurate records.

-

Original Invoice Number:

Reference to the original purchase order (PO) number or invoice against which the credit note is issued.

-

Seller and Buyer Information:

Include the names, addresses, and GSTIN (if applicable) of both parties to identify who is issuing and receiving the credit note clearly.

-

Reason for Credit:

A brief explanation, such as a product return, overcharge, or incorrect billing, outlining why the credit note is being issued.

-

Credit Amount:

The exact amount being refunded or adjusted. This includes the total taxable value, tax rate, and applicable taxes (e.g., GST).

-

Signature:

The supplier’s or an authorised representative’s signature to validate the document.

2) Additional Details

-

Product or Service Details:

The items’ description, quantity, and rate.

-

Return Authorisation Number:

This number can be included if the goods are being returned.

-

Payment Terms:

Any specific terms related to the use of the credit, such as how long it’s valid or if a refund will be processed.

How Does a Credit Note Work?

A credit note is a corrective document issued by a seller to adjust an invoice. It ensures that the buyer’s account is updated correctly and rectifies any errors in the original transaction.

Step 1: Identification of Discrepancy

The process begins when a discrepancy is identified, such as an overcharge, wrong product delivery, or defective goods. The customer or the seller may raise this issue, highlighting the need to correct the invoice.

Step 2: Issuing the Credit Note

Once the discrepancy is confirmed, the seller generates a credit note. The credit note includes essential details such as the reference to the original invoice, the amount to be credited, the reason for issuance, etc.

Step 3: Adjustment in Accounts

The credit note is then recorded in the business’s accounting system. This reduces the amount owed by the buyer. Depending on the situation, the buyer may receive a refund, or the amount can be adjusted for future transactions. For sellers, this ensures their books remain accurate.

Step 4: Application of Credit

Finally, the credit note is applied to the buyer’s account. If it’s a refund, the amount is returned to the customer. Alternatively, the credit can be used as a deduction from future payments. Clear communication with the customer regarding the credit note is crucial for maintaining trust and transparency in the transaction. Once the credit note is issued, both parties must be fully aware of the adjustment.

When to Issue a Credit Note?

Credit notes are typically issued when correcting an error or adjusting an amount from a previous invoice is necessary. Here are common reasons for issuing a credit note:

1) Invoice Mistakes:

If a customer has been overcharged or incorrectly billed, a credit note is issued to adjust the amount.

2) Product Returns:

When goods are returned due to defects or incorrect orders, a credit note reflects the refund or reduced payable amount.

3) Service Cancellations:

A credit note adjusts the charge accordingly if a service is cancelled or not fully provided.

4) Discounts or Special Offers:

When an unclaimed discount is applied after the original invoice, a credit note helps rectify the amount.

Types of Credit Notes:

1) Incoming Credit Note:

This is issued by your supplier or vendor to correct an overcharge or when you return products.

Example: You order ₹1,00,000 worth of goods but later return ₹20,000 due to defects. The supplier issues an incoming credit note for ₹20,000.

2) Outgoing Credit Note:

You issue this to your customer in case of errors or returns.

Example: You sell products worth ₹50,000, but the customer finds some damage and returns them. You issue a credit note to reduce their payable amount.

Issuing a credit note is crucial for maintaining accurate financial records. It ensures that the buyer’s and seller’s accounts are updated and balanced. Without a credit note, discrepancies may lead to confusion, disputes, and accounting errors. Additionally, credit notes help businesses maintain transparency and build trust with their clients.

How to Issue a Credit Note?

Step 1: Select a Template:

Start by choosing a credit note template in Excel, Word, or accounting software. You can also use invoice-creation tools that have built-in templates for credit notes. Ensure the template meets your business requirements.

Step 2: Add Business Information:

Update the template with your business logo, name, address, and GSTIN. This keeps the document formal and recognisable for the customer.

Step 3: Input Key Details:

-

Date of Issue:

Enter the date the credit note is issued.

-

Unique Credit Note Number:

Assign a unique number to the credit note for easy tracking.

-

Invoice Reference Number:

Mention the original invoice number against which the credit note is issued.

Step 4: Specify Buyer Details:

Include the customer’s GSTIN, place of supply, and other necessary information like their name and address.

Step 5: Add the Adjustment Amount:

Indicate the value being credited, whether a full or partial refund, and provide a clear explanation for the credit (e.g., product return, service cancellation, or overcharge).

Step 6: Save and Send the Credit Note:

After verifying all details, save the credit note in your system and send it to the customer via email or through your invoicing software.

You can simplify the process of issuing and managing credit notes using Razorpay. Razorpay’s invoicing tool offers an intuitive platform to easily create, track, and send credit notes. It automates the entire workflow, from generating unique credit note numbers to keeping your financial records accurate and up to date.

The Importance of Credit Notes

- Credit notes play a vital role in correcting invoice errors and ensuring accuracy in financial transactions. Whether it’s an overcharge, wrong item delivery, or service cancellation, credit notes act as an official record that adjusts the amount owed by the buyer. This transparency is essential for maintaining trust between businesses and customers.

- In addition to fixing invoicing mistakes, credit notes document returns and refunds, providing a clear audit trail. They help both the buyer and seller maintain accurate accounts by reflecting these changes, reducing potential discrepancies during audits. Proper management of credit notes ensures that your accounts remain balanced and error-free.

- Credit notes also serve as an essential tool in dispute resolution. When a customer raises a concern, issuing a credit note offers an immediate solution and prevents conflicts from escalating. In India, credit notes are equally significant in GST reporting. They allow for adjustments in taxable value and tax liability, ensuring compliance with the law.

- Effective credit note management can enhance cash flow, improve customer satisfaction, and ensure smooth accounting processes. Properly handled, credit notes simplify returns, prevent payment disputes, and provide clarity in business transactions.

Best Practices for Managing Credit Notes

Effective management of credit notes is essential for maintaining accurate financial records and ensuring smooth business operations. Proper handling prevents accounting discrepancies and builds trust with customers.

1) Organised Record Keeping

-

Clear Documentation:

Every credit note should be documented appropriately with all relevant details, including the original invoice reference, reason for issuance, and the credited amount. This ensures transparency and helps during audits.

-

Date and Numbering:

Sequential numbering and accurate dating are crucial to avoid confusion and maintain a clear audit trail. Each credit note should have a unique identifier for easy tracking.

2) Timely Issuance of Credit Notes

-

Prompt Resolution:

Issue credit notes immediately after identifying a discrepancy or return. Prompt action maintains customer trust and ensures that your financial records reflect the accurate amounts owed or refunded.

3) Automating Credit Note Management

-

Use of Invoice Management Systems:

Automating the process of credit note in accounting or invoice management systems ensures efficiency, reduces manual errors, and streamlines documentation.

4) Regular Reconciliation and Auditing

-

Periodic Review:

Regular reconciliation of credit notes helps ensure they are properly recorded and applied to your accounts. This also prevents financial mismanagement and provides accurate reporting during audits.

Clear Communication with Customers

-

Informing Customers:

Always communicate with customers when a credit note is issued. Explain the reason, the credited amount, and how it will be applied as a refund or deduction from future payments.

Compliance with Financial Regulations

-

Adherence to Legal Guidelines:

Ensure compliance with tax laws and financial regulations when issuing credit notes, mainly regarding GST reporting and adjustments. Proper legal adherence protects your business from potential liabilities.

What is the Difference Between a Credit Note And a Debit Note?

Aspect |

Credit Note |

Debit Note |

| Definition | A document issued by the seller to correct an overcharge or to refund for returned goods/services. | A document issued by the buyer to notify the seller of a return of goods or undercharge in an invoice. |

| Issuer | Seller | Buyer |

| Purpose | Adjust or reduce the amount owed by the buyer, reflecting refunds or returns. | Request a reduction in the amount due to overcharge, defective products, or other discrepancies. |

| Impact on Buyer’s Accounts | Reduces the amount payable in the buyer’s accounts. | Increases the payable amount for the buyer or decreases receivables. |

| Impact on Seller’s Accounts | Reduces receivables in the seller’s accounts. | Increases the amount owed by the buyer or reduces liabilities. |

| Matching for Accurate Accounts | Both credit and debit notes should align to ensure correct adjustment of receivables and payables, maintaining accurate records for both buyer and seller. | Both notes need to reflect the same adjustment to keep accounts accurate. |

Credit Notes in Razorpay Invoices

Razorpay Invoices offers seamless handling of credit notes, making the process simple and efficient for businesses. Here’s how it works:

-

Automatic Linking to Invoices:

When a credit note is issued, it automatically links to the original invoice, ensuring that both buyer and seller accounts are updated correctly. This eliminates manual matching and reduces the risk of errors.

-

Unique Numbering System:

A unique credit note number is assigned for each transaction, offering transparency and easy tracking. This organised approach is crucial during audits and helps maintain clear records.

-

Customisation Features:

Businesses can fully customise their credit notes by adding logos, adjusting formats, and including specific tax details. This flexibility ensures the credit notes align with your branding and compliance needs.

-

Efficient Management:

Credit notes are managed in real-time, with updates instantly reflected in your accounting system. You can easily issue, track, and apply them, ensuring prompt and accurate adjustments.

Conclusion

Credit notes are essential for correcting invoicing errors, managing returns, and ensuring accurate financial records. They help maintain transparency in business transactions, resolve disputes, and comply with tax regulations. Effective use of credit notes fosters trust and ensures smooth accounting processes for buyers and sellers.

FAQs

Q1. Who will issue a credit note?

The seller issues a credit note to adjust an invoice for errors, returns, or refunds.

Q2. Is a credit note a refund?

No, a credit note is not the same as a refund. It acknowledges the amount due to the buyer and can be used to reduce payments on an unpaid invoice or applied to future payments rather than providing immediate cash back.

Q3. Who pays a credit note?

The seller issues a credit note to the buyer, acknowledging a reduction in the amount owed. It allows the buyer to reduce a future payment either or adjust an outstanding invoice, but the seller makes no immediate cash payment.

Q4. Can a buyer issue a credit note?

No, a buyer cannot issue a credit note. Instead, buyers use debit notes to notify sellers of issues like overcharges or returns.