In today’s interconnected world, freelancers in India are increasingly finding opportunities to work with clients from around the globe. As per several industry reports, the number of Indian freelancers rose to a whopping 15 million in 2020. In 2022, the number of tech companies hiring freelancers grew to 65%, as compared to 57% in 2020. Whether you’re a web developer collaborating with a startup in Silicon Valley or a content writer contributing to publications in Europe, receiving payments from international clients can sometimes be a hassle. From high transfer charges to complex processes, traditional methods often leave freelancers grappling with unnecessary challenges while receiving international payments.

But fret no more!

Razorpay is proud to launch a solution tailored just for our Indian Freelancers – the MoneySaver Export Account, designed to simplify the international payment experience for freelancers, ensuring seamless receipt of payments from clients across the globe. With this innovative solution, freelancers can bid farewell to the complexities of traditional remittance systems and embrace a hassle-free way of accepting international payments.

But first, let’s understand the significant challenges freelancers face in detail below:

The Complexity of International Payments for Freelancers

- Fragmented Payment Modes: The available payment modes for export payments are fragmented and intricate, making it challenging for freelancers to navigate.

- High SWIFT Charges: Approximately 50% of cross-border payments to exporters rely on International Bank Transfers, incurring substantial SWIFT charges. For every $200 remitted internationally, $13 is spent on these fees, leading to significant financial implications.

- Costly Card Payments: Card payments exacerbate the financial burden on freelancers due to their expensive fees, further limiting payment options.

- Limited Support from Indian Payment Gateways: Most Indian PGs do not support international payments for individuals, forcing freelancers to seek alternatives like international payment gateways, which come with their expenses.

- Cumbersome Direct Deposits: Freelancers often resort to accepting payments directly into their Indian accounts, which is a cost-ineffective and time-consuming process.

- Complex Transaction Processes: Reports highlight the need for multiple visits to bank branches for a single global B2B transaction, adding layers of complexity and inefficiency.

Revolutionize your Freelance Finances with the Razorpay MoneySaver Export Account

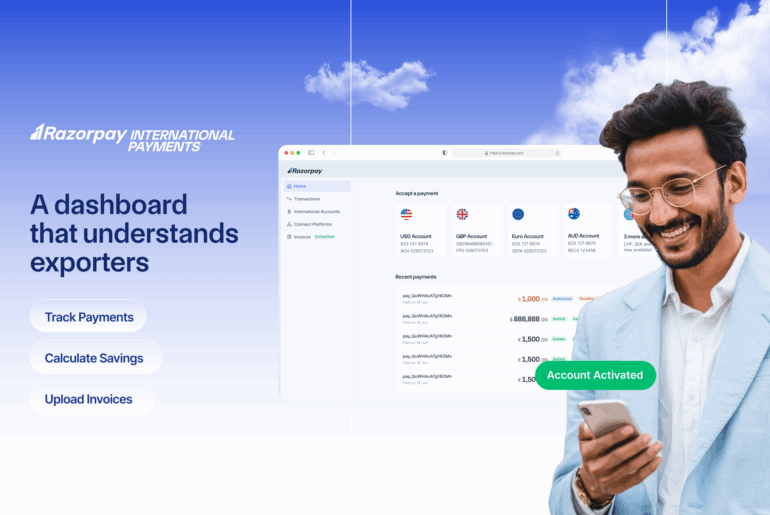

Razorpay introduces the MoneySaver Export Account – India’s first Smart Account to offer 50% savings on International bank transfers for exporters and 100% free for International customers, on all bank transfer transactions. With this innovative offering, freelancers can seamlessly open a MoneySaver Export Account in their preferred country and accept payments locally via bank transfers through the Razorpay platform. This smart account is available across key markets such as the US, UK, Canada, Australia, and Europe, allowing freelancers to leverage preferred banking networks like ACH (USA), SEPA (Europe), SWIFT, FPS (UK), and more for collecting payments.

So, what sets the MoneySaver Export Account apart? Let’s delve into its key features:

- Built for Freelancers

Razorpay understands the unique challenges faced by freelancers. We’ve created the MoneySaver Export Account specifically to address your needs for a simple, affordable, and secure way to receive payments from international clients.

- Say Goodbye to Hidden Fees and Hello to Transparency

Unlike traditional wire transfers with their exorbitant fees and hidden charges, the MoneySaver Export Account offers a transparent pricing structure. You’ll know exactly what you’re paying upfront, with no surprise deductions.

- International Payments Made Easy

Imagine receiving international payments with the same ease as domestic transfers. That’s the magic of the MoneySaver Export Account. Your clients can pay you in their local currency, eliminating the hassle of currency conversion for them. The funds are then seamlessly deposited into your Indian bank account.

- Seamless Compliance and Account Creation

Fully compliant with RBI regulations, the account requires a quick Video KYC process, in line with the latest guidelines for Cross Border licenses. Once completed, opening a US/UK/Australia/Canada account through Razorpay is swift, ensuring a seamless experience for freelancers.

- Risk-Free Transactions

International bank transfers via the Razorpay platform are completely risk-free, with additional compliance support through automated Foreign Inward Remittance Statements (e-FIRS) for each transaction.

- Focus on Your Work, We’ll Handle the Rest

Razorpay takes care of the complexities behind international payments, allowing you to focus on what you do best – your work. Our automated systems ensure smooth transactions and provide detailed reports to help you manage your finances effectively.

Transform your Freelance Journey Now!

Expanding your freelance business beyond borders has never been easier. By offering 1-click onboarding, support for USD and over 160 currencies, and affordable, transparent pricing, Razorpay empowers freelancers to focus on growing their business without worrying about the complexities of accepting payments. Whether you’re a seasoned freelancer or just starting your journey, the Razorpay MoneySaver Export Account empowers you to scale your business globally.

Ready to Get Started?

Sign up today and experience the freedom, flexibility, and efficiency it offers your freelancing business!