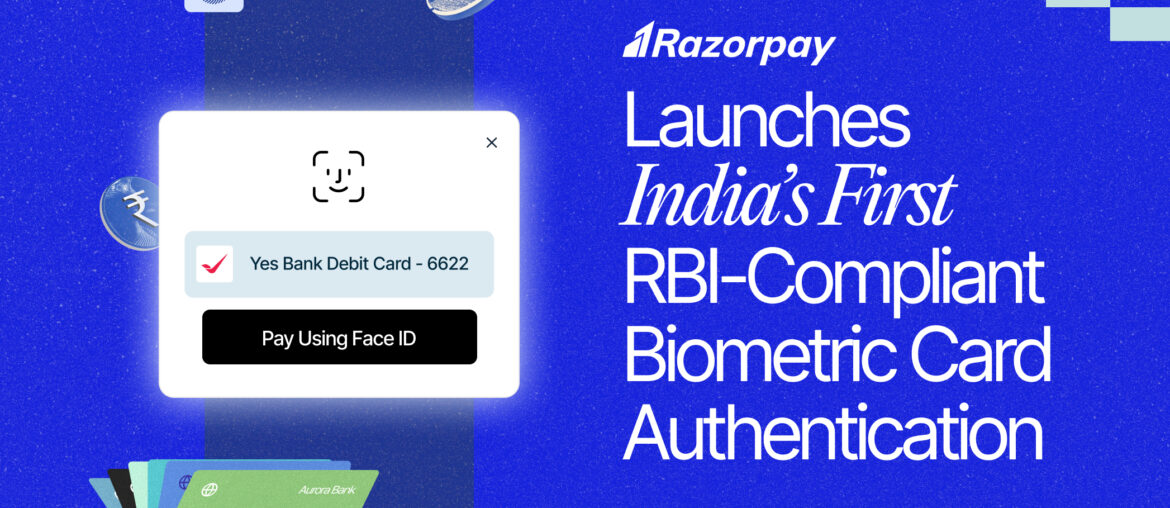

- Razorpay ACS approves payments instantly with biometrics, eliminating OTP delays and delivering a smooth, 1-click experience

- Ensures RBI compliance, 35% reduction in OTP authentication errors, and frictionless checkout control

INDIA, Bengaluru – 6 October 2025: Razorpay, India’s Leading Full-Stack Payments and Banking Platform for Businesses, today announced the launch of India’s First Biometric Card Authentication, Access Control Server (ACS), in partnership with YES BANK. Traditionally, payment authentication till now was limited to a two-factor authentication – a combination of PIN and SMS OTP. But for the first time ever in India, as per the RBI’s latest guidelines, online card payments can now be authenticated using Face ID.

ACS is the technology behind online card authentication, which is built for scale – powers 10,000 transactions per second with the highest success rate, powered by AI and now, biometrics.

- With AI-powered risk checks, ACS keeps payments secure in real time while ensuring smooth checkouts for users, reducing failures for banks, and higher conversions for businesses.

- And, Biometric authentication offers a higher level of security by design, as unique identifiers like facial recognition cannot be easily copied or stolen like an OTP.

Authentication is the foundation of trust in digital payments – but traditional methods like OTPs have struggled to keep up. In India, 35% of payment failures stem from issues like delayed or incorrect OTPs. At the same time, digital payment fraud is rising sharply, with losses exceeding ₹520 crore in FY25, according to RBI data. OTP-only flows are increasingly fragile against today’s scale and threats, and the lack of support for newer methods like biometrics or device-based verification continues to cause failed transactions.

With the RBI’s latest guidelines announced in September 2025, mandating stronger and smarter authentication, the industry needs a solution that balances robust security with seamless customer experience, one that keeps fraud at bay without slowing payments down.

Razorpay ACS addresses these challenges and aims to make digital payments:

- Secure & seamless for customers: Approve transactions instantly with biometrics, no more entering CVV or waiting for OTPs. Unique digital biometrics add an extra layer of security while ensuring a smooth, 1-click experience across devices.

- Reliable & Compliant for banks: With the highest success rates, Razorpay ACS reduces drop-offs, lowers operational costs by 10%, and ensures full compliance under RBI’s new rules. Banks also benefit from faster integrations and more efficient operations.

- Growth-focused & Trusted for merchants: Increased revenues, larger ticket sizes, and repeat purchases, with trust and security built into every checkout. Razorpay ACS reduces OTP errors by 35% reduction and offers instant card controls, affordability options, and rewards directly – all seen on the authentication screen.

Khilan Haria, CPO, Razorpay, said, “Following the RBI’s final guidelines, we are proud to pioneer and co-create the future of card authentication in India. With Razorpay ACS, we’re not just bringing biometric authentication to every card issuer and merchant – we’re creating a safer experience for users, unlocking new growth opportunities for businesses, and helping banks meet today’s toughest compliance standards with confidence. This is why today means so much to us. It is not just about solving today’s OTP delays or fraud risks, it’s about building the next decade of digital trust, where authentication becomes invisible, intuitive, and growth-focused for businesses, while being effortless and secure for customers.”

Anil Singh, Country Head, Credit Cards & Merchant Acquiring, YES BANK, said, “At YES BANK, we are delighted with the performance of Razorpay ACS, which we have co-created in partnership with Razorpay. We remain committed to delivering secure, seamless, and future-ready payment experiences to our customers. The high authentication success rates and real-time fraud prevention delivered by Razorpay ACS are being widely acknowledged by our customers, further strengthening their trust and reinforcing our vision of enabling safer, smarter, and more intuitive digital payments at scale.”

With Razorpay ACS, the company continues to strengthen India’s digital payments ecosystem by delivering industry-first solutions that combine cutting-edge technology, regulatory compliance, and customer-centric design. By integrating biometric authentication and AI-driven fraud detection, Razorpay is helping businesses and consumers transact with confidence, while supporting the growth of a safer, more reliable Digital India.

***