Imagine you’re an Indian business owner who has just completed a major project for a client in the United States. You send the invoice and wait for the payment. But days turn into weeks. When the money finally arrives, it’s less than you expected after high fees and a confusing currency conversion process. This frustrating scenario is a common headache in global trade.

But what if your US client could pay you directly in Indian Rupees (INR), just as easily as they pay a local vendor? This is where a crucial piece of banking infrastructure, the Vostro account, comes into play. It’s the invisible engine that makes cross-border payments in local currency smooth, fast, and efficient.

In this article, we’ll break down what a Vostro account is, how it works with real-world examples, and why it’s a game-changer for Indian exporters, freelancers, and businesses.

Key Takeaways

- A Vostro account is an account held by a foreign bank with an Indian bank, denominated in Indian Rupees (INR).

- It allows foreign entities to settle payments for Indian goods and services directly in INR.

- This system reduces currency conversion risks and delays for Indian exporters.

- You don’t interact with Vostro accounts directly; they are part of the backend banking infrastructure that payment platforms like Razorpay use to simplify your international transactions.

What is a Vostro Account?

The word “Vostro” is Latin for “yours.” In the world of banking, a Vostro account literally means “your account with us.”

Think of it this way: a Vostro account is an INR account that a foreign bank (like JPMorgan Chase from the US) opens with an Indian bank (like the State Bank of India). From SBI’s perspective, they are telling JPMorgan, “This is your account with us.”

This special account allows the foreign bank to hold funds in Indian Rupees and make payments on behalf of its clients directly within the Indian banking system. It’s the foundational mechanism that enables international trade to be invoiced and settled in INR, bypassing the need for multiple currency conversions.

How Does a Vostro Account Work?

The process is simpler than it sounds. It’s all about creating a local payment pathway for a foreign entity.

Let’s use an analogy. Imagine your friend from Germany is visiting you in India. Instead of them struggling to exchange Euros for every small purchase, they hand you €500. You convert it to INR and keep it in a separate pouch. Whenever your friend wants to buy something, you pay the local shopkeeper from that pouch on their behalf.

The Vostro account is that “pouch.” The foreign bank is your friend, you are the Indian bank, and the pouch holds the INR ready for local payments.

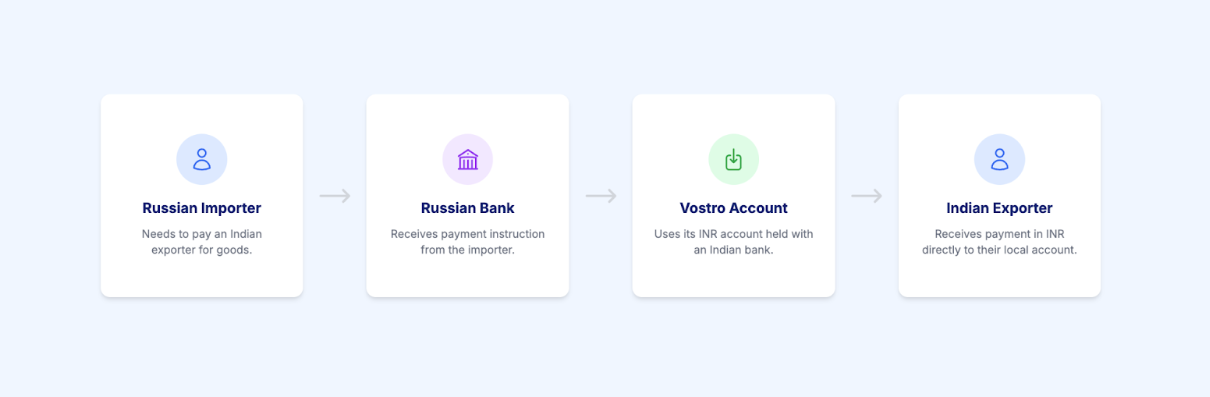

The typical transaction flow looks like this:

- A foreign bank (e.g., a bank in Russia) opens a Vostro account with an Indian bank and funds it.

- An Indian exporter sells goods to a Russian buyer and sends an invoice in INR.

- The Russian buyer instructs their bank to make the payment.

- The Russian bank uses the funds in its Vostro account in India to transfer the exact INR amount to the Indian exporter’s account.

The payment is settled quickly and entirely within India, just like a domestic transfer.

Real-life Vostro Account Examples

Vostro accounts aren’t just a theoretical concept; they are actively used to facilitate global trade today.

- Example 1: Russia-India Trade: In recent years, India and Russia have increasingly settled their trade in national currencies to bypass reliance on the US dollar. Several Russian banks have opened Vostro accounts with Indian banks. This allows Indian oil importers to pay Russian suppliers in INR and Indian exporters of pharmaceuticals or tea to receive payments in INR.

- Example 2: Global Correspondent Banking: A massive global bank like HSBC, headquartered in the UK, needs to process payments for its clients who do business in India. To do this efficiently, HSBC holds an INR Vostro account with an Indian bank like HDFC. When an HSBC client in London needs to pay an Indian supplier, HSBC uses its Vostro account at HDFC to make the local INR transfer.

These accounts are vital for various international business activities, including settling payments for imports and exports, funding large-scale project contracts, and managing finances for joint ventures.

Vostro vs. Nostro Account – What’s the Difference?

You’ll often hear the term “Nostro account” alongside Vostro. They are two sides of the same coin, describing the same account but from different perspectives.

- Vostro is Latin for “yours.” (“Your money in our bank.”)

- Nostro is Latin for “ours.” (“Our money in your bank.”)

Let’s break it down with a table:

| Feature | Vostro Account | Nostro Account |

| Perspective | The bank holding the funds (e.g., SBI in India). | The bank that owns the funds (e.g., JPMorgan in the US). |

| Meaning | “Your account in our bank” | “Our account in your bank” |

| Currency | Held in the local currency (INR in India). | Held in the foreign currency (USD in the US). |

| Example | JPMorgan’s INR account held at SBI is a Vostro account for SBI. | That same account is a Nostro account for JPMorgan. |

| Did You Know? 💡

A Vostro and a Nostro account are never separate things. They are simply two different names for the very same account. It’s all about who is doing the accounting: the bank that holds the money (Vostro) or the bank that owns the money (Nostro). |

Why Do Vostro Accounts Matter for Indian Exporters?

As a business owner, you don’t need to manage a Vostro account, but their existence directly benefits you in several powerful ways:

- Eliminates Currency Risk: When you invoice and get paid in INR, you don’t have to worry about fluctuating exchange rates eating into your profits. What you invoice is what you get.

- Simplifies and Speeds Up Payments: By using a domestic route for the final leg of the transfer, Vostro accounts cut down on the number of intermediary banks involved. This means faster settlement times and fewer chances for delays.

- Opens Up New Markets: For countries with which the RBI has permitted INR trade settlement, Vostro accounts make doing business much easier. It removes a significant barrier for foreign buyers who may find it difficult to transact in USD or EUR.

- Reduces Transaction Costs: Fewer intermediaries generally mean lower processing fees, so more money lands in your pocket.

Receive International Payments Seamlessly with Razorpay

While Vostro accounts form the essential backbone for INR-based international trade, businesses need a simple, accessible way to leverage this system without getting bogged down in banking technicalities. Your focus should be on growth, not on the complexities of payment processing.

This is where a payment solution like Razorpay International plays a crucial role. It acts as a user-friendly interface built on top of this robust global banking network, translating complex backend processes into a seamless experience for exporters and freelancers.

Razorpay International enables businesses to:

- Accept Global Payments Easily: Users can accept payments in major currencies like USD, EUR, and GBP. The platform handles the conversion, settling the final amount directly into their Indian bank account in INR.

- Eliminate Operational Headaches: The system abstracts away the complexity of Vostro accounts, SWIFT codes, and other banking jargon. It manages all backend compliance and payment routing automatically.

- Automate Compliance: Every international transaction is supported with the necessary documentation, like a digital Foreign Inward Remittance Advice (e-FIRA), which is crucial for tax filings and claiming export benefits.

- Support Business Growth: The solution is tailored for a wide range of users—from solo freelancers and D2C exporters to established SaaS companies—helping them receive international payments without stress.

By handling the intricacies of cross-border finance, Razorpay International allows businesses to focus on what they do best: creating great products and serving their global customers.

Start Accepting International Payments Today with Razorpay

FAQs

-

Can a business or an individual open a Vostro account?

No. Vostro accounts are exclusively a bank-to-bank arrangement. They are opened by a foreign bank (known as a correspondent bank) with a domestic bank (a respondent bank). Businesses and individuals use standard bank accounts to receive payments that are routed through this infrastructure.

-

Who regulates Vostro accounts in India?

The Reserve Bank of India (RBI) regulates and provides the framework for opening and operating Vostro accounts in the country. They issue guidelines that banks must follow, especially concerning anti-money laundering (AML) and know-your-customer (KYC) norms.

-

As an exporter, do I need to worry about the Vostro setup?

Not at all. The entire Vostro mechanism is handled by the banks and your payment service provider. Your only responsibility is to use a compliant platform, like Razorpay International, that ensures payments are processed correctly through these regulated channels.

-

What currencies are supported under the Vostro route?

The Vostro account itself is held in Indian Rupees (INR). However, it facilitates trade from any country whose currency the RBI has approved for trade settlement in INR. This allows a foreign partner to pay in their currency, which is then settled in INR through the Vostro channel.