(This article first appeared in ET Tech on November 11th, 2016.)

In a one hour-two minute address to the nation, the Prime Minister of India detailed out his biggest move to weed out corruption in the nation.

He gave a four hour notice to demonetize Rs 500 and Rs 1000, invalidating their status as legal tender. The plan was deliberate and laser focused in its execution. It’s no wonder that commentators are talking up the move as the Prime Minister’s biggest ‘surgical strike’ against black money. It has almost unanimously galvanised his ardent supporters and critics alike – so much so, the shock election of Donald Trump is not the prime focus.

The decision also has major reverberations for businesses and lower income groups. It’s not going to be an easy few months. A quarter of India’s $2 trillion economy is unaccounted for, and making such bold moves is mandatory to tackle corruption. The economy is set for a major overhaul and if such a large populace is going to embrace digital modes of transacting, it will require the collective will of entrepreneurs and influencers to educate the masses. My own watchman cringed when I handed him a Rs 500 note. There’s an obvious chasm to bridge, and when less than 15% of the population uses the Internet, the ramifications are stark.

But bear with me for a moment here. The move also pushes the poor, who save money under their mattresses, to come out and open a bank account, understand banking. My watchman wants to know how he can transact online. He has a Micromax smartphone and now is willing to take that leap of faith.

Needless to say, we shouldn’t be passing off these notes to people who are not aware of these announcements. Instead, educate, inform. While this is an important step, let’s be clear, cash is not going anywhere. There is however, a small window to present what a cashless society portends. And that’s simplicity, reliability and accountability in our economy. The one certainty – Cash is going to be in short supply for a long time. To give you an idea, according to the Reserve Bank of India, nearly 84% of all rupee bills in circulation are in the form of Rs 500 and Rs 1,000 notes.

Wallets don’t solve large ticket purchases either. Most of them have limits, which forces consumers to get accustomed to online transactions. Predictably, e-commerce companies have stopped accepting cash on delivery orders that are more than Rs 1,000. This leaves merchants out in the sun, who are now scrambling for options. The inability of small merchants to accept payments is going to hit the economy the most. It also places a severe burden on consumers for day-to-day products. We’re already witnessing massive queries and traffic on our properties to accommodate such requests.

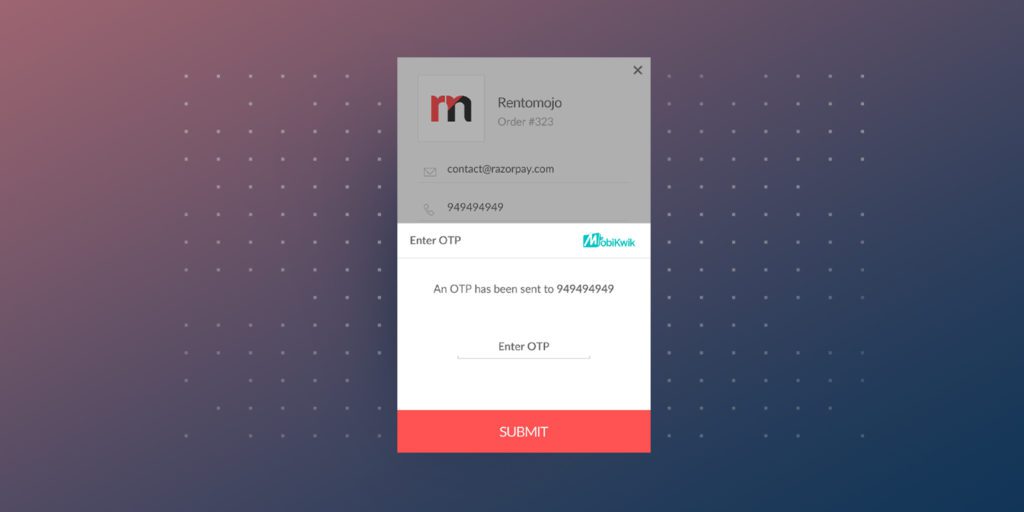

At times like these, it is important to open up to consumers. We’re activating merchants’ accounts in one hour to help make online transactions as simple as using cash. The idea is to replicate offline modes of transacting in an online environment. Another way to look at this is to enable the principle of ‘cash on delivery’ by allowing users to pay with their digital wallets or UPI.

To elaborate – Once an executive delivers a product, you can pay on the spot using one of many digital wallets the executive has enabled on his/her smartphone. As a customer, I can pay on the spot, without scrambling for change. It’s a neat combination of online-offline-online. The move would essentially kill the nuisance that cash on delivery has been for the industry.

Changing an age-old behaviour is not easy. Nearly 98% of India uses cash. The message is clear from the Prime Minster – Physical cash is no longer welcome. We’re witnessing the early days of India getting on the digital bandwagon. There’s already talk on how the government will impose a ban on large ticket cash transactions. Physical cash is clunky and I’ve always stated that this archaic form of payments needs disruption.

It’s the most favorable time for online commerce to capitalize on this moment and fuel a change in mindset. But for entrepreneurs like me, the mission is clear – enable online payments for businesses in India, irrespective of their size.