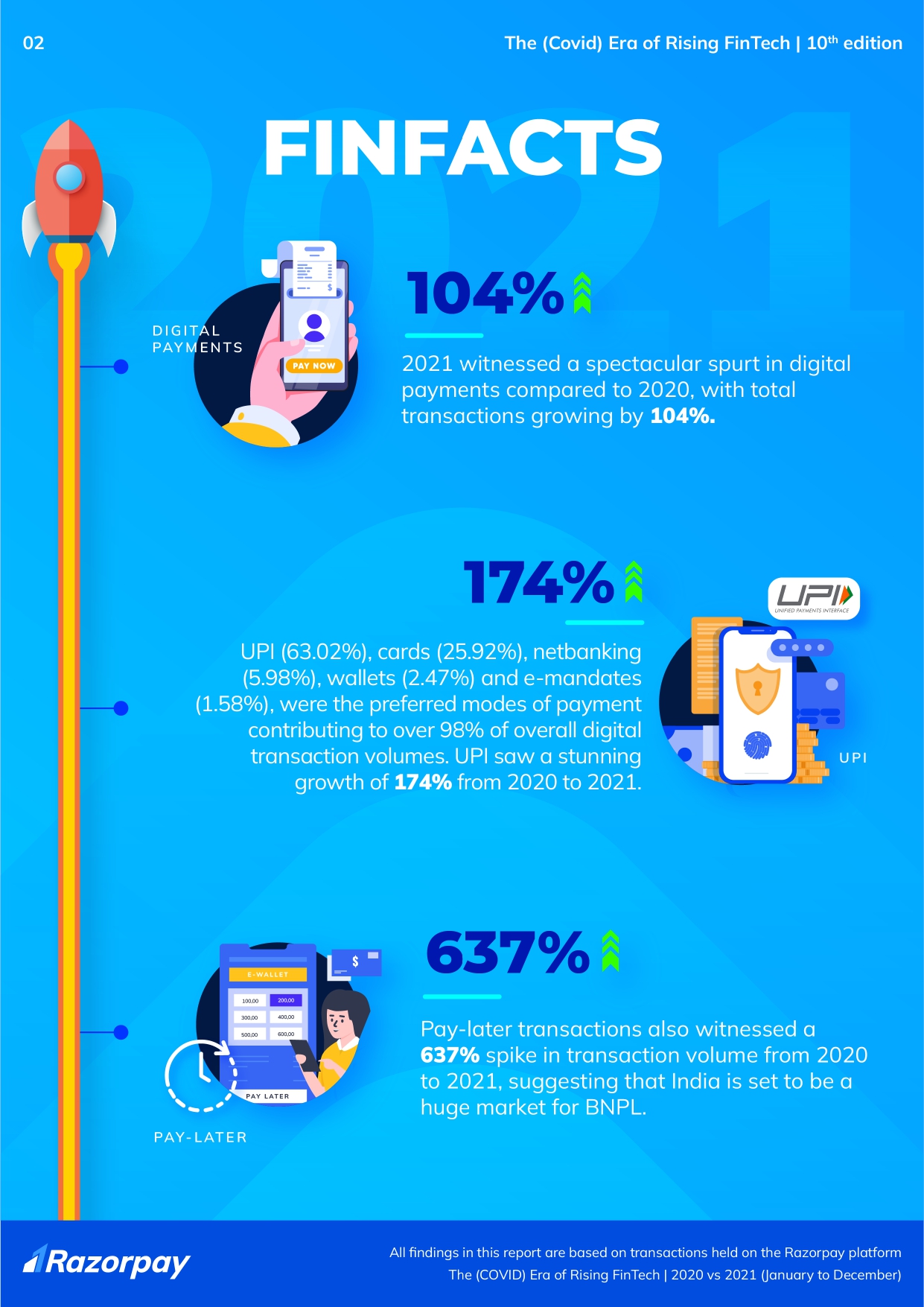

If the pandemic hastened the adoption of digital payments in 2020, then 2021 was the year that digital payments went truly mainstream. Online payment transactions more than doubled in 2021 compared to the year before, crossing a billion in number.

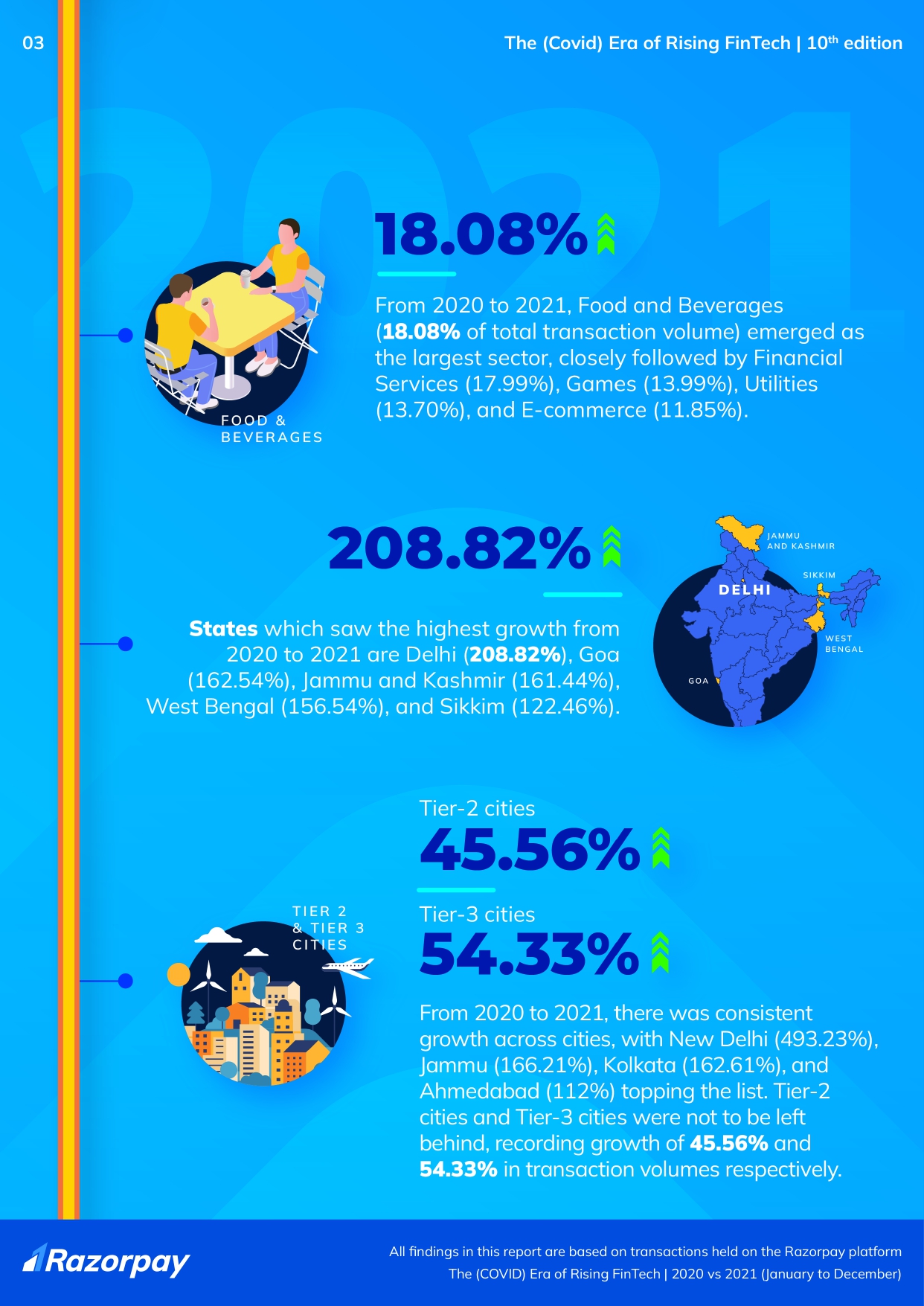

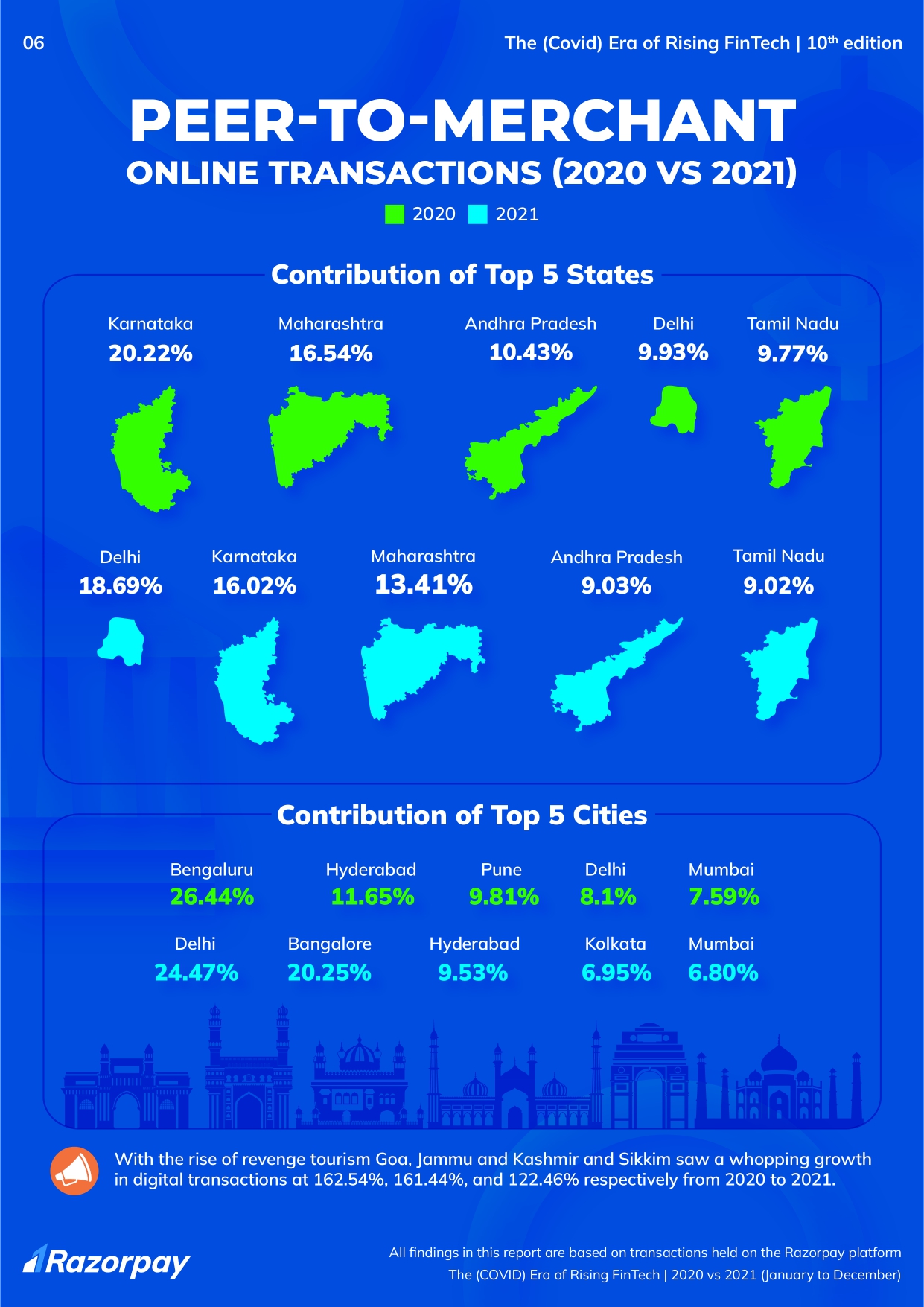

In 2021, with the country in the grip of a second wave of the pandemic, digital financial transactions assumed a key role again. Bolstered by growing smartphone and internet penetration, Tier-2 and 3 cities recorded significant growth in online transaction volumes, of 45.56% and 54.33% respectively.

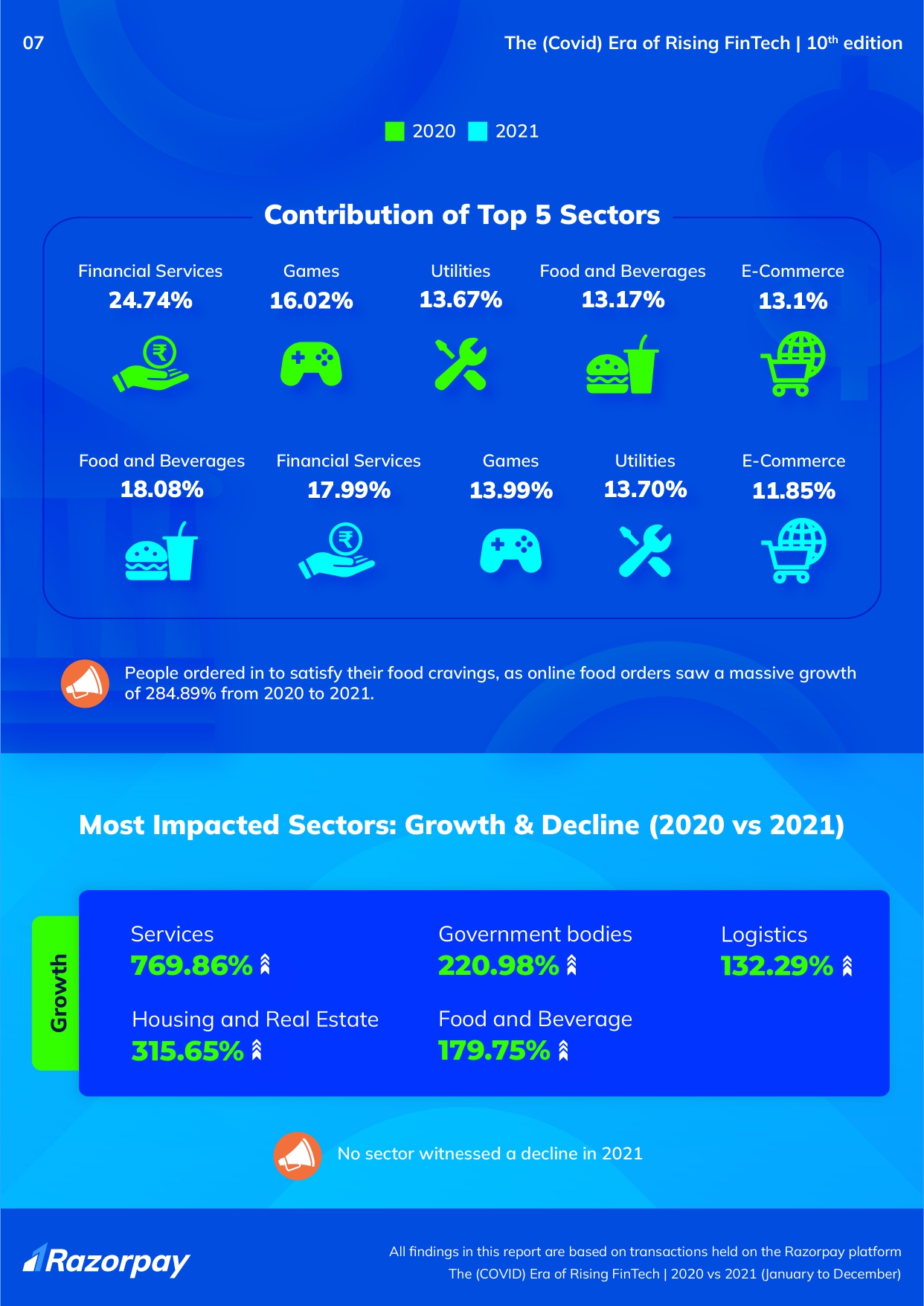

Virtually every sector witnessed growth, with Food and Beverages (18.08%), Financial Services (17.99%), Games (13.99%), Utilities (13.70%), and E-commerce (11.85%) the top contributors.

This 10th edition of the ‘Era of Rising Fintech‘ report studies the remarkable growth in digital payments in 2021, with the preceding year serving as a benchmark. If 2020 saw a boom in digital payments, then 2021 witnessed a veritable explosion.

The report is based on online transactions held on the Razorpay platform from January to December, 2020 & 2021. It provides a detailed view of the evolving FinTech ecosystem, the digital spending patterns of consumers and an analysis of how different sectors and payment modes performed during 2020 to 2021.