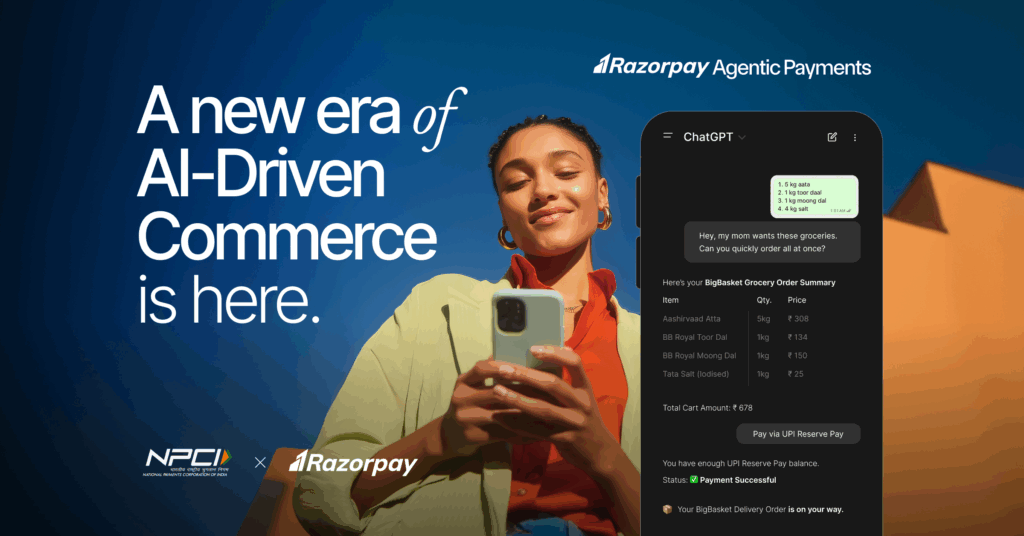

India leads the world in AI adoption and is the fastest-growing user base for ChatGPT, surpassing every other country. Starting today, together we’re taking the first steps toward helping Indians find the right products on ChatGPT and instantly check out using their favorite way to pay: UPI.

Imagine this: You tell your AI assistant, “Order my usual groceries,” and it simply does it. No stopping to open the right grocery app, no typing a UPI PIN, no entering an OTP. AI just handles the payment, securely, on your behalf.

This isn’t science fiction anymore. India’s digital landscape is about to undergo its biggest shift since the launch of UPI.

Razorpay—India’s leading payments and banking platform—has just announced the private beta launch of Agentic Payments, the country’s first AI-powered conversational payment experience, developed in a landmark collaboration with NPCI (the force behind UPI) and OpenAI’s ChatGPT.

This is more than a new feature; it’s a fundamental breakthrough that moves AI from helping you find products to helping you securely complete the entire purchase.

The “Human-in-the-Loop” Problem, & How We Solved It

Today, every major transaction on UPI or a card requires a “human-in-the-loop.” You can delegate the discovery of a product to AI, but you can’t delegate the payment authority.

The old process can be frustrating in an AI-native world: AI finds the item, the human stops the process, the human authenticates with a PIN or OTP, and then the purchase is completed. This manual step, while necessary for security, is the friction preventing truly autonomous, AI-native commerce.

Agentic Payments changes this entirely.

By leveraging new capabilities from NPCI—specifically UPI Circle and UPI Reserve Pay—the system allows users to securely pre-authorize their trusted AI agent to make purchases within pre-set, user-defined spending limits. This removes the need for constant human authentication.

Essentially, your AI assistant transforms into a true, trustworthy shopping agent that can act on your secure payment delegation.

AI + UPI: A Landmark Indian Collaboration

This private beta represents a unified vision from the leaders of India’s digital ecosystem: OpenAI’s ChatGPT brings the advanced conversational intelligence; NPCI provides the secure, bank-grade infrastructure via UPI; and Razorpay builds the crucial connecting layer—the payment experience itself.

As Preeti Jain, Product Head, bigbasket, a tata enterprise says “With Agentic Payments, we’re enabling effortless shopping through AI assistants. From discovery to checkout, bigbasket and Razorpay integration delivers a fast, seamless grocery shopping experience—all in one conversation.”

A Glimpse into the AI-Native Storefront

Razorpay’s live demos at the Global Fintech Fest showcased the effortless nature of this technology with major partners. The demonstrations covered scenarios where the user could browse products and check out from bigbasket, a tata enterprise, directly within the ChatGPT conversation. They could also recharge a mobile plan entirely via conversational AI within the Vodafone Idea (Vi) App.

With the support of major banks like Axis Bank and Airtel Payments Bank, the secure, compliant framework is already being established.

What’s Next? The Road to AI-Native Commerce

From groceries to mobile recharges, the possibilities are vast. This private beta is just the first step. Over the coming months, Razorpay, NPCI, and OpenAI will work together to move this innovation from a proof-of-concept into full production.

The message is clear: The future of commerce in India is here. AI will be the storefront, and UPI will be the secure, invisible backbone.