Payroll and compliance are among the most challenging tasks for a business.

Can you believe 57% of businesses in India still rely on paper or spreadsheet-based payroll management? No, Right? We couldn’t believe either! 🙉

We organised a webinar, ‘Payroll in India – Why Compliance is Important and How to Get it Right’ on the 18th of July.

Anuj Jain, Director of Engineering at Razorpay along with Samarth Masson, Cofounder of Dockabl and Rohit Venugopal, Senior Business Manager at Razorpay, teamed up to put on a show. They discussed the flaws of the current payroll processing and management in India, and the complex compliance requirements. Further, they talked about how to tackle these problems too!

Here are some highlights from the webinar.

Problems with payroll processing in India

Businesses need to process payroll effectively with minimal human intervention. But, payroll processing with the help of spreadsheets and other paper-based calculations are causes of concerns in more ways than one.

Human error

- Payroll calculations involving spreadsheets and other manual methods are prone to human error since there is manual keying in of data

- Payroll teams require several components to calculate employee salary. The difficulty level rises when an employee joins or leaves the organisation

Being compliant with changing regulations

- Employers need to consider various laws and regulations like PF, ESI, PT, and TDS. Any delay in tax remittance to the government or miscalculation can leave businesses with serious repercussions

- Also, laws often change. The best example to support this is the Dual Tax regime and the changes to the PF deduction under Atmanirbhar Bharat Abhiyaan

Data security

- Employees provide sensitive information like their Aadhaar, PAN, rental agreement, and more, to their employers for payroll processing. Maintaining such information on spreadsheets can be very risky

Lack of flexibility for employees

- Employees cannot access their payslips instantly or update their particulars when payroll is processed manually

Learn how you can tackle Payroll troubles! Get your free Payroll and Compliance Ebook

Statutory compliance in payroll processing

Fundamentally, four components make up payroll compliance.

Read more: Everything a Business Needs to Know About the EPF Scheme

How RazorpayX Payroll is getting payroll and compliance right

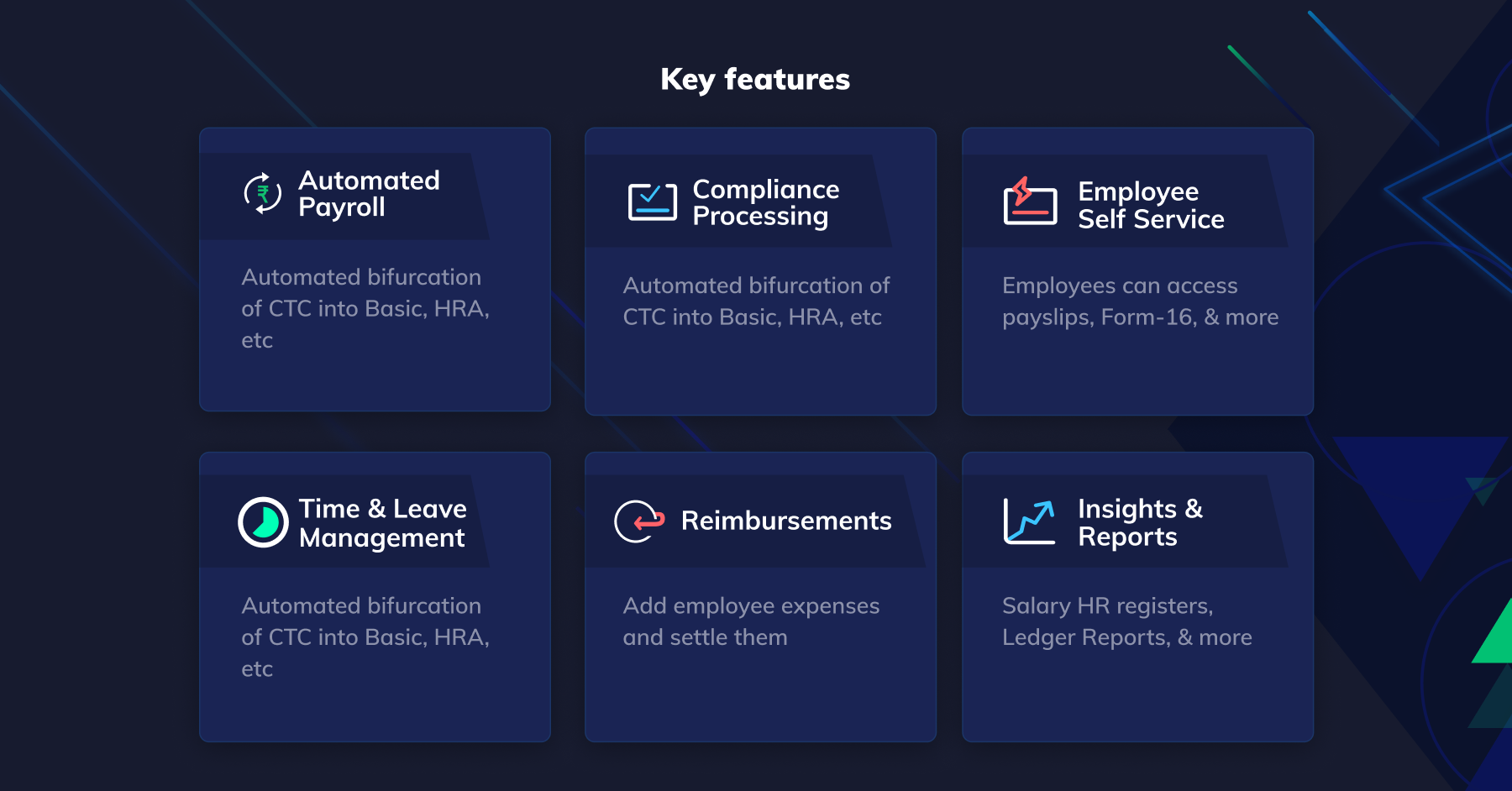

RazorpayX Payroll is built to provide a one-click, seamless, and end-to-end payroll processing experience to businesses. The product not only computes employee salary but also executes payroll, including statutory deductions.

RazorpayX Payroll takes care of all the statutory payments as well as submission of recurring returns. It not only benefits businesses but also guides employees to choose from the two tax regimes.

Furthermore, RazorpayX Payroll enhances payroll transparency by ensuring that all the relevant information is instantly accessible to all employees.

Stay tuned to know what else is in store!

Until next time!