When you’ve just landed a major international client for your SaaS product, the focus should be on delivering excellent service. However, Indian exporters often hit a wall of tax compliance, particularly the requirement to pay IGST upfront, which can block a significant chunk of hard-earned money. This leads to a critical question: is there a way to legally export goods or services from India without this immediate tax burden?

The GST framework provides an effective solution for this. It’s called an LUT, or a Letter of Undertaking.

Think of it as a special pass for exporters. It’s a simple declaration you make to the government, promising that you’ll meet all your export obligations. In return, the government allows you to export without the burden of paying GST upfront. This simple document is a game-changer for countless Indian SaaS exporters, freelancers, MSMEs, and e-commerce merchants.

Let’s break down what an LUT is, why it’s crucial, and how you can get one.

Key TakeawaysWhat is it? An LUT (Letter of Undertaking) is a document that allows you to export goods or services without paying IGST upfront. Why use it? It frees up your working capital that would have otherwise been stuck in the tax refund cycle. Who needs it? Any registered taxpayer exporting goods or services, including freelancers, startups, and MSMEs. How long is it valid? For one financial year. You must renew it annually. |

What is a Letter of Undertaking (LUT) in GST?

The full form, Letter of Undertaking, might sound formal, but its purpose is simple. Governed by Rule 96A of the CGST Rules, 2017, an LUT is a declaration filed by an exporter stating they will fulfill all the requirements of exporting under GST.

Whether you’re exporting physical goods or digital services, the LUT applies. For instance, a SaaS startup in Bengaluru exporting software to a client in the US can file an LUT to supply its service without charging IGST on the invoice. This makes their pricing more competitive and simplifies their accounting.

| Think of an LUT as an Export Passport for your goods and services. With a regular passport, you can travel across borders. With an LUT, your exports can cross borders without having to pay the IGST “entry fee” at the port. It’s a trusted traveler program for Indian exporters. |

Why is an LUT So Important for Exporters?

Filing an LUT isn’t just about paperwork; it’s a strategic business decision that directly impacts your finances and operations.

Free Up Your Working Capital:

The biggest advantage is that you don’t have to pay IGST when you export. Without an LUT, you would have to pay the tax first and then go through the lengthy process of claiming a refund. This can lock up your funds for months.

Simplify Your Process:

An LUT eliminates the entire tax refund process. This means less paperwork, no follow-ups with the tax authorities, and more time to focus on growing your business.

Enable Zero-Rated Exports:

Exports are considered “zero-rated supplies” under GST. This means the government aims to tax neither the inputs nor the final products/services meant for export. The LUT is the mechanism that makes this possible in practice.

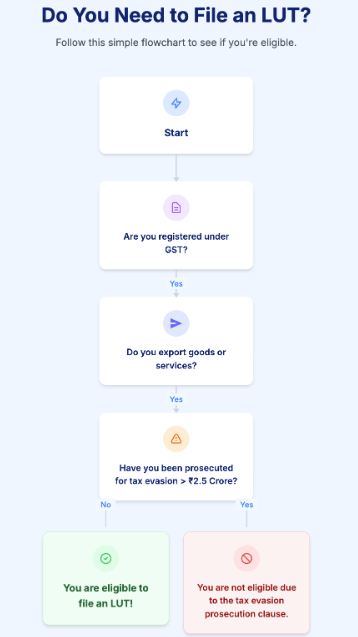

Who Should File an LUT?

Almost any business or individual registered under GST who exports can file an LUT. This includes:

- Businesses exporting goods to other countries.

- Tech startups and SaaS companies with foreign clients.

- Freelancers and consultants providing services to clients outside India.

- MSMEs selling products on international e-commerce platforms.

The main eligibility condition is that the person should not have been prosecuted for tax evasion for an amount of ₹2.5 crores (₹250 lakh) or more.

Documents Required to File an LUT

Before you start the filing process, make sure you have these simple documents handy. The entire process is online, so you’ll need scanned copies.

| Document Type | Description |

| GST Registration | Proof that your business is registered under GST. |

| Business PAN Card | The Permanent Account Number card of your entity. |

| Authorized Signatory’s PAN | The PAN of the person authorized to sign the documents. |

| IEC (Import Export Code) | A mandatory code for businesses engaged in export. |

| Cancelled Cheque | Proof of your active business bank account. |

| Letter of Authorization | A letter authorizing a signatory to file on behalf of the company. |

How to File an LUT Online (Step-by-Step)

Filing an LUT is a completely online and straightforward process on the GST portal. Here’s a simple guide:

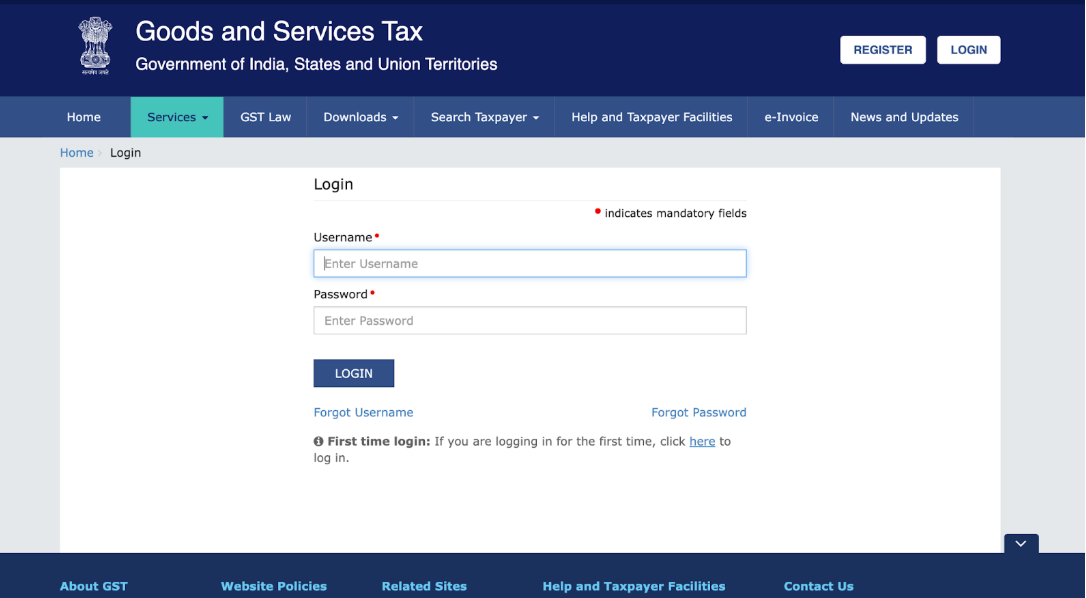

Step 1: Log In to the GST Portal Head over to www.gst.gov.in and log in with your credentials.

Step 2: Navigate to the LUT Section Once logged in, go to the top menu and click on:

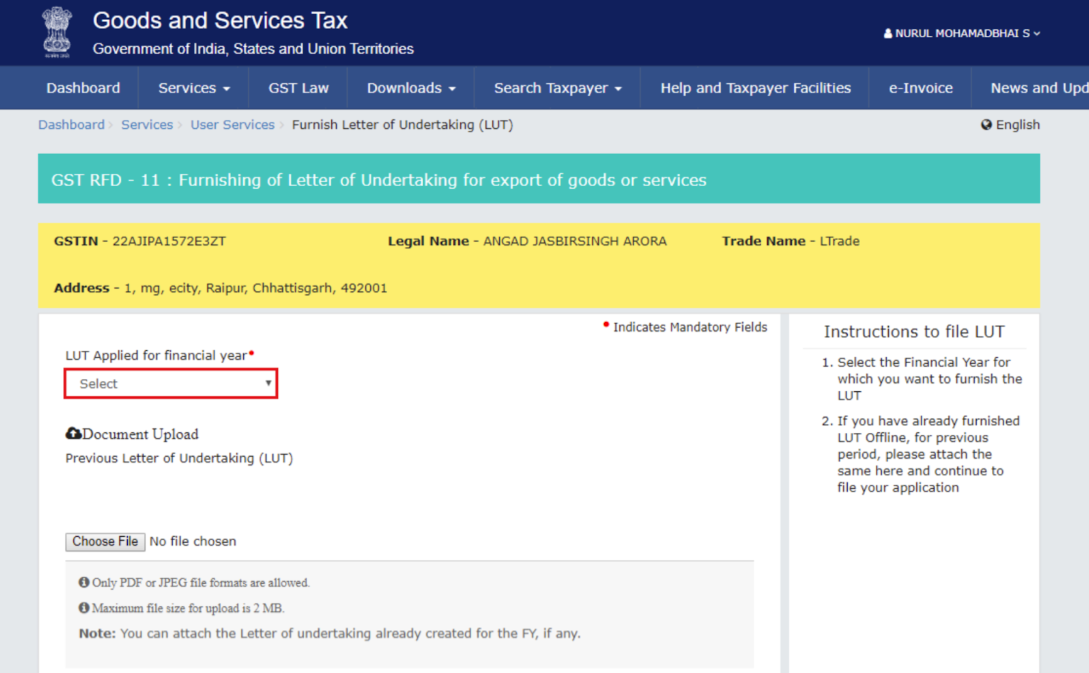

Services > User Services > Furnish Letter of Undertaking (LUT).

Step 3: Select the Financial Year Choose the financial year for which you want to file the LUT from the drop-down list. Remember, you have to do this every year.

Step 4: Fill the Declaration Form A simple form (GST RFD-11) will appear. Most of your details like GSTIN and business name will be auto-filled. You need to tick the three checkboxes, which are self-declarations promising to:

- Complete the export within three months.

- Abide by all GST laws.

- Pay IGST with 18% interest if you fail to export.

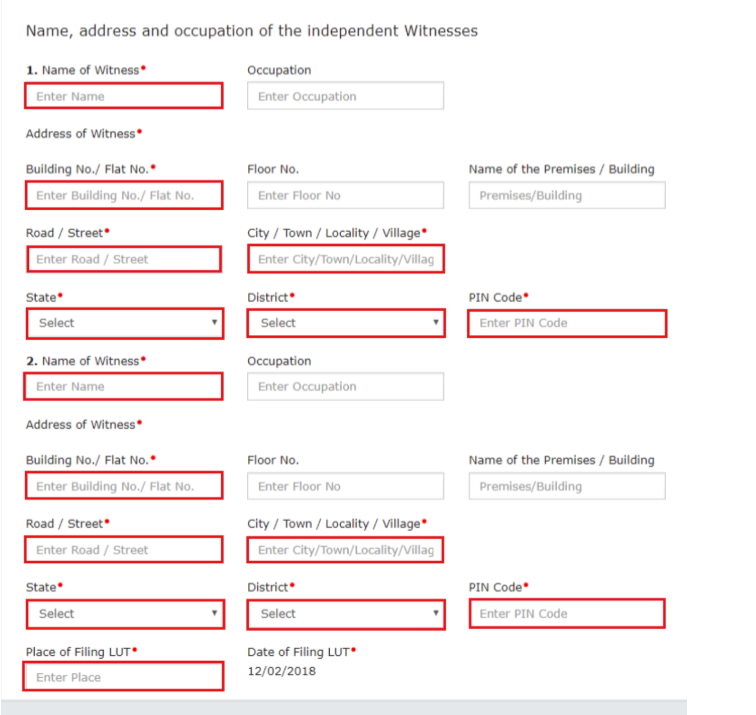

You will also need to provide the name, occupation, and address of two independent witnesses.

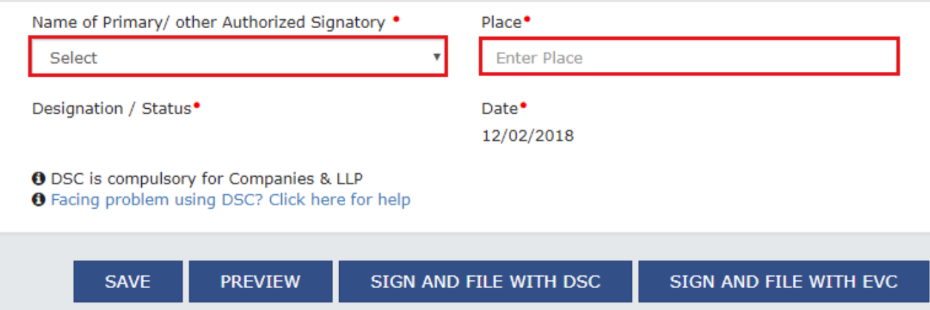

Step 5: Sign and Submit Finally, you need to sign and submit the form electronically. You can do this using either:

- Digital Signature Certificate (DSC): This is mandatory for companies and LLPs.

- Electronic Verification Code (EVC): An OTP will be sent to your registered mobile number and email.

Once you submit, an Application Reference Number (ARN) is generated and you will receive an acknowledgment. You can download this for your records.

Validity of an LUT

An LUT is valid for one full financial year. For example, an LUT filed on April 10, 2025, will be valid until March 31, 2026. You must file a new LUT for the next financial year to continue exporting without paying IGST.

If you forget to renew it, the privilege may be withdrawn, and you might have to submit bonds instead.

LUT vs. Bond: What’s the Difference?

If an exporter is not eligible for an LUT (for instance, due to prosecution for tax evasion), they must furnish a Bond. Here’s a quick comparison:

| Feature | Letter of Undertaking (LUT) | Bond |

| Applicability | For most regular exporters. | For those not eligible for an LUT. |

| Format | A simple self-declaration submitted on the GST portal. | A document on non-judicial stamp paper. |

| Requirement | No financial guarantee needed. | Requires a bank guarantee, which should not exceed 15% of the bond’s value. |

| Renewal | Must be renewed every financial year. | Valid until the export obligation is met. |

Common LUT Filing Mistakes to Avoid

The process is simple, but small mistakes can cause delays. Watch out for these:

- Not Renewing Annually: This is the most common mistake. Set a calendar reminder for the last week of March every year.

- Incorrect Witness Details: Ensure the witness details are accurate and that they are independent (not related to the business).

- Not Saving the ARN: Always download and save the acknowledgment copy. It’s proof that you have filed your LUT.

- Signing with the Wrong Method: Remember, companies and LLPs must use a DSC.

| Pro Tip: Your annual LUT filing should be a part of your financial year-end checklist, just like closing your books. A simple calendar reminder can save you from the major headache of blocked working capital. |

Conclusion

For Indian exporters, the Letter of Undertaking is a vital tool for financial health. By allowing you to export without paying IGST upfront, it ensures your working capital remains in your hands, fueling your growth instead of being stuck in tax refunds.

The process is simple, entirely online, and a must-do for every service provider, freelancer, and MSME with global ambitions.

Frequently Asked Questions (FAQs)

-

Can I export without an LUT under GST?

Yes, you can, but you will have to pay the applicable IGST on your export invoice and then claim a refund from the government later, which is a more cumbersome process.

-

How long does it take to get an LUT approved on the GST portal?

The acknowledgment containing the Application Reference Number (ARN) is generated instantly upon submission on the GST portal.

-

Is an LUT applicable for both goods and service exporters?

Yes, it is applicable to anyone registered under GST who is exporting either goods or services.

-

What happens if I forget to renew my LUT?

If the conditions of the LUT are not met or it is not renewed, the privilege may be withdrawn, and the exporter will be required to furnish bonds instead.

-

Is there any fee for filing an LUT online?

The sources do not mention a fee for filing an LUT online. The process is described as being available on the GST portal.

-

Can a freelancer or consultant file an LUT?

Yes. Any registered taxpayer engaged in exporting goods or services can utilize a Letter of Undertaking.

-

Is an LUT mandatory for service-based exports?

It is not mandatory, but it is the mechanism that allows you to export services without the upfront payment of IGST. The alternative is to pay IGST and claim a refund.

-

How often do I need to file a new LUT?

You need to file a new LUT for each financial year, as it is valid for one year.

-

Can I file an LUT offline instead of online?

The process for furnishing an LUT has been rationalized and is now entirely online through the GST portal.

-

Does LUT filing require a digital signature?

It requires a digital signature (DSC) for companies and LLPs. Other authorized signatories can also file using an Electronic Verification Code (EVC).