If you send or receive money internationally, you must comply with India’s foreign remittance rules. Two forms are central to this process: Form 15CA and Form 15CB.

These forms serve to notify the Indian tax authorities of payments being made abroad and ensure that tax has been appropriately deducted in accordance with the Income Tax Act. Only after submitting these forms can the bank release the money to another country. Whether you’re a freelancer, SaaS exporter, agency, or product seller, filing them correctly is essential to avoid remittance delays, penalties, or audit issues.

Read this guide to learn when each form is required and how you can file them smoothly.

Key Takeaways

- Form 15CA and 15CB are mandatory compliance steps for most taxable foreign payments.

- Understanding which part of Form 15CA applies helps avoid confusion and delays.

- Choosing the wrong form or missing documentation can delay payments, especially when banks demand clarification or additional certification.

- Keeping a clear record of all foreign payments makes compliance much easier.

What Are Form 15CA and Form 15CB?

Form 15CA

Form 15CA is a declaration you must submit before sending money abroad. It is required under the Income Tax Act, 1961 and helps the government track foreign remittances to make sure tax rules are followed.

Form 15CB

Form 15CB is a certificate that your Chartered Accountant issues when you make a taxable payment to a non-resident or foreign company and the total amount crosses ₹5 lakh in a financial year. In this form, the CA checks the taxability of the remittance and certifies how much tax should be deducted.

Why These Forms Are Crucial for Your Business?

- They act as clearance documents for banks without them, your remittance may be delayed or stopped until compliance is confirmed.

- They prove that tax liability has been properly assessed, and the correct TDS if applicable has been deducted as per the Income Tax Act.

- They help prevent tax evasion by certifying that every foreign payment is backed by valid documentation.

- They track overseas transactions, giving the government visibility over fund transfers made outside India.

- They reduce risk for both banks and businesses, as the CA certification confirms that the remittance complies with Indian tax laws and the Double Taxation Avoidance Agreement (DTAA).

Do You Need to File? A Simple Compliance Checklist

Not every international payment requires Form 15CA or 15CB but if you’re sending money abroad for business, services, or subscriptions, it’s important to check whether you fall under the filing requirement. Use this quick checklist to know if these forms apply to you.

Who Is Required to File These Forms?

You need to file Form 15CA when:

- Any person responsible for making a payment to a Non-Resident or to a Foreign Company must file Form 15CA.

- The remitter may be an individual, freelancer, agency, resident or non-resident, or any company.

- Based on Section 5 of the Income Tax Act, 1961 if income arises, accrues, is received, or is deemed to be received in India, Form 15CA must be submitted before remittance.

You need to file Form 15CA when:

- The payment made to a non-resident is taxable in India.

- The total remittance exceeds ₹5 lakh in a financial year.

- A certificate or order from the Assessing Officer (AO) is NOT available.

When Are Form 15CA and 15CB NOT Required? (Key Exemptions)

When Form 15CA Is NOT Required:

- The payment falls under the exempt list specified in Rule 37BB of the Income Tax Rules.

- When Section 5 of FEMA allows the payment without RBI approval, Form 15CA is usually not needed.

- The remittance is not taxable as per the Income Tax Act or DTAA.

- Total remittances to non-residents during the financial year are below ₹5 lakh, and the payment is not for foreign travel or purchase of foreign assets.

- Payments are made for education abroad, within the limit prescribed by the RBI.

When Form 15CB Is NOT Required:

- The remittance is not taxable in India.

- The income is taxable in the recipient’s country, and the remittance is sent there.

- The total remittance during the year is under ₹5 lakh.

- The remittance is not related to foreign asset purchase or foreign travel and stays within RBI limits.

- A certificate from the Assessing Officer (under Section 197 or 195(2)/(3)) has already been obtained.

Explore Razorpay’s Global Payment Solutions

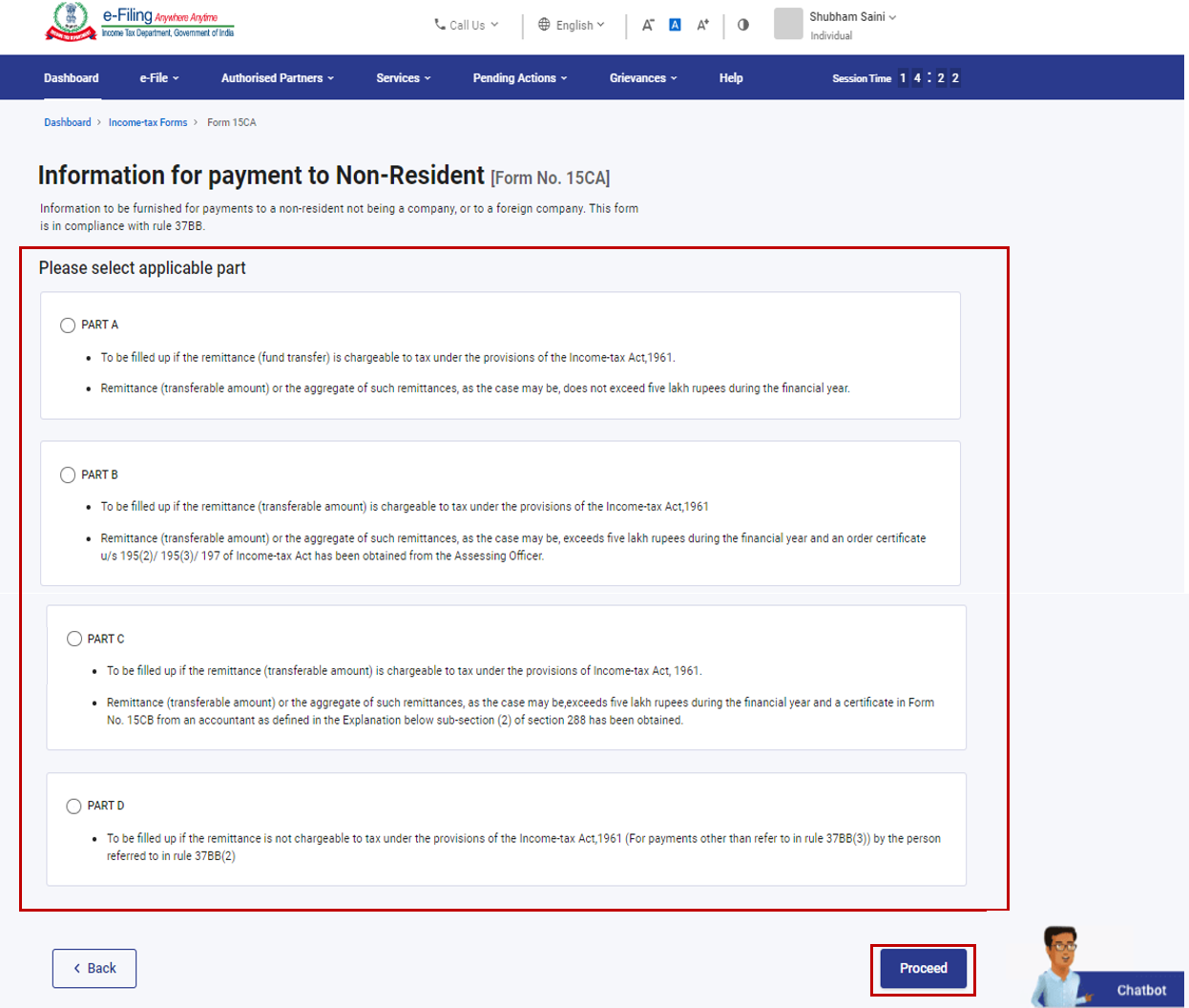

A Part-By-Part Breakdown of Form 15CA

Part A: When Your Payment is Taxable and Under ₹5 Lakh

Use Part A when the payment you’re making abroad is taxable, and the total taxable payments in the financial year are up to ₹5 lakh.

What you need to fill:

- Details of the remitter and remittee

- Remittance details, including purpose code and amount

- A verification declaration confirming the accuracy of the information

This is the simplest section of Form 15CA. No Certificate from a Chartered Accountant (Form 15CB) is required at this stage.

Part B: When Your Payment Is Taxable and Exceeds ₹5 Lakh

Use Part B when the payment you’re making abroad is taxable, the total taxable payments in the financial year are above ₹5 lakh, and you already have an order or certificate from the Assessing Officer under Section 195(2), 195(3), or 197.

What needs to be submitted:

- Remitter and remittee details

- Details of the Assessing Officer’s order/certificate

- Remittance details

- Verification declaration

This part does not require Form 15CB, because the Assessing Officer’s certificate confirms the tax implications for the remittance.

Part C: When Your Payment Is Taxable and Exceeds ₹5 Lakh (With CA Certificate)

Use Part C when the payment you’re making abroad is taxable, and the total taxable payments in the financial year are more than ₹5 lakh, and you have already obtained Form 15CB from a Chartered Accountant to certify the tax details of that payment.

What you must provide:

- Remitter and remittee details

- Remittance details

- Details of the Chartered Accountant, including registration number

- Attachments linked to Form 15CB

This section applies when no AO order has been taken, and tax is being evaluated and certified by a Chartered Accountant instead.

Part D – When Your Payment Is Not Chargeable to Tax

Select Part D when the payment you’re making abroad is not chargeable to tax under the Income Tax Act.

What needs to be filled:

- Remitter and remittee details

- Remittance details

- Verification confirming that the payment is not taxable

No Assessing Officer certificate or CA certificate is required when Part D applies.

Which Part Should You Use?

| Part | Applicable Scenario | Total Payment Amount (in a FY) | Is Form 15CB Required? |

| Part A | Payment is taxable | Up to ₹5 lakh | No |

| Part B | Payment is taxable and AO order/certificate under Section 195(2), 195(3), or 197 has been obtained | Above ₹5 lakh | No (AO order replaces Form 15CB) |

| Part C | Payment is taxable, and a CA certificate in Form 15CB has been obtained | Above ₹5 lakh | Yes |

| Part D | Payment is not chargeable to tax | Any amount | No |

How to File Form 15CA and 15CB Online?

The filing process is fully digital and takes place through the Income Tax e-filing portal. Below is a breakdown of the steps each section gives you just the action you need to take.

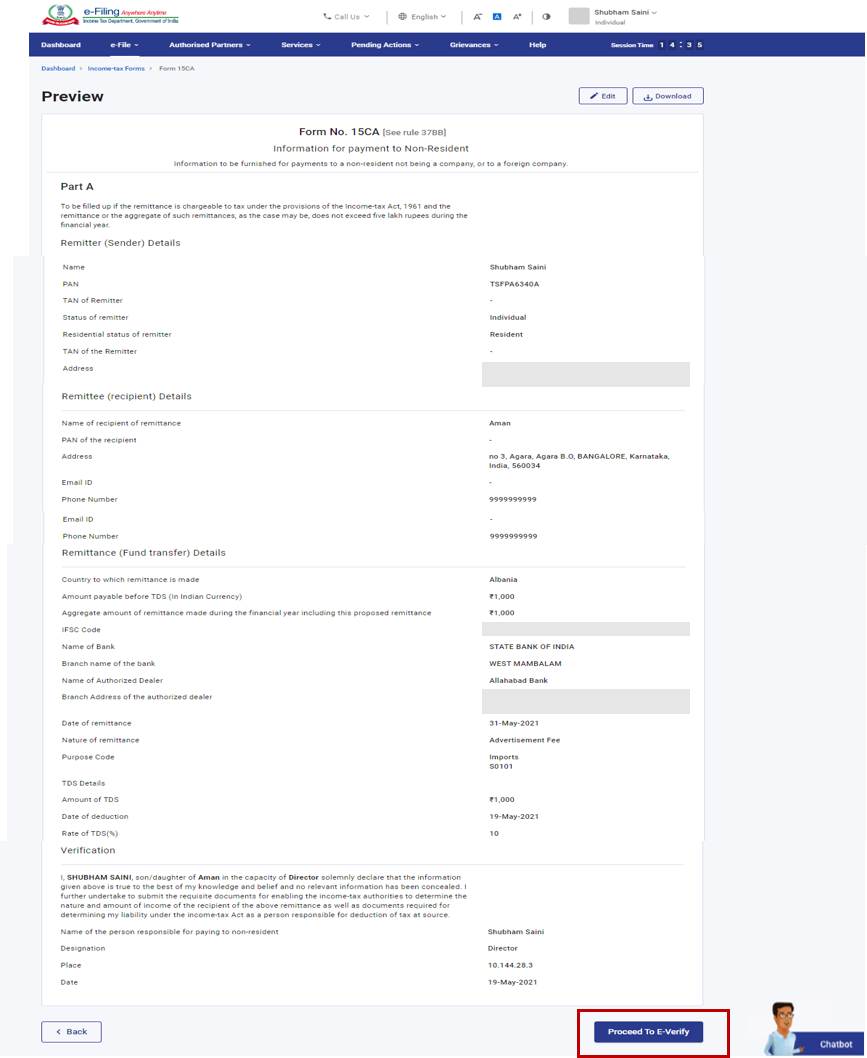

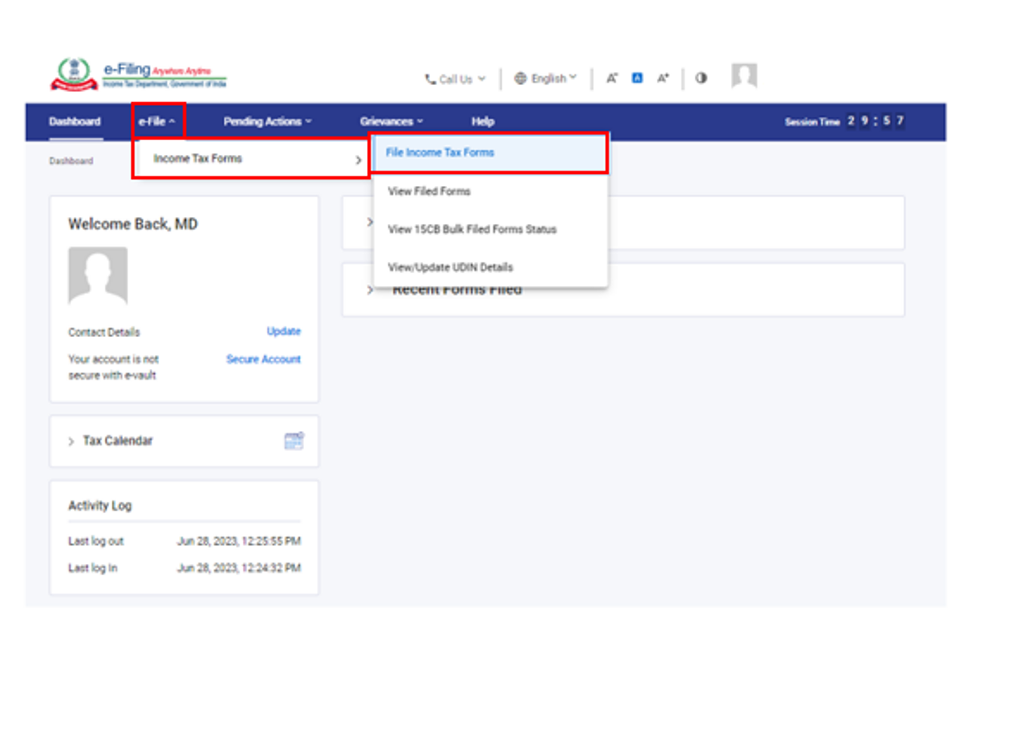

How to File Form 15CA? (Parts A, B & D)

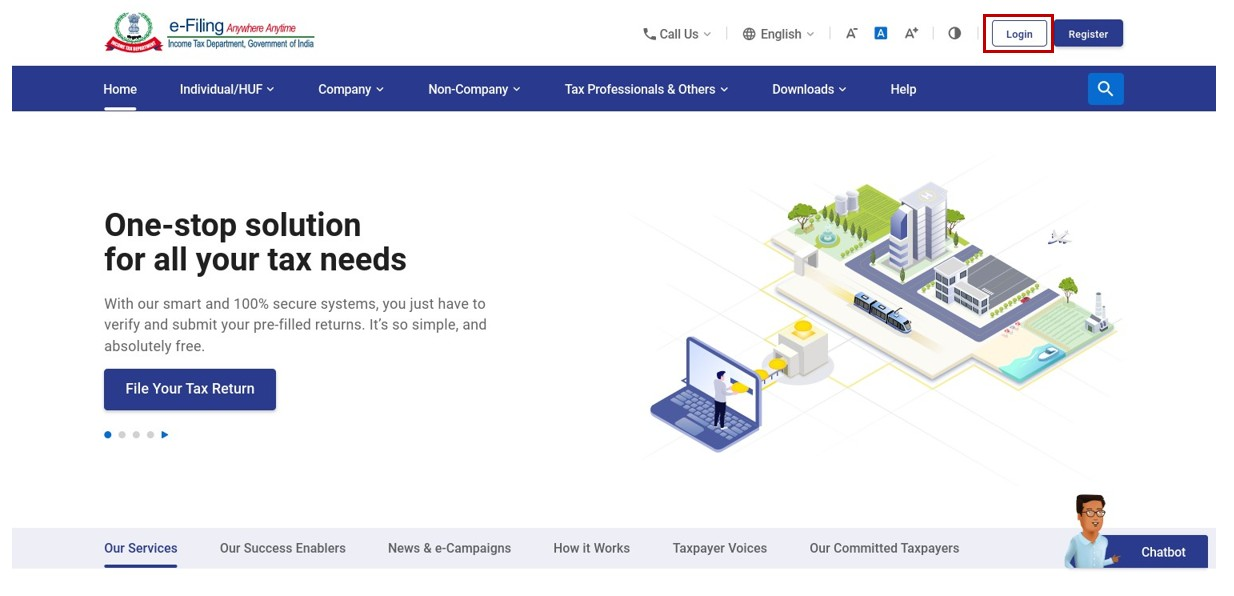

1, Log in to your e-Filing portal using your user ID and password.

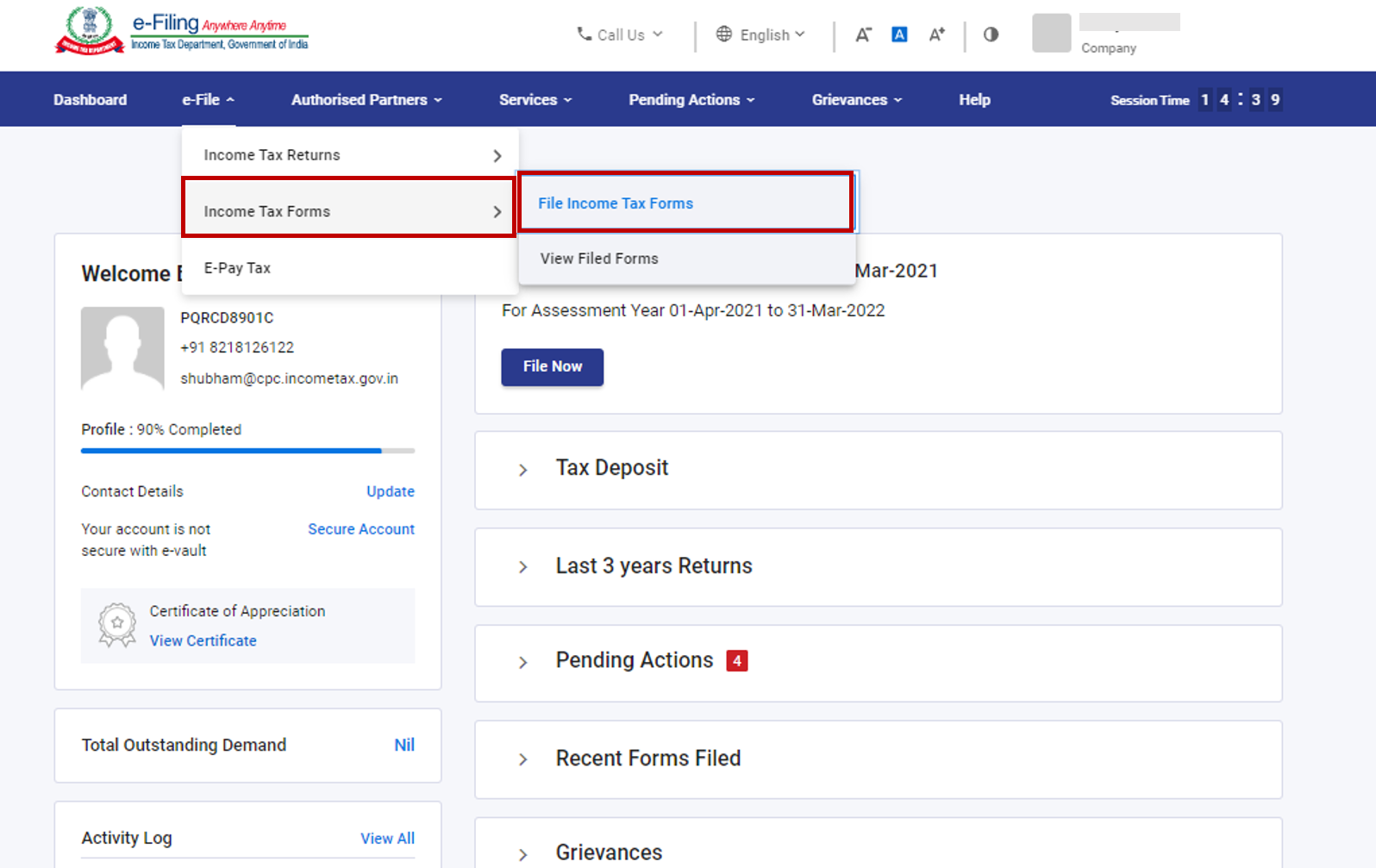

2, On your dashboard, navigate: e-File → Income Tax Forms → File Income Tax Forms.

3, Select “Form 15CA” or search for it using the search box.

4, Read the instructions and then click “Let’s Get Started”.

5, Choose the applicable section (Part A, B or D), then fill in the mandatory details like remitter, remittee and remittance info.

6, Preview the form to verify all data is correct, then click Proceed to e-Verify.

7, Complete e-Verification After successful verification, you’ll receive a Transaction ID and Acknowledgement Number on your registered email & mobile number.

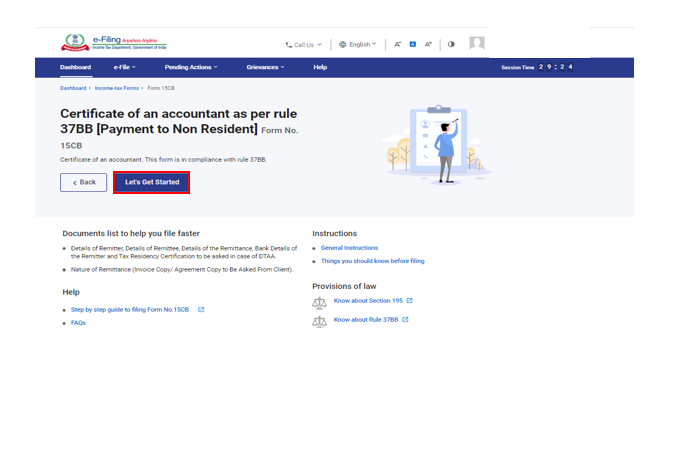

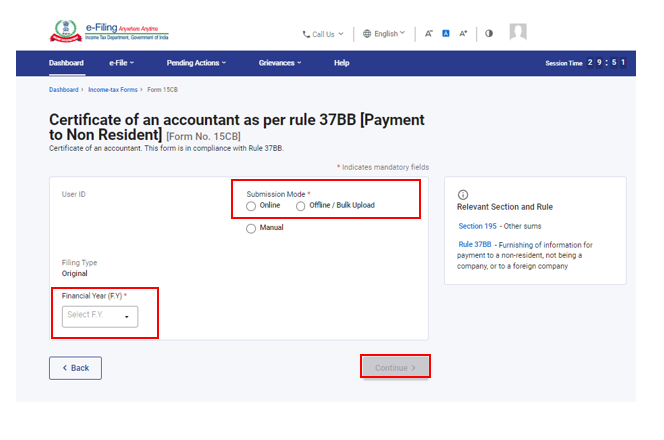

How to File Form 15CB?

1, Log in to the e-Filing portal using your CA credentials.

2, Navigate: e-File → Income Tax Forms → File Income Tax Forms.

3, Then, on the File Income Tax Forms page, select Form 15CB. Or simply type “Form 15CB” in the search box to find it quickly.

4, Choose Submission Mode as “Online”, select the correct financial year and click Continue.

5, On the “Instructions” page click Let’s Get Started.

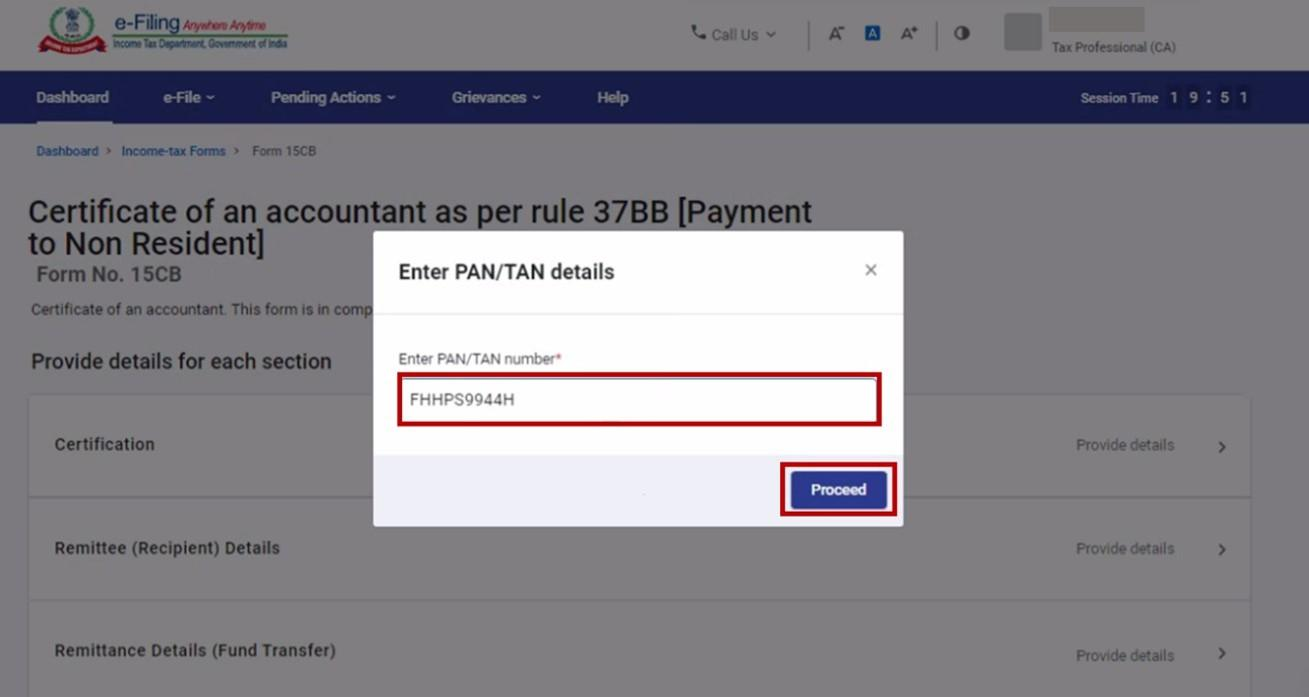

6, Enter the PAN of the taxpayer for whom the form has been assigned.

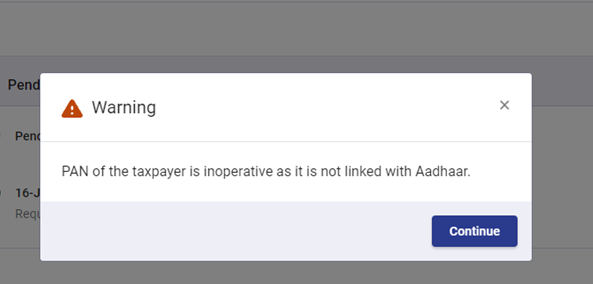

If the PAN is not linked with Aadhaar, a notification will appear stating that it is inoperative.

If the PAN is not linked with Aadhaar, a notification will appear stating that it is inoperative.

7, Click Continue to move forward and start filling the form.

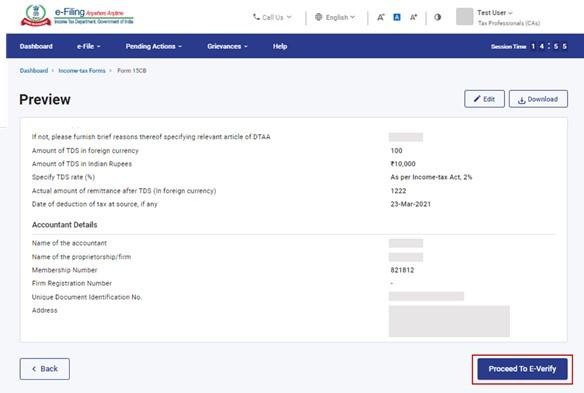

8, Click Preview, then Proceed to e-Verify.

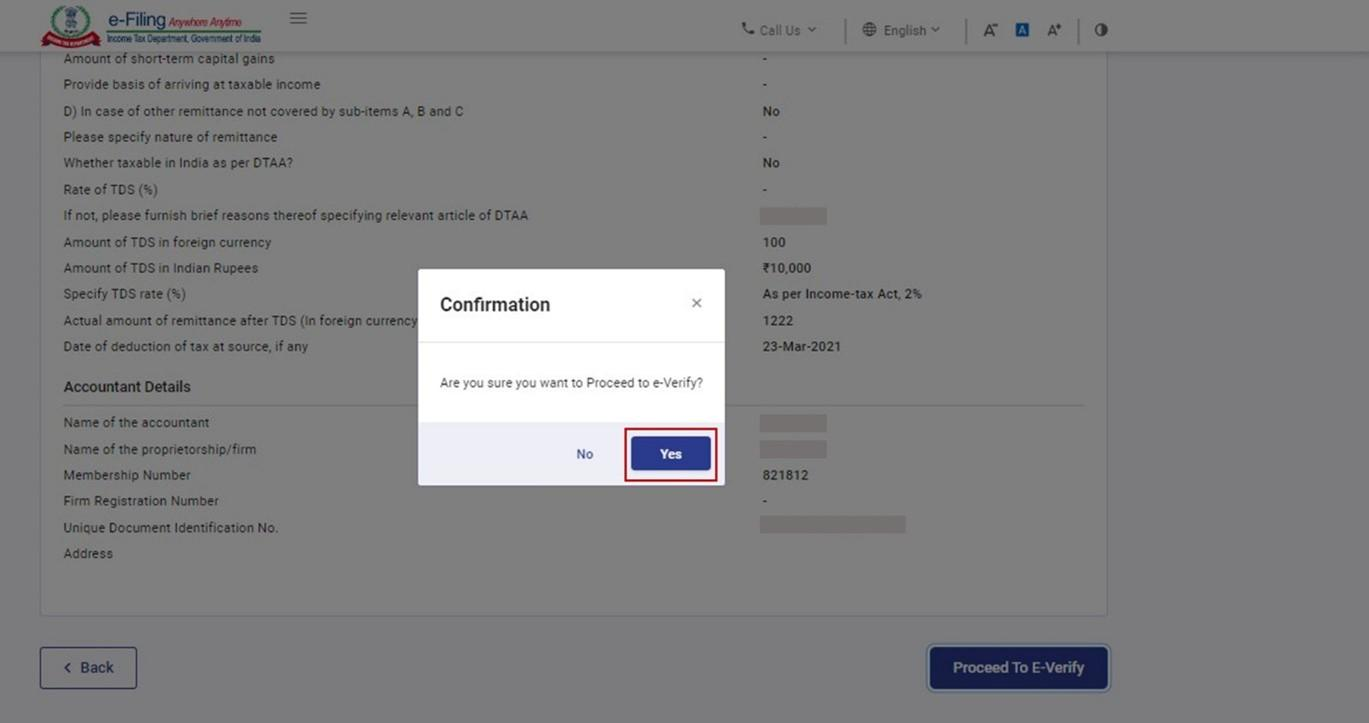

9, Click Yes to submit.

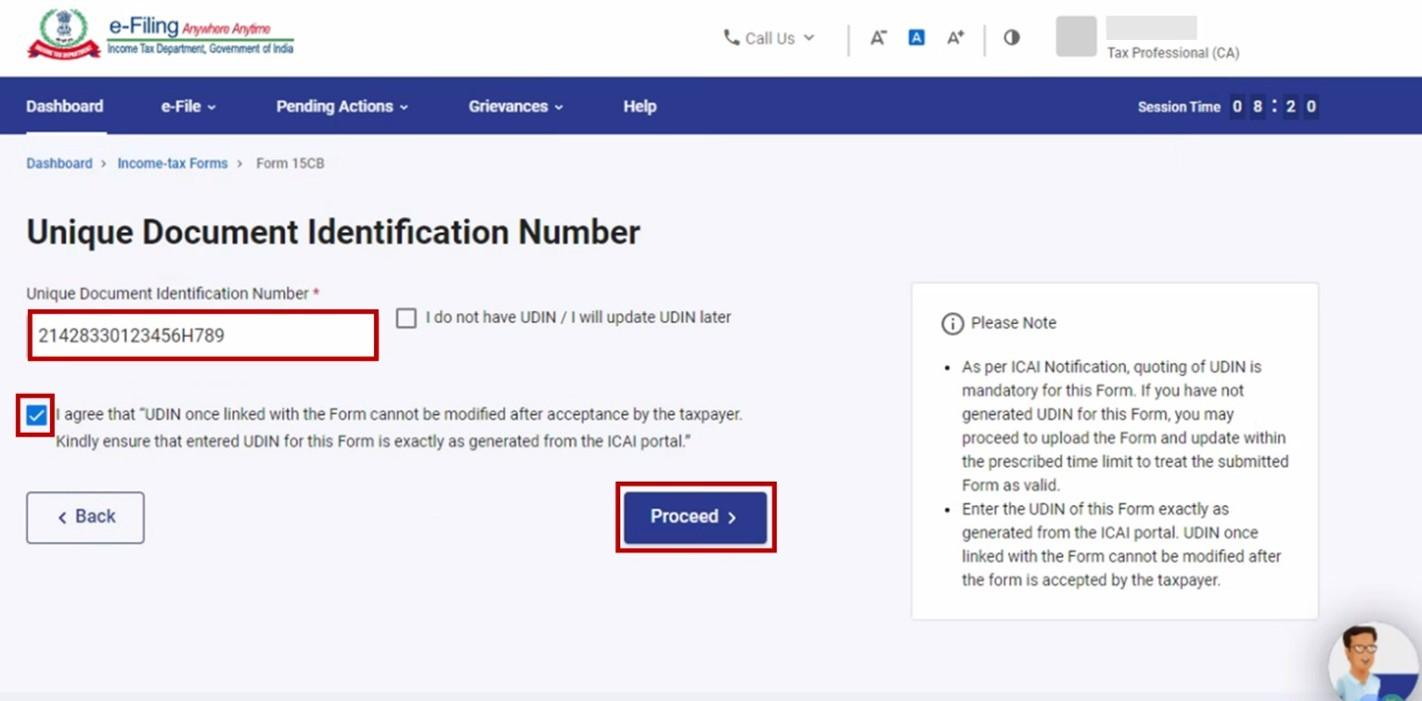

10, On the UIDN page, enter the Unique Document Identification Number, tick the checkbox, and click Proceed to continue.

Note: If you don’t have a UDIN, you can still continue by selecting the checkbox “I do not have UDIN / I will update UDIN later.”

11, Complete the e-Verification with your Digital Signature Certificate (DSC).

On successful submission, you’ll receive a Transaction ID and Acknowledgement Number.

Common Mistakes to Avoid While Filing Form 15CA and 15CB

-

-

-

- Filing the Wrong Part of Form 15CA: Many filers select the wrong part simply because they do not calculate the aggregate taxable remittances for the financial year. Filing Part A instead of Part C, for example, can make the bank reject the submission.

-

- Filing After the Remittance Is Made: Form 15CA and 15CB must be filed before the money is transferred outside India. Several freelancers and agencies submit forms after initiating transfers, which results in non-compliance and additional documentation requests.

- Incorrect Tax Rate or Remittance Categorisation: Selecting the wrong purpose code, tax rate, or DTAA treatment often leads to rejection by the bank’s compliance team. In many cases, the nature of services (e.g., “software development” vs “licensing fees”) changes the taxable category entirely.

-

-

Did You Know?

Incorrect tax deduction under Section 195 can invite a penalty or future tax notices even if the payment has already been sent abroad.

- Using Outdated or Incomplete Documentation: Supporting documents like invoices, contracts, DTAA references, and CA certificates must match the latest financial year. Outdated or partially filled documentation is one of the most common reasons for processing delays.

Challenges Faced by Exporters and Freelancers

- Complexity in Understanding Compliance Forms: Forms like 15CA and 15CB contain tax terms that are difficult to understand. Many exporters and freelancers are unsure about which part of the form applies to them and whether their payment is taxable in India.

- Dependency on Chartered Accountants for Certifications: If the total taxable payment crosses ₹5 lakh in a financial year, a CA certificate becomes necessary. This creates dependence on a professional, and if the CA takes time to respond, the payment process gets delayed.

- Delays Due to Manual Document Flow: Banks require invoices, contracts, client details, and filled forms before processing foreign payments. These documents are usually shared by email or scanned copies, which increases the chance of errors or missing details.

- Lack of Integration Between Payment Systems and Tax Compliance: Payment tools and tax compliance systems do not work together. Money may be received first and compliance handled later, while banks ask for forms before sending payments abroad. As a result, businesses find it hard to track total payments made during the year, and they are unsure which part of Form 15CA to file. This increases the chances of errors and confusion.

How Razorpay Helps Simplify the Process

Razorpay does not file Form 15CA or 15CB, but it helps reduce many of the operational hurdles linked to international payments. Keeping payments organised and easy to track makes compliance easier.

- Built for Borderless Businesses: Razorpay is a platform designed specifically for cross-border payments. It already supports payments from 180+ countries, enabling Indian exporters and freelancers to accept global clients without setting up multiple systems.

- 130+ Currencies and Multiple Payment Methods: The platform supports 130+ currencies and offers payment options like international cards, Apple Pay, PayPal and global bank transfers. This helps businesses provide a familiar payment experience to international buyers.

- One Dashboard for Tracking All Foreign Payments: All transactions appear in a single dashboard, allowing users to monitor dates, amounts and currency values. This helps maintain transaction history across the financial year.

Interested in simplifying your international payments?

Track global payments, manage currencies, and maintain clean records from one dashboard to simplify compliance and reporting year-round.

FAQs

1. What is the main difference between Form 15CA and 15CB?

Form 15CA is a declaration submitted online to the Income Tax Department. Whereas Form 15CB is a certificate issued by a Chartered Accountant.

2. Is Form 15CB mandatory for all international payments over ₹5 lakh?

No. Form 15CB is mandatory only when the payment is taxable, and no order from the Assessing Officer is available. If you already have an AO certificate under Section 195(2), 195(3), or 197, Form 15CB is not required.

3. What will happen in case of non-compliance with Form 15CA and Form 15CB?

If the required forms are not filed correctly, the bank may hold or reject the remittance. The Income Tax Department may also impose penalties and question the transaction during assessment or audit.

4. When is Form 15CA not required to be furnished?

Form 15CA is not required when the payment is not chargeable to tax in India, or if it falls under the list of exempt payments notified by the Income Tax Department under Rule 37BB.

5. How do you download Form 15CA and Form 15CB?

You can access and submit both forms on the Income Tax e-filing portal, and once submitted, they can be downloaded as PDF copies for your records.

6. Who is eligible for Form 15CA?

Any person or business making a foreign remittance that may be taxable under the Income Tax Act is required to file Form 15CA.