When you use your card to make an international payment, whether online or while travelling, there’s often an additional cost known as a forex markup fee. This is an extra charge applied by banks or card issuers on transactions made in a foreign currency.

The primary reason most people don’t notice this fee is because it’s not listed as a separate item on their statement. Instead, it’s hidden within the currency exchange rate itself. While a small percentage on a single purchase may seem minor, these fees can add up significantly over time, especially for frequent travelers or those who regularly shop on international websites. Understanding these hidden costs is crucial for anyone looking to save money on travel and cross-border purchases.

Key Takeaways

What it is: A forex markup fee is an extra charge, typically 1% to 3.5%, that banks and card issuers add to the currency exchange rate for international transactions.

Who it affects: Anyone making international payments—travelers, online shoppers, students studying abroad, freelancers, and businesses.

The Hidden Cost: This fee isn’t usually listed separately on your bill. It’s embedded within the exchange rate you get, making your purchases more expensive than they seem.

How to Avoid It: Use zero-forex markup credit cards, opt for prepaid forex cards, or use modern fintech apps. When abroad, always choose to pay in the local currency, not Indian Rupees (INR).

What is a Forex Markup Fee?

Forex markup fees are extra charges added by banks and card issuers on international transactions and currency conversions. Usually ranging from 1% to 3.5%, this fee is applied over the base exchange rate rather than shown as a separate charge. As a result, the actual cost of foreign online or in-store purchases becomes higher than it appears, making international spending more expensive without clear visibility to the user.

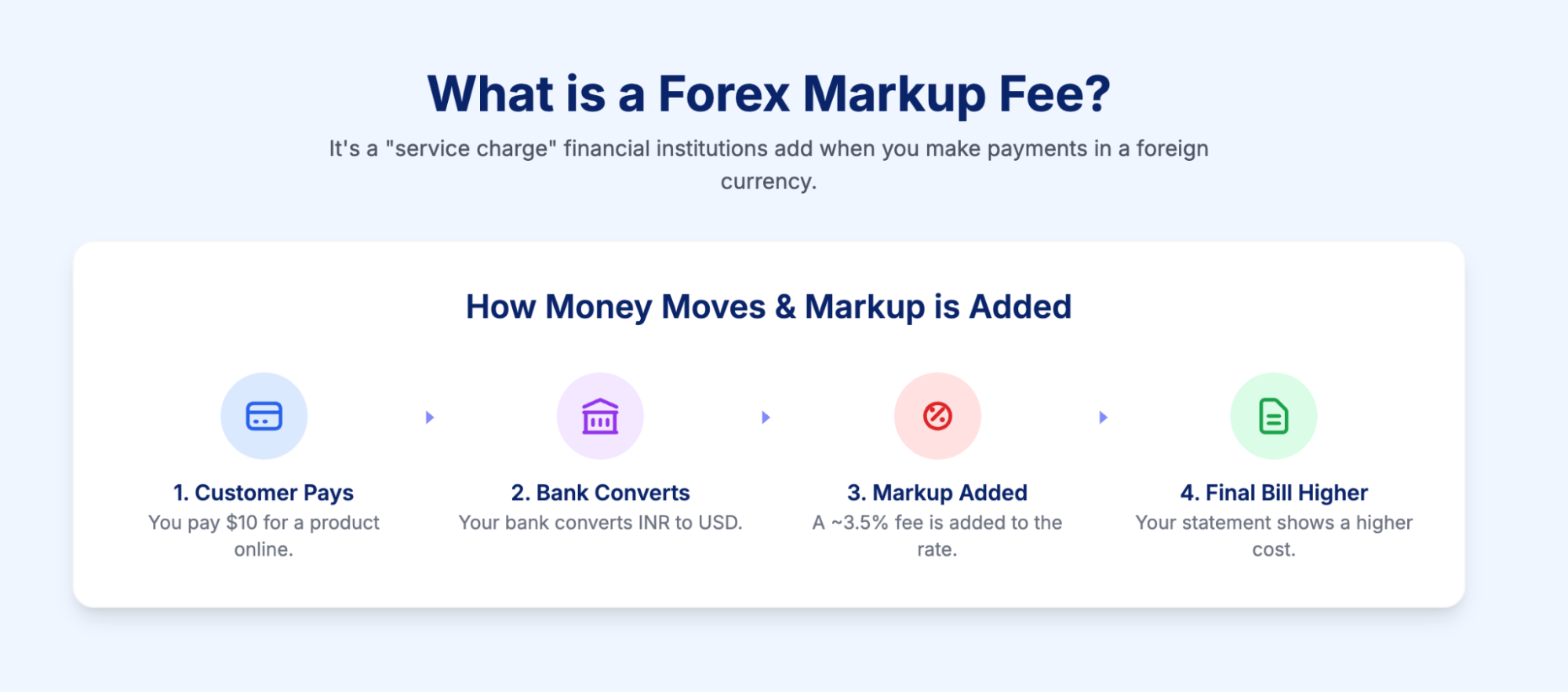

Think of a forex markup fee as a “service charge” your bank or card provider adds for the convenience of converting your money. When you buy something in U.S. Dollars, for example, they convert your Indian Rupees to make the payment. The real exchange rate (also known as the mid-market rate, the one you see on Google) is the baseline. The bank, however, gives you a slightly less favorable rate and pockets the difference. That difference is the markup.

It’s an extra percentage (usually between 1% and 3.5%) added by financial institutions on top of the standard exchange rate during a foreign currency transaction.

- Who charges it? Your bank (for both credit and debit cards), your card issuer (like Visa or Mastercard), and sometimes payment processors.

- Why is it charged? While banks claim it covers the cost of currency conversion, it’s primarily a significant revenue stream for them.

Who Pays Forex Markup Fees?

This fee is more common than you might think. You’re likely paying it if you are:

- A Traveler: Swiping your Indian debit or credit card at a café in Paris or a shop in New York.

- An Online Shopper: Buying products from an international website that bills in dollars, euros, or any foreign currency.

- A Freelancer or Business: Receiving payments from clients abroad, where the platform or bank applies a markup when converting the payment to INR.

- A Student: Paying university tuition or living expenses in a foreign country.

- A Business Owner: Making payments to international suppliers or vendors.

Typical Forex Markup Fee Rates

The fees aren’t standardized and can vary widely. Here’s a general breakdown:

- Credit Cards: Most issuers charge between 2% to 3.5% on each transaction.

- Debit Cards: Typically a bit lower, ranging from 1% to 3%.

- Forex/Prepaid Travel Cards: These are designed for travel and usually have the lowest rates, often between 0% and 1%. Some even offer zero markup.

- International UPI/Fintech Apps: Many modern fintech platforms have disrupted this space by offering zero or very minimal markup fees, giving you the real exchange rate.

How Does a Forex Markup Fee Work? A Simple Example

Let’s make this real. Imagine you find a perfect pair of sneakers on a U.S. website for $100.

- The Actual Cost: Let’s say the current exchange rate is 1=₹83. So, the sneakers should cost you ₹8,300.

- The Bank’s Calculation: You pay with your credit card. Your bank, which charges a 3.5% forex markup fee, doesn’t give you the ₹83 rate.

- The Markup is Added: They add their fee.

- Markup Amount = 3.5%×₹8,300=₹290.50

- Your Final Bill: The amount debited from your account isn’t ₹8,300. It’s:

- ₹8,300 (actual cost) + ₹290.50 (markup fee) = ₹8,590.50.

You just paid nearly ₹300 extra without it ever being listed as a “fee.” Now, imagine this happening on all your international spending—from hotel bookings to meals and shopping. It adds up fast.

Behind the Scenes

When you swipe your card, the transaction is routed through an international network like Visa or Mastercard. The currency conversion and the addition of the markup fee happen automatically at your bank’s end before the final amount appears on your statement. It’s a seamless process designed to be invisible.

When Do You Incur Forex Markup Fees?

You’ll be charged this fee in any of these common scenarios:

- Physically swiping or tapping your card in a foreign country.

- Withdrawing cash from an ATM abroad.

- Shopping online from international e-commerce stores.

- Booking hotels or flights directly on international websites that bill in their local currency.

The Hidden Costs Don’t Stop at Markup Fees

The forex markup fee isn’t the only ghost in your statement. Watch out for these other charges:

- ATM Withdrawal Charges: Banks often charge a separate, flat fee for withdrawing cash from an international ATM, on top of the markup.

- Dynamic Currency Conversion (DCC): This is a tricky one. Sometimes, a foreign merchant or ATM will offer to bill you in your home currency (INR). It sounds convenient, but you should always say no. The exchange rates used for DCC are often far worse than your bank’s markup rate.

- GST: In India, GST is applied to the forex markup fee amount, adding another layer of cost to your transaction.

How to Avoid or Reduce Forex Markup Fees

Tired of giving away your hard-earned money? You don’t have to. Here’s how to fight back:

- Get a Zero Forex Markup Credit Card: Many banks now offer premium credit cards specifically designed for travelers that come with zero or very low forex markup fees.

- Use a Forex Travel Card: These prepaid cards are your best friend for travel. You can load them with a foreign currency beforehand, locking in an exchange rate and often avoiding markup fees on your swipes.

- Embrace Fintech Wallets and Apps: Modern financial apps often provide international transaction services with mid-market exchange rates and transparent, low fees.

- Always Choose the Local Currency: As mentioned in our pro-tip, refuse the offer to be billed in INR when you’re abroad.

- Do Your Homework: Before you travel, compare the policies of different cards and banks. A quick call to customer care can save you a lot of money.

The Big Win: Benefits of Avoiding Forex Markup Fees

Why go through this effort? The rewards are tangible.

- Direct Savings: You save a solid 2-4% on every single international transaction.

- Transparent Spending: You know exactly what you’re paying without hidden costs, making budgeting for trips much easier.

- Better Value for Your Money: For freelancers and businesses, this means keeping more of your international earnings. A 3% fee on a $10,000 payment is $300—money that should be yours.

Forex Markup Fee Charges by Different Banks (India)

Here’s a quick look at the typical markup fees from major Indian banks.

(Note: The data below is indicative and for general comparison. These rates can vary based on the type of card and may change. It’s always best to check with your specific bank for the most current information.)

| Bank / Card Issuer | Typical Markup Fee | Zero Markup Option Available? |

| HDFC Bank Credit Cards | 3.5% | Yes, on some premium cards |

| ICICI Bank Credit Cards | 3.5% | Yes, but options are limited |

| Axis Bank Credit Cards | 3.5% | Yes, on select travel cards |

| SBI Credit Cards | 3.0% – 3.5% | Rare, on specific premium cards |

| Fintech Cards (e.g., Niyo) | 0% – 1% | Yes, this is their main feature |

Troubleshooting Common Forex Fee Issues

Encountered a problem? Here’s a quick guide.

| Issue | Likely Cause | How to Solve It |

| The charge on your statement is unexpectedly high. | The forex markup fee and GST have been applied. | Review your card’s fee structure before you use it internationally. The cost is likely legitimate, just hidden. |

| You see a duplicate charge for the same transaction. | This is usually a processing or network error. | Contact your bank immediately to raise a dispute and get the duplicate charge reversed. |

| You were charged in INR, but the rate was terrible. | You likely accepted Dynamic Currency Conversion (DCC) at the point of sale. | Unfortunately, this is hard to reverse. Always remember to choose “Pay in Local Currency” next time. |

A Note for Businesses & Freelancers

If you receive international payments, forex markup fees directly impact your revenue. When a client pays you $5,000, a 3% markup by the bank or payment platform means you lose $150 before the money even hits your account. Over a year, this can amount to thousands of dollars.

Choosing the right payment platform is critical. While services like PayPal are convenient, they often have higher markups. Modern platforms designed for cross-border trade, like RazorpayX, prioritize transparency by offering better exchange rates and clearer fee structures, ensuring you keep more of what you earn.

Avoid Hidden Fees with Razorpay International

As a business or freelancer, forex markup fees aren’t just a small cost—they’re a direct hit to your revenue. Watching 2-3% of your hard-earned income disappear in hidden charges is frustrating. This is where choosing the right payment platform makes a critical difference.

Razorpay International is designed to bring transparency and efficiency to your global payments, helping you keep more of what you earn.

Here’s how it helps:

- Transparent Rates, Better Earnings: Receive payments from clients in 100+ currencies at competitive exchange rates, minimizing the impact of hidden markups.

- Simplified Accounting: Easily access invoices, remittance advice (e-FIRA ready), and transaction histories from a single dashboard for effortless reconciliation.

- No Hassle of Foreign Accounts: Eliminate the complexity and high costs of maintaining foreign bank accounts. Invoice your global clients and receive funds directly in INR.

Ready to stop losing money to hidden fees and simplify your global payments?

FAQs

What is a forex markup fee on a credit card?

It is an additional fee, typically 2-3.5%, charged by your credit card issuer on transactions made in a foreign currency. It’s added to the exchange rate, not listed as a separate fee.

How can I avoid forex markup charges when traveling abroad?

The best ways are to use a credit card with zero forex markup, a prepaid forex card, or a fintech app that offers mid-market exchange rates. Also, always choose to pay in the local currency.

Which cards in India have zero forex markup?

Several premium credit cards from banks like HDFC (Infinia, Diners Club Black) and Axis Bank (Burgundy Private) offer zero markup. Additionally, many fintech-powered cards like Niyo Global are built around this feature.

Is the forex markup fee the same as GST on foreign transactions?

No. The forex markup is a fee charged by the bank. GST is a tax levied by the government on that fee. So, you pay GST on the markup amount.

Do prepaid forex cards charge markup fees?

Most don’t charge a markup fee for transactions made in the currency loaded on the card. However, they may have fees for loading, unloading, or inactivity.

Can I get a refund for wrongly charged markup fees?

A markup fee is a standard charge, so it cannot be “wrongly” charged unless there’s a processing error (like a duplicate charge). If you believe there has been an error, you should contact your bank to raise a dispute.