If you’re exporting software, digital services, or physical goods and have faced delays in receiving international payments or explaining your earnings to the bank, the problem often lies in your export invoice. Getting paid smoothly depends on this one crucial document, and it’s much more than just a bill you send to your overseas client.

An export invoice is a legally recognised proof of sale that confirms the value of your export, ensures timely payments, and keeps you compliant with Indian regulations under the Foreign Exchange Management Act (FEMA) and Goods and Services Tax (GST). In simple terms, it bridges your business with the global banking system.

Read on to learn everything you need to create a correct and compliant export invoice format, from mandatory components and e-invoicing rules to simple tips that make documentation easier.

Key takeaways

A well-prepared export invoice ensures smooth international payments and compliance with GST, FEMA, and Customs regulations.

Include all mandatory details—from buyer and shipment information to GST and bank declarations—to avoid payment or documentation issues.

Stay compliant by registering your AD Code, issuing e-invoices if applicable, and receiving payments within nine months as per FEMA rules.

What is an Export Invoice? (And How is it Different from a Tax Invoice?)

An export invoice is a commercial document you issue when selling goods or services to a customer outside India. It lists what you’re exporting, the currency, quantity, and value, along with details required under Indian GST laws and FEMA regulations.

While a domestic tax invoice focuses on GST collection within India, an invoice for export serves a broader purpose. Here’s how they differ:

| Basis of Difference | Export Invoice | Tax Invoice (Domestic) |

| Purpose | Used for cross-border sales to foreign buyers | Used for sales within India |

| Currency | Usually in foreign currency (USD, EUR, etc.) | Always in Indian Rupees (INR) |

| GST Applicability | Zero-rated under Goods and Services Tax | GSTis charged as per applicable rates |

| Regulatory Use | Shared with customs, Directorate General of Foreign Trade (DGFT), and banks for compliance | Used mainly for domestic GST filing |

Three Core Functions of an Export Invoice

- For the Buyer: It’s the official bill that tells your overseas client what to pay, in what currency, and under what terms. Without it, foreign remittances can’t be processed smoothly.

- For Customs: The invoice acts as a key document for clearance — customs officers verify the value, product description, and destination to ensure the export complies with trade regulations.

- For Compliance: It helps exporters claim GST refunds or export goods without paying GST under a Letter of Undertaking (LUT). It also serves as proof for FEMA and RBI reporting, showing that the payment for exported goods was received properly.

Did You Know?

The RBI mandates that every exporter must receive export proceeds within nine months from the date of export.

What Are the Different Types of Export Invoices?

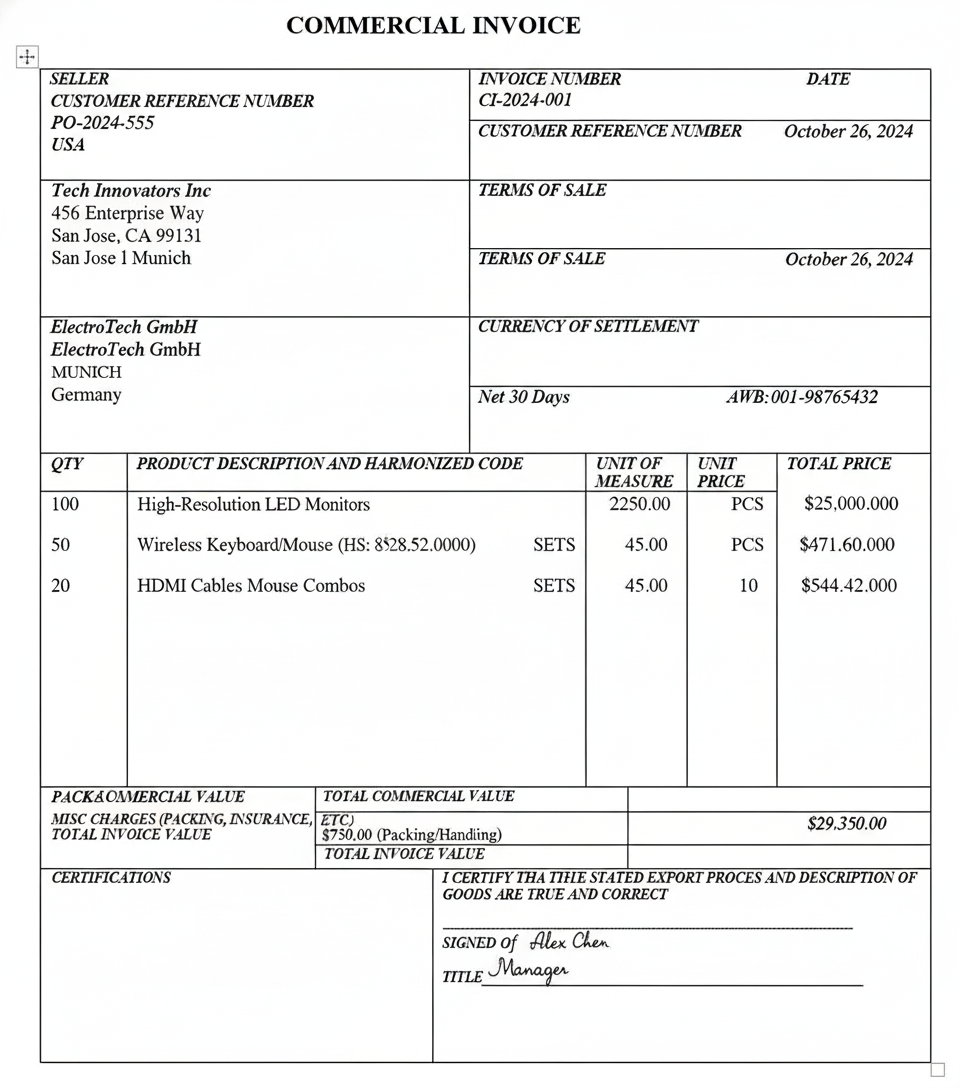

1. Commercial Invoice

A commercial invoice is the primary export document that serves as legal proof of sale between the buyer and seller. It includes details like item description, quantity, value, and shipping terms used by customs to assess duties and by banks to process payments.

2. Consular Invoice

A consular invoice is certified by the destination country’s consulate or embassy. It provides an official record of the goods’ type, quantity, and value, helping importing authorities verify the shipment and calculate applicable duties faster.

3. Proforma Invoice

A proforma invoice is a preliminary bill or quotation sent before the actual sale. It outlines estimated prices, quantities, and shipping details, allowing the buyer to arrange payment and import permits before confirming the order.

4. Customs Invoice

A customs invoice is required by certain importing countries in addition to a commercial invoice. It includes extra details — such as freight, insurance, and packing costs — to help customs determine the import value accurately.

5. Legalised Invoice

A legalised invoice is often needed for exports to Middle Eastern nations. It is attested and stamped by the importer’s country’s consulate, verifying the authenticity of the document and ensuring compliance with local trade requirements.

Mandatory Components: An Anatomy of the Perfect Export Invoice

Seller & Buyer Details (The Basics)

- Exporter Details: Include your business name, address, contact details, GSTIN, and IEC. These help authorities and banks identify your business and verify export eligibility.

- Invoice Reference: Add a unique invoice number and date. Keep numbering sequential to meet GST and accounting standards. You can also include the buyer’s purchase order number for easy tracking.

- Buyer (Consignee) Details: Mention the foreign buyer’s or consignee’s name, address, and contact details. Having the correct consignee ensures smooth customs clearance and delivery.

Transaction & Shipping Details

- Shipment Details: Specify the mode of transport (air, sea, courier) and, if applicable, the port of loading and port of discharge. Include the shipping bill number once generated. These details link your invoice to the official export documentation.

- Country of Origin and Destination: Mandatory for customs and trade reporting.

- Dispatch or Expected Delivery Date: Helps track shipment timelines for both the buyer and customs records.

Product & Payment Details

- Description of Goods/Services: Clearly describe what’s being sold. For goods, mention product names, Harmonised System of Nomenclature (HSN) codes, quantities, unit prices, and total value. For services, describe the nature and duration of service.

- Value and Currency: State the invoice currency (e.g., USD, EUR) and total value in both foreign currency and INR. Include the exchange rate if required by your bank or GST filing.

- Terms of Sale (Incoterms): Mention agreed trade terms like Free on Board (FOB), Cost, Insurance, and Freight (CIF), or Delivered at Place (DAP), defining who bears freight, insurance, and risk.

- Payment Terms: Clearly state how and when payment will be made — for example, “100% advance via wire transfer” or “Net 30 days after shipment.”

Bank & Legal Declarations

- Bank Details for Payment: Add your bank name, account number, SWIFT/BIC code, and beneficiary name. This ensures accurate and faster remittance.

- Tax and Export Declarations: Mention whether the supply is under LUT (without IGST) or with IGST paid. Example: “Zero-rated supply under LUT – IGST not applicable.” This ensures GST compliance and smoother refund processing.

- Signature and Certification: End with an authorised signature and seal along with a declaration such as “We certify that the particulars are true and correct and the goods are of Indian origin.” A digital signature is acceptable for online submissions.

Exporting Goods vs. Exporting Services: A Key Difference

When You Export Goods

Goods exports involve the movement of physical items from India to a foreign country. Every transaction is tied to tangible products and must be backed by the right trade and customs documents.

Key elements include:

- HSN Codes: Identify the product category under GST for correct tax reporting.

- Shipping Bill: Filed electronically through ICEGATE; it’s essential for customs clearance.

- Bill of Lading / Air Waybill: Proof that goods have been shipped and are in transit.

- Ports and Logistics: Details of shipment port, carrier, and destination are mandatory.

- Incoterms: Define who bears the cost and risk during transportation between you and your buyer.

When You Export Services

Service exports, on the other hand, have no physical movement of goods. These include SaaS platforms, IT consulting, design, and other digital services provided to overseas clients.

Key elements include:

- Service Accounting Code (SAC): Used instead of HSN codes to classify exported services under GST.

- Place of Supply: This tells the government where your service is used — if it’s used outside India, it counts as an export.

- Proof of Delivery: You need to show that the work was done, like sharing completed projects, signed approvals, or timesheets from your client.

- No Shipping Documents: Since services are intangible, you’ll rely on contracts, invoices, and bank realisation certificates rather than shipping records.

How to Stay Compliant with GST, E-Invoicing & FEMA?

The Big Question: GST on Exports (LUT vs. IGST Refund)

There are two ways to handle GST on exports. If you export goods or services under LUT, you don’t need to pay IGST upfront. However, you must receive payment in foreign currency within nine months of export.

Alternatively, you can choose to pay IGST on exports and later claim a refund from the government. In both cases, make sure your invoice clearly mentions whether it’s issued under LUT or with IGST paid.

Mandatory E-Invoicing for Exports (IRN)

If your business turnover is ₹5 crore or more, you must generate an Invoice Reference Number (IRN) for each export invoice. The invoice must also include the QR code generated from the e-invoicing portal. Without this, the invoice is not valid for GST filing or refund claims.

FEMA & RBI Compliance: Getting Your Money Home

According to FEMA, you must receive export payments in freely convertible foreign currency through your Authorised Dealer (AD) bank within nine months from the date of export.

Ensure that your shipping bill, e-invoice, and Bank Realisation Certificate (BRC) carry the same details. This consistency helps banks and customs verify your export and release the payment without issues.

Common Export Challenges: Avoiding Invoicing Errors and Payment Delays

Even when your export deal is finalised, a small invoicing mistake can cost you valuable time and money. Whether you’re a SaaS company billing an overseas client or a seller shipping products abroad, accurate export documentation is what keeps your payments moving and your compliance intact.

Many exporters struggle not because of poor sales, but because of errors in their export invoice format — something that can easily trigger bank rejections, customs queries, or GST mismatches.

Common Invoicing Mistakes Exporters Make

- Missing or incorrect invoice numbers make it hard for banks or customs to verify the transaction.

- Using domestic tax invoice formats instead of the correct invoice for export, leading to GST errors.

- Forgetting to include HSN or SAC codes, which are mandatory for classification under GST.

- Not mentioning the Place of Supply for services, causing GST compliance issues.

- Errors in currency conversion or exchange rates at the time of invoicing.

Why These Mistakes Matter

- Payment Delays: Banks may hold foreign remittances if the invoice doesn’t match customs or FEMA requirements.

- Customs Penalties: Wrong or incomplete information can hold up your shipment at customs and may even lead to fines.

- RBI Issues: You must receive your export payment within nine months. If you don’t, or if your documents aren’t correct, it can cause problems with RBI rules and future transactions.

Simplify Global Payments with Razorpay Payment Gateway

If you’ve faced delayed payments or compliance issues while exporting, you already know how stressful managing international transactions can be. That’s where Razorpay Payment Gateway helps — it brings every step of the export payment process under one reliable platform.

With Razorpay, you don’t just receive payments — you simplify your entire export workflow. It helps you get paid faster, stay compliant automatically, and avoid delays caused by manual errors or missing documents. Whether you export goods, services, or digital products, Razorpay ensures your global payments arrive securely, in your preferred currency, and right on time.

Simplify International Payments with Razorpay

Razorpay International ensures effortless FEMA compliance by automatically handling authorized fund processing and digital reporting for all your overseas payments.

FAQs

1. What is the difference between an HSN code and an SAC code?

HSN codes apply to goods, while SAC applies to services. Both are used to classify items under GST for accurate tax reporting and export documentation.

2. Is an e-invoice (IRN) mandatory for all exporters in India?

E-invoicing is mandatory only if your aggregate turnover exceeds ₹5 crore in a financial year.

3. What is an AD Code, and where do I get one?

An Authorised Dealer Code is a unique 14-digit number that connects your export transactions to your bank account. It’s issued by the bank where you hold your current account and must be registered with Indian Customs through the ICEGATE portal.

4. How long do I have to receive my payment for exports under FEMA?

Under FEMA regulations, exporters must receive full payment in freely convertible foreign currency within nine months from the date of export.

5. Can I create one invoice for multiple purchase orders?

Yes, you can combine multiple purchase orders into one export invoice, provided all orders are for the same buyer and shipment.

6. What is a Letter of Undertaking (LUT) in GST?

An LUT allows you to export goods or services without paying IGST upfront, provided you receive the export proceeds within the prescribed period.

7. What is the difference between a tax invoice and a shipping bill?

A tax invoice is a document you issue to your overseas buyer—it lists what you’re selling, the value, and the terms of payment. A shipping bill, on the other hand, is filed with Indian Customs when you export goods. It’s a mandatory document for Customs clearance and proof that the goods have legally left the country.