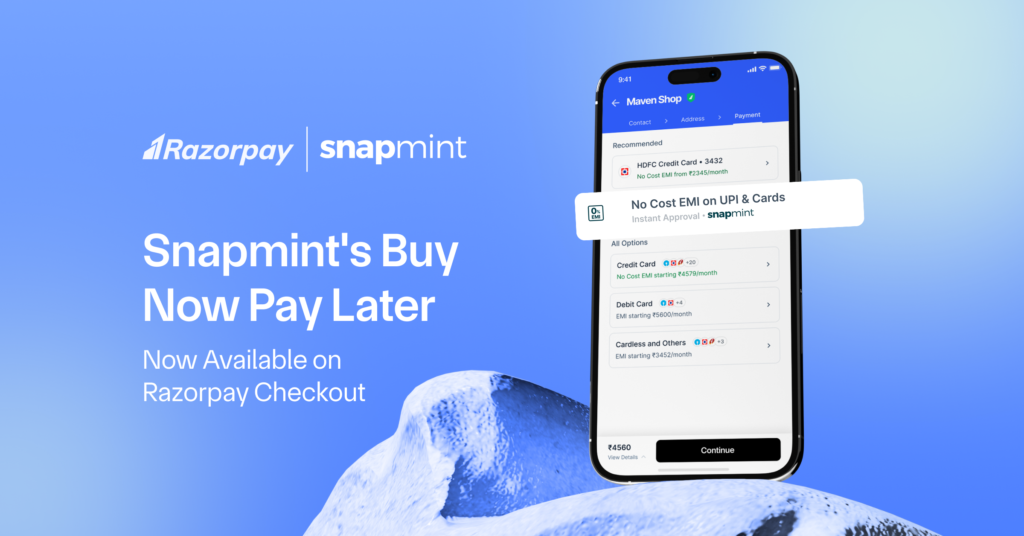

Razorpay, India’s leading full-stack financial solutions company, is excited to announce that the powerful Snapmint Buy Now Pay Later option is now available on Razorpay Checkout. This collaboration marks a significant leap forward in our mission to democratize financial access, empowering millions of Indian consumers to make higher-value online purchases more accessible than ever.

Table of Contents

About Snapmint

Snapmint is India’s leading Buy Now, Pay Later (BNPL) platform, making shopping more affordable and accessible through its 0% interest, cardless EMI solution. Founded in 2017, Snapmint has enabled over 50 million users across 2,600+ cities to split their payments into easy EMIs – without needing a credit card or lengthy paperwork.

The platform solves two major consumer pain points: lack of access to formal credit and high checkout drop-offs due to affordability constraints. With Snapmint, users enjoy instant approval, zero hidden fees, and a frictionless experience both online and in-store.

For brands and merchants, Snapmint acts as a powerful growth lever:

- 10–12% increase in conversions

- ~25% boost in Average Order Value (AOV)

- 1–2% RTO on Snapmint Orders

- 8–10% repeat customer rate

Additionally, brands benefit from premium features such as:

- White-labeled EMI solutions that retain brand identity

- Widget 2.0 for faster checkout

- Visibility on the Snapmint EMI Store, driving new customer acquisition

Trusted by 1,200+ leading eCommerce, D2C and retail brands like Meesho, Titan, Mokobara, Ixigo, Hyphen, BoAt; Snapmint is reshaping how India shops – making affordability a catalyst for business growth.

The Future of Flexible Payments is Here

The Snapmint Buy Now, Pay Later integration addresses two distinct consumer needs. For a vast segment of Indian consumers, especially Gen Z and those in Tier 2-5 cities, it removes barriers caused by limited access to traditional credit. For many others, it’s simply a preferred way to pay, offering the convenience and peace of mind that come with flexible payment options. With Razorpay Checkout and Snapmint, your customers can now seamlessly split their payments into easy monthly installments without the prerequisite of a credit card.

Related Read- About Snapmint Cardless EMI

How it Works: Simple and Secure

Once activated on your checkout, Snapmint EMI will appear as a convenient payment option for your customers. Eligible shoppers can select their preferred EMI plan and will be guided through a simple and secure process to complete their purchase without needing a credit card.

Razorpay maintains its industry-leading standards of data security throughout this integration, ensuring all data is encrypted and compliant with relevant regulations. Businesses will also have access to detailed analytics in their Razorpay dashboard to track the performance of Snapmint EMI transactions.

What This Means for Your Business: Driving Growth and Conversions

- Increased Conversion Rates: Experience a significant boost in conversions, especially for higher-value items.

- Expanded Customer Reach: Tap into a massive, underserved market of Gen Z and Tier 2-5 customers.

- Higher Average Order Values (AOV): Empower customers to complete larger purchases by paying in installments.

- Seamless Integration: Enabling Snapmint is straightforward for existing Razorpay users and requires no additional integration costs.

How to Enable Snapmint on Your Checkout

Getting Snapmint up and running on your Razorpay Checkout is a straightforward process. Here’s how you can get started:

Prerequisites:

✅ Have a Snapmint account

✅ Snapmint production API credentials (Merchant ID, Key, and Token)

✅ Have a Razorpay account

Express Your Interest

Snapmint Cardless EMI is now available to add to your store. This feature is available by request, and the first step is to let us know you’re interested!

Get Ready: Snapmint Buy Now Pay Later is Live!

Not yet on Razorpay Magic Checkout? Don’t miss out!

Snapmint EMI is available through Razorpay Checkout. If you haven’t enabled Magic Checkout yet, now is the perfect time to ensure you’re ready to offer this powerful EMI option.