You’ve done the hard work. You’ve delivered a great product, provided an excellent service, and your international client is happy. A payment of $1,000 lands in your Indian bank account. The money is here, but how do you officially prove it? What is the single most important document that legitimises this cross-border transaction for all official purposes?

The answer is the e-FIRA, or electronic Foreign Inward Remittance Advice.

For any Indian business earning in foreign currency, this digital document isn’t just a piece of paper; it’s mandatory proof of your export proceeds. It’s the key that unlocks Goods and Services Tax (GST) refunds, helps you claim benefits from the Directorate General of Foreign Trade (DGFT), and ensures you stay compliant with the RBI’s Export Data Processing and Monitoring System (EDPMS).

This guide will walk you through exactly what an e-FIRA is, why it’s crucial for your business, how to get one, and how modern platforms like Razorpay can make the entire process effortless.

Key Takeaways

|

What is e-FIRA?

e-FIRA stands for Electronic Foreign Inward Remittance Advice. Think of it as a digital passport for the money you receive from abroad. It’s an official document issued by your bank (an Authorised Dealer or AD Bank) that confirms the details of a foreign currency payment credited to your account.

It is the modern, digital successor to the old physical FIRC (Foreign Inward Remittance Certificate). While FIRC is now only used for specific cases like Foreign Direct Investment (FDI), the e-FIRA is the standard for all export-related transactions.

An e-FIRA contains several critical fields that provide a complete picture of the transaction:

| Field | Description |

| Sender Name | The name of your overseas client or the company that sent the payment. |

| Beneficiary Name | Your name or your company’s name as the Indian account holder. |

| Foreign Currency Amt | The original amount you received in the foreign currency (e.g., $1,000 USD). |

| INR Equivalent | The final amount credited to your account in Indian Rupees after conversion. |

| UTR Number | The Unique Transaction Reference number, which helps track this specific payment. |

| Purpose Code | An RBI-mandated code that classifies the nature of the payment (e.g., software exports). |

| Exchange Rate | The conversion rate applied by the bank to change the foreign currency into INR. |

Why is e-FIRA Important for Exporters?

Getting an e-FIRA isn’t just good practice; it’s a non-negotiable part of exporting from India. It’s the cornerstone of your compliance strategy and the key to unlocking financial benefits.

Here’s why it’s so critical:

- Mandatory Compliance: The Reserve Bank of India (RBI), DGFT, and Customs authorities require you to have proof of inward remittance. The e-FIRA is that proof. It ensures every dollar you earn is accounted for under the Foreign Exchange Management Act (FEMA).

- Claiming GST Refunds: If you are a goods or service exporter, you are likely eligible for a GST refund on your exports. To process this claim, the GST authorities will ask for your e-FIRA and Bank Realisation Certificate (BRC) as evidence that you have received payment for the exports.

- Reconciling Remittances (EDPMS): The RBI uses the EDPMS portal to track export transactions from the shipping stage to the final payment. Your bank uses the information from your e-FIRA to update this portal, closing the loop and preventing your transaction from being flagged as overdue.

- Accessing Export Incentives: The Indian government offers several schemes to promote exports. To claim benefits under these schemes, you must furnish your e-FIRA as proof of export realization.

- Avoiding Penalties: Failing to properly document and report foreign income can lead to penalties from regulatory bodies. Having a clear and organised file of all your e-FIRAs keeps you safe during audits.

FIRA vs. FIRC vs. e-FIRA vs. FIRS – Key Differences

The world of export documentation is filled with acronyms. Let’s clear up the confusion.

| Document | Purpose | Current Use? |

| FIRC | A physical certificate as proof of remittance. | Now obsolete for exports. Only used for Foreign Direct Investment (FDI) or Foreign Institutional Investment (FII). |

| e-FIRA | A digital advice confirming receipt of foreign funds. | Actively used for all export transactions. This is the document you need. |

| FIRS | Foreign Inward Remittance Statement. An internal advice generated by banks for reporting to EDPMS. | Used internally by AD banks for reporting; not typically shared with the exporter. |

| e-BRC | Electronic Bank Realisation Certificate. A confirmation that the exporter has realized their payment against a specific shipping bill. | Generated after e-FIRA, specifically for goods exporters to close the loop in DGFT. |

Let’s make this real with an example. Imagine you’re a SaaS founder in Bengaluru who just closed a $1,000 deal with a client in the US. The money lands in your Indian bank account. Now, here’s how the different documents come into play:

-

FIRC (Foreign Inward Remittance Certificate)

Earlier, your bank would have given you a physical FIRC as proof of the inward remittance. But for exporters like you, this is now outdated. Today, FIRC is only used in special cases like Foreign Direct Investment (FDI) or venture capital inflows.

-

FIRA (Foreign Inward Remittance Advice)

This was the earlier “advice” issued by banks confirming your remittance. It has now evolved into its digital version.

-

e-FIRA (Electronic Foreign Inward Remittance Advice)

This is what you’ll actually get today. The bank automatically generates an e-FIRA that confirms your $1,000 SaaS payment, lists the sender, exchange rate, INR equivalent, and the purpose code (say, P0801 for software exports). This is the document you’ll use for GST refunds, DGFT incentives, or compliance with RBI’s EDPMS.

-

FIRS (Foreign Inward Remittance Statement)

While you download your e-FIRA, your bank is also filing a FIRS in the backend. This is an internal statement banks prepare to update RBI’s monitoring systems. You don’t need it directly, but it’s how your transaction gets formally reported to regulators.

So, in practice: For your SaaS export, you don’t have to worry about FIRC or FIRS. The only thing you need to track and keep safe is the e-FIRA. That’s your golden document for compliance and benefits.

| Pro Tip: Don’t get lost in the jargon! As a modern service or goods exporter, the e-FIRA is the primary document you need to track and manage for every single international payment. |

Who Needs an e-FIRA?

If you are an Indian individual or business receiving money from outside India for goods or services, you need an e-FIRA. This includes a wide spectrum of businesses:

- Goods Exporters: Companies shipping physical products overseas.

- Service Exporters: This is a broad category that includes:

- Freelancers and Consultants working with international clients on platforms like Upwork and Fiverr.

- SaaS (Software-as-a-Service) Companies with a global customer base.

- IT Service Providers and BPOs.

- Marketing, design, and creative agencies billing overseas clients.

- E-commerce Sellers on platforms like Amazon Global Selling or Etsy.

What Details Does an e-FIRA Contain?

As we saw earlier, an e-FIRA holds specific details about your transaction. The most crucial of these for compliance is the Purpose Code.

This code tells the RBI the exact nature of your service or goods. For instance:

- P0801: Software exports

- P0802: Business and management consultancy services

- P1007: Marketing and public relations services

Getting this code right is vital. An incorrect purpose code can lead to compliance issues and delays in processing your transaction.

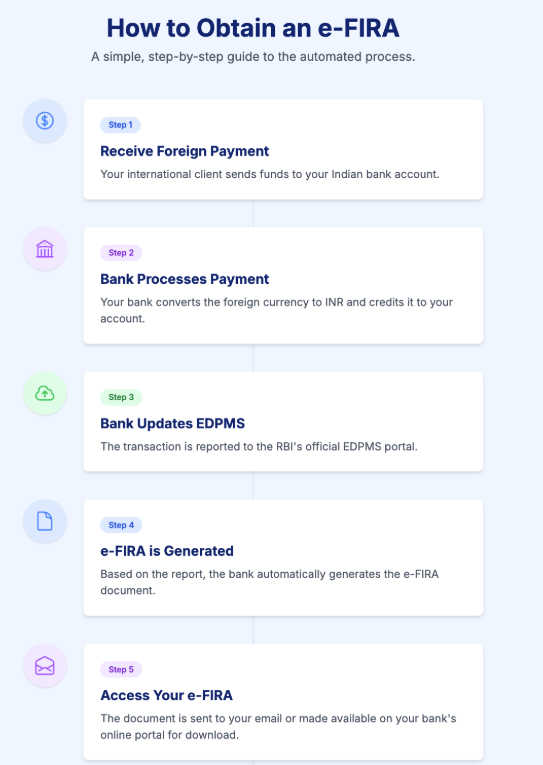

How to Obtain an e-FIRA?

The process of getting an e-FIRA is largely automated and handled by your bank. Here’s a simple step-by-step breakdown:

- Receive Your Foreign Payment: Your international client sends funds to your Indian bank account.

- Bank Processes the Payment: Your bank receives the foreign currency, converts it to INR, and credits it to your account.

- Bank Updates EDPMS: The bank reports this transaction to the RBI’s EDPMS portal.

- e-FIRA is Generated: Based on this, the bank automatically generates the e-FIRA document.

- Access Your e-FIRA: The bank sends the e-FIRA to your registered email address or makes it available for download on its corporate internet banking portal. You should download and store this PDF for your records.

- Use it for Compliance: Use this document when filing for GST refunds, applying for government schemes, or providing proof to auditors.

Accept International Payments Seamlessly with Razorpay International

Now that you understand the importance of the e-FIRA, the next step is to ensure your payment collection process is just as smooth and compliant. Manually tracking payments, reminding banks for documents, and correcting purpose codes can be a drain on your time.

This is where Razorpay International comes in.

Designed for Indian exporters, Razorpay simplifies global payments while keeping compliance at the forefront.

Why Choose Razorpay for Your Export Business?

- Accept Payments Globally: Receive payments in over 100 currencies without needing separate international accounts.

- Compliance-First Approach: Our platform helps you with automated purpose code mapping, ensuring your transactions are correctly classified from the start.

- Documentation on Demand: Get e-FIRA-compatible records, detailed settlement reports, and export-ready invoices, making your compliance paperwork a breeze.

- Seamless Integration: Easily integrate Razorpay with your website, whether it’s built on Shopify, WooCommerce, or a custom platform.

- Transparent and Fast: Enjoy real-time currency conversion and clear reporting, so you always know the status of your funds.

Conclusion

In the world of international trade, success isn’t just about what you earn; it’s about how well you document it. The e-FIRA is the essential digital document that bridges the gap between receiving a foreign payment and being fully compliant.

For freelancers, SaaS founders, and product exporters alike, understanding and managing the e-FIRA process is fundamental to sustainable growth. By embracing digital-first solutions like Razorpay, you can automate the complexities of cross-border payments and focus on what you do best—building a world-class business.

Frequently Asked Questions (FAQs)

-

Is e-FIRA mandatory for all exporters?

Yes, it is considered mandatory proof of inward remittance for all goods and service exporters in India to comply with RBI (FEMA) regulations and to claim various export-related benefits.

-

Can I use e-FIRA for GST refund claims?

Absolutely. The e-FIRA is a primary document required by the GST department to verify that you have received payment for the goods or services you have exported, which is a prerequisite for processing your refund claim.

-

How quickly is an e-FIRA generated?

Typically, banks generate an e-FIRA within 24-48 hours after the foreign remittance is successfully credited to your account. The timeline can vary slightly between banks.

-

What happens if my payment doesn’t have a purpose code?

If a purpose code is missing or incorrect, your bank may hold the payment and ask you for clarification. This can cause delays. It’s crucial to provide the correct purpose code to your client or ensure your payment platform helps you map it correctly.

-

Can Razorpay provide transaction documentation for e-FIRA?

Razorpay provides detailed transaction and settlement reports that contain all the necessary information (like UTR, sender details, amount) that your bank uses to generate the e-FIRA. This makes the reconciliation process much simpler for you and your bank.