In our increasingly connected world, businesses and individuals are no longer limited by geographical boundaries. Whether you’re an Indian exporter selling to global customers, an importer paying overseas suppliers, or an individual sending money to family abroad, you’re participating in the global economy. This seamless interaction is powered by cross-border payments.

This guide will explain everything you need to know about cross-border payments, from the basic mechanics to the latest trends, helping you navigate the complexities of international transactions.

Table of Contents

What Are Cross-Border Payments?

Cross-border payments are financial transactions where the payer and the recipient are located in different countries. These transactions are the backbone of international trade, e-commerce, and remittances, facilitated by a network of different financial institutions.

A Real-World Example of a Cross-Border Payment

To truly understand cross-border payments, let’s consider the choices facing a business owner in India today. Meet Priya, the founder of a boutique home decor brand in Jaipur. She needs to pay her trusted supplier in Portugal €5,000 for a shipment of handcrafted ceramics. The invoice is due, and Priya now faces a critical business decision: how to send the money. She has two main paths, each a classic example of a cross-border payment:

-

Path 1: The Traditional Bank (SWIFT Transfer):

Priya could visit her nationalized bank to initiate an international wire transfer. This process would involve filling out paperwork for the outward remittance. The bank would convert her INR to EUR at that day’s board rate, which includes a markup. The payment would be sent via the SWIFT network, where it might pass through one or more intermediary banks, each potentially deducting a fee. The payment would likely arrive in her supplier’s account in Portugal in 3-5 business days, with the final received amount being slightly less than expected due to unpredictable fees.

-

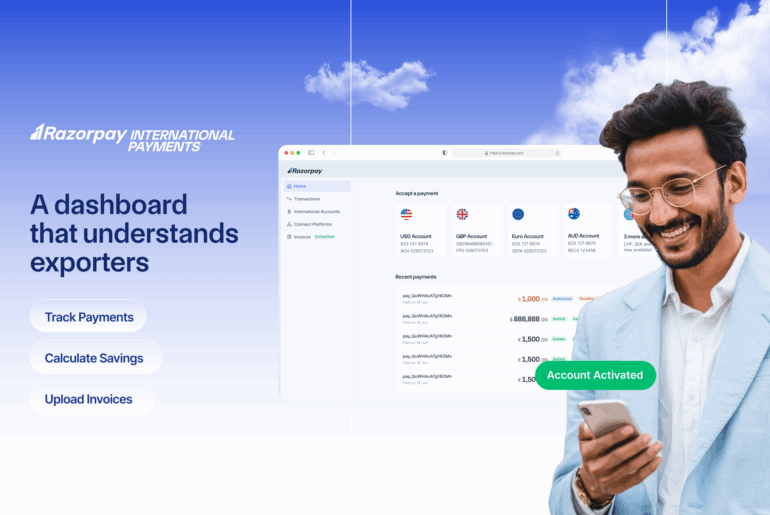

Path 2: The Modern Fintech Platform (like Razorpay):

Alternatively, Priya could use a digital platform like Razorpay. This would involve logging into a dashboard, entering the payment details, and seeing the exchange rate and final INR cost upfront before confirming. The platform sends the funds via its optimized global network, often arriving within 24 hours with full transparency on all charges.

Key Players in the Cross-Border Payment Ecosystem

A successful international transaction involves several key players working together:

- Traditional Banks: These are legacy institutions that handle large volumes of payments via networks like SWIFT.

- Fintech Platforms: This category includes agile, digital-first companies like Razorpay, Wise, and PayPal that often offer faster and more user-friendly solutions.

- Payment Processors: These are the intermediaries that ensure the secure routing and settlement of payments.

- Central banks and regulatory bodies: These are the agencies, such as the Reserve Bank of India (RBI), that enforce compliance and govern the rules of the financial system.

How Do Cross-Border Payments Work?

Understanding the mechanics of cross-border payments and the role of an international payment gateway helps businesses optimize their international payment strategy. While methods vary, they generally follow these key steps:

The Step-by-Step Process

- Initiation: The sender creates a payment instruction with their bank or payment provider.

- Currency Conversion: The sender’s local currency is converted to the recipient’s currency based on the applicable foreign exchange (FX) rates.

- Intermediary Processing: Banks or fintechs process the payment across various systems and networks.

- Compliance Checks: The transaction is screened for all regulatory requirements.

- Settlement: The funds are routed and delivered to the recipient.

- Confirmation: The sender and receiver are notified of the completed transaction.

Settlement Time Expectations

| Method | Settlement Time |

| Standard bank transfers | 2-5 business days |

| Expedited transfers | 24-48 hours |

| Real-time payment systems | Minutes to seconds |

Factors affecting speed include the currency corridor, international bank holidays, and potential compliance hold-ups.

Common Cross-Border Payment Methods

Various methods are available for sending money internationally, each with distinct advantages and limitations.

Traditional Methods

- SWIFT Wire Transfers: These are electronic transfers sent through the global SWIFT network, a secure messaging system linking banks worldwide.

- Bank-to-Bank International Transfers: This is a direct transfer of funds between bank accounts in different countries, often using the SWIFT system.

- Foreign Drafts and Cheques: A traditional and slower method where a physical bank draft or cheque is mailed internationally.

- Card-based International Payments: These transactions leverage global card networks like Visa or Mastercard to process cross-border payments.

Modern Digital & Fintech Solutions

- Razorpay Cross-Border Payments Stack: A specialized solution built to help Indian businesses accept international payments from over 100 countries with full RBI and FEMA compliance.

- Online Payment Platforms: Digital platforms like Wise, Stripe, and PayPal offer a streamlined alternative to traditional banks with faster settlements.

- Mobile Wallets: Digital wallets on mobile devices that facilitate quick cross-border payments, especially for P2P remittances.

- E-commerce Payment Gateways: Integrated solutions that allow an online exporter to securely accept payments from global customers in multiple currencies. You can learn more about how they function in our article, “What is a Payment Gateway?“.

- Benefits and Challenges of Cross-Border Payments

Engaging in international transactions offers significant opportunities but also comes with unique challenges.

Benefits

- Access to global markets and customers: Businesses can sell to and engage with customers from different countries.

- Increased revenue opportunities: Reaching a global audience opens up new streams of income.

- Business diversification: It allows companies to reduce dependency on a single economy.

- Competitive advantage: Businesses that efficiently handle international transactions can outperform competitors.

- Supply chain optimization: This enables companies to pay international suppliers and partners efficiently.

Challenges

- Currency exchange risk: Fluctuating exchange rates can impact the final amount received.

- Transaction fees and hidden costs: International payments can involve multiple charges, some of which may not be transparent. For a detailed breakdown, read our guide on Cross-Border Fees Explained.

- Regulatory complexity: Businesses must navigate the different financial laws of each country. For more on this, read our guide to FEMA compliance.

- Processing delays: Cross-border transactions can be slowed down by compliance checks and differing bank hours.

- Fraud and security concerns: Sending money internationally carries inherent risks that require robust security measures.

The Future of Cross-Border Payments

The world of cross-border payments is constantly evolving, driven by new technologies and a push for greater efficiency.

Technology Trends:

Innovations like blockchain technology, Central Bank Digital Currencies (CBDCs), and real-time payment (RTP) networks are poised to make international transactions faster, cheaper, and more transparent.

Regulatory Evolution:

Global standards like ISO 20022 are being adopted to create a common language for payment data worldwide, which promises to reduce errors and processing delays.

Power Your Cross-Border Payments with Razorpay

If your business sends or receives payments internationally, it’s crucial to use a cross-border payment solution that’s fast, transparent, and fully compliant. Razorpay’s Cross-Border Payments Stack is built to streamline international transactions for Indian businesses—whether you’re a SaaS company, exporter, freelancer, or eCommerce seller.

Ready to take your business global with seamless, compliant, and cost-effective payments?

Explore Razorpay’s Cross-Border Payment Solutions today!

Frequently Asked Questions (FAQ)

1. What are cross-border payments?

A cross-border payment is a financial transaction where the sender and receiver are based in different countries. It involves converting one currency to another and transferring funds across international banking networks, subject to the regulations of both countries involved.

2. How do cross-border payments work?

The process starts when a payer initiates a transfer through a bank or payment provider. The funds are converted and sent through intermediary networks, after which the transaction undergoes compliance checks before the money is finally settled in the recipient’s account.

3. What are the best cross-border payment solutions?

The “best” solution depends on your needs. Traditional banks are reliable for large transactions, while modern fintech platforms like Razorpay often provide a faster, more user-friendly, and cost-effective solution for businesses, freelancers, and exporters.

4. How can businesses reduce cross-border transaction fees?

To reduce fees, businesses can use modern payment platforms that offer transparent FX rates and lower transfer costs. Additionally, using multi-currency accounts can help avoid conversion fees for every transaction.