Let’s say you purchased a Canva Pro subscription priced in USD. You expected your Indian credit card to be charged Rs 830—but the bill was Rs 870. That extra Rs 40? It’s probably a cross-border fee.

Cross-border fees are common but often poorly understood charges that sneak into international transactions—whether you’re buying software online, running ads globally, or receiving export payments. If you’re a freelancer, SaaS founder, exporter, or simply managing global payments, this guide is for you.

Table of Contents

Understanding Cross-Border Fees: The What, Why, and How

What Are Cross-Border Fees?

A cross-border fee is an extra charge applied when a transaction involves two countries—usually when your bank card or payment account is used outside its issuing country or for payments in a foreign currency. For example, if you use your Indian card on a US-based website, your bank, card network, and the processor may each add a small fee.

Why Are They Charged?

These fees exist to cover the cost, risk, and currency conversion complexity of cross-border transactions. For the financial institutions involved, processing payments across different countries, currencies, and regulatory systems is a complex task, and these fees compensate them for that service.

How Can You Reduce Cross-Border Fees?

- Choose the Right Payment Processor: Some processors, like Razorpay, specialize in international transactions and offer more transparent and competitive rates by using direct payment routes.

- Use Multi-Currency Accounts: Holding funds in currencies like USD or EUR can help avoid frequent conversion fees.

- Compare True FX Costs: Always check the total cost, which includes not just the transfer fee but also the markup hidden in the exchange rate.

Breaking Down the 4 Common Types of Cross-Border Fees

A single international transaction can feel like it’s being hit by multiple small charges. That’s because it often is. Here’s a clear breakdown of the four key fees you may encounter.

1. Cross-Border Transaction Fee

Think of this as the basic “toll” for a payment crossing a digital border. It’s a fee charged simply because a card from one country is being used with a merchant based in another, and it applies automatically, even if the transaction is in your home currency.

- Charged by: Card Networks (like Visa or Mastercard).

- Typical cost: 0.5% to 1% of the transaction value.

2. Cross-Border Processing Fee

This is the fee charged by the payment processor or the merchant’s bank (the “acquirer”) for the service of securely handling and clearing the payment through complex international banking systems. It’s their charge for moving the money from your bank to the seller’s bank across the world.

- Charged by: The Payment Processor or Acquiring Bank.

- Typical cost: 1%–2% of the transaction value.

3. Foreign Transaction Fee (FTF)

This is a separate charge levied by your own bank or card issuer (e.g., HDFC, ICICI, Amex) for the convenience of allowing you to make a purchase in a foreign currency. Some premium cards waive this fee, but for most, it appears as a separate line item on your statement.

- Charged by: Your Personal or Business Bank/Card Issuer.

- Typical cost: 1%–3.5% of the transaction value.

4. Currency Conversion Fee (or FX Markup)

This is often the biggest and most deceptive fee because it’s usually hidden. Instead of charging an explicit fee, providers give you an exchange rate that’s worse than the real mid-market rate. That difference, or “markup,” is their profit. For example, the Rs 1.70 difference between a real rate of 1 USD = ₹83.50 and a provider’s rate of 1 USD = ₹81.80 is the hidden fee you pay.

- Charged by: The platform or bank converting the currency.

- Common markup: 2%–4% above the real exchange rate.

Cross-Border Fees in the Indian Context

For Indian businesses and consumers, international transactions are a daily reality. However, each time money crosses India’s borders, a unique set of fees and taxes comes into play. Here’s a detailed look at how these charges apply in common scenarios.

Common Scenarios for Cross-Border Fees in India

- Subscribing to International SaaS and Digital Tools: When your business subscribes to essential tools like Adobe Creative Cloud or Slack, the payment is often processed by their international entities, triggering a foreign transaction fee from your bank and a processing fee from the card network.

- Running Global Advertising Campaigns: Funding your Google Ads or Meta ad account is a classic B2B cross-border transaction subject to multiple fees.

- Receiving Payments as a Freelancer or Exporter: When you invoice a client in the US for $1,000, you will almost never receive the full amount converted to INR. The payment is reduced by intermediary bank fees, platform service charges, and currency conversion losses.

GST on Cross-Border Payments: The OIDAR Rule

If your business in India purchases digital services from a non-Indian provider (like paying for AWS server hosting), 18% GST applies under the OIDAR (Online Information Database Access and Retrieval) rules. Under the Reverse Charge Mechanism (RCM), the responsibility to pay this GST falls on you, the Indian recipient of the service. You must self-calculate and pay the tax to the government during your regular GST filings, and then claim it back as an Input Tax Credit (ITC) if you are eligible.

The Bottom Line for Exporters: Net Payout ≠ Gross Invoice

Let’s illustrate this with a real-world scenario. An Indian freelance developer invoices a US client for $1,000. While the client pays the full amount, the money that actually reaches the developer’s Indian bank account is significantly less after various fees are deducted. Here is a realistic breakdown of how a $1,000 payment can shrink:

In this scenario, over $42 (or more than 4%) of the original invoice value was lost to various cross-border charges. This is why understanding every fee, both visible and hidden, is crucial for protecting your profit margins.

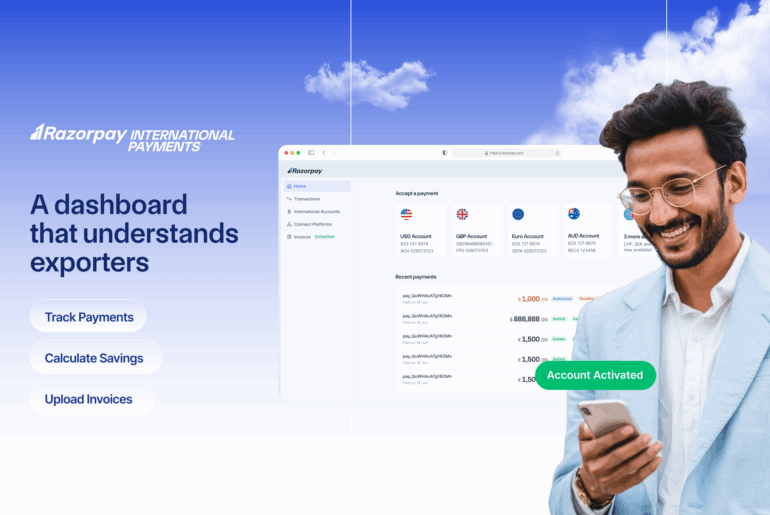

Switch to Razorpay: Transparent Cross-Border Payments, Zero Hidden Fees

Tired of unclear charges, FX losses, and compliance hassles? Razorpay’s Cross-Border Payment Solutions are built for Indian businesses—with full visibility, lower fees, and regulatory peace of mind.

Why Razorpay?

- No FX markups: Get real interbank rates with no surprises.

- Fewer Intermediaries: Benefit from direct global settlement routes.

- Live Currency Conversion: Know exactly what you pay or receive.

- Automated Compliance: GST, FIRC, Softex, and IEC are handled automatically.

- Supports INR & UPI: Let Indian customers pay you in their currency, friction-free.

Join 10,000+ global businesses using Razorpay for secure, compliant cross-border payments. Explore Razorpay’s Cross-Border Solutions

Expanding to Southeast Asia? Accept local payments seamlessly with our Payment Gateway in Malaysia, built for fast settlements, local compliance, and friction-free customer experiences.

FAQs

1.What is a cross-border fee?

A cross-border fee is an umbrella term for charges applied when a financial transaction crosses international borders, for example, when a card issued in India is used at a US-based merchant. This fee covers the costs and complexities of processing payments between different countries and currency systems.

2. What is the cross-border transaction fee for credit cards?

The cross-border transaction fee is a specific charge, typically 1-3% of the transaction value, levied by credit card networks (like Visa/Mastercard) and the card-issuing bank when a card is used for a purchase outside its issuing country.

3. How can I avoid or reduce cross-border processing fees?

To reduce the cross-border processing fee, cross-border sellers and buyers should use a modern payment gateway like Razorpay that offers transparent pricing and direct settlement routes. Using a multi-currency account to pay in the merchant’s local currency can also help avoid unnecessary conversion charges and intermediary fees.

4. Is there GST on cross-border payments from India?

Yes, for certain transactions. An 18% GST is levied on the import of digital services from international companies under OIDAR rules, which is payable by the Indian recipient.

5. How do foreign transaction fees work?

Foreign Transaction Fee (FTF) are charged by your own bank or card issuer as a percentage of the transaction amount whenever you make a purchase in a foreign currency. This fee is a charge for the service of processing an international payment through an international payment gateway and is separate from the currency conversion cost.

6. What’s the difference between foreign transaction and currency conversion fees?

Foreign Transaction Fees are explicit charges from your bank for making an international purchase. In contrast, currency conversion fees are often hidden costs baked into the exchange rate as a “markup,” representing the profit a provider makes for converting one currency to another.