India has become one of the most important markets for global AI SaaS companies. Millions of teams, founders, and fast-growing startups in India adopt AI tools every day. They look for tools that help them ship faster, hire smarter, and operate globally.

CloudHire is one of the companies leading that shift. Today, CloudHire is also one of India’s fastest-growing AI-powered recruitment platforms, connecting job seekers and recruiters seamlessly in one place. It helps businesses hire high-quality talent using AI. Recruiters use CloudHire for pre-screened candidate pools, structured skill-based filtering, and data-driven insights, while job seekers use it to validate skills, improve resumes, and increase visibility. Companies use CloudHire to find, screen, and match candidates with speed and accuracy.

As CloudHire grew, interest from India kept rising. Indian customers were signing up, testing the product, and asking for a simple way to pay locally.

For a US based company, this was the moment that signalled a real opportunity. India was not just another market. It was becoming one of CloudHire’s strongest growth drivers. CloudHire wanted to move fast and meet that demand.

To make that happen, CloudHire needed to adapt to the India way of being. They needed to offer payment methods Indian customers use every day, like UPI. They needed a checkout experience that felt familiar and smooth. They needed to go live fast. And they needed compliance sorted from day one, without setting up an India entity.

This is where the shift happened

CloudHire partnered with Razorpay to make India a market they could enter and scale quickly.

What CloudHire Needed

- To cater to a diverse set of Indian customers & their payments behaviour. UPI Scan and Pay. Debit cards. Credit cards. EMIs. Everything Indians expect.

- A checkout made for India. Fast. Familiar. Zero friction.

- A simple go-live. No heavy lifting. No legal counsel. No compliance maze to navigate.

- INR payments for Indian customers. But, USD settlements in their bank account.

- Reliable infrastructure with high success rates, and no drop offs.

- Timely settlements

How the Partnership Helped

- Every payment method Indians swear by.

UPI, cards, netbanking, EMIs. If Indian customers prefer it, CloudHire now accepts it. One integration. Zero complexity. - A checkout that speaks India.

Fast. Familiar. No friction. CloudHire’s payment flow now feels instantly native to Indian users, which means fewer drop-offs and more completed payments.

- Compliance on autopilot.

No India entity setup. No legal loops. No regulatory guesswork. Razorpay handled PACB, PAPG and all other compliance norms from day one, so CloudHire could focus on growth, not paperwork.

- Local currency for users. Global currency for CloudHire.

Indian customers pay in INR. CloudHire receives settlements in USD. FX, routing, reporting, all taken care of behind the scenes by Razorpay.

- Success rates that actually deliver.

CloudHire now clocks over 90% success rates across flows. No jitters. No drop-offs. Just smooth, reliable payments that keep Indian customers moving from checkout to “done” in seconds.

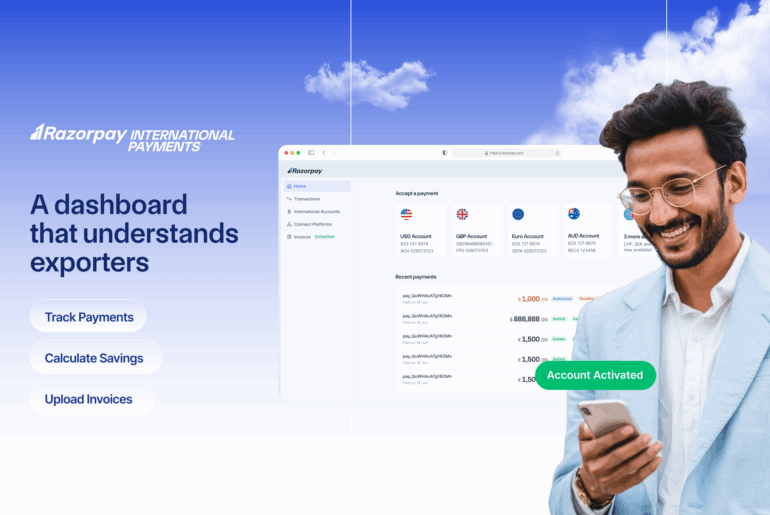

- A dashboard to monitor it all

One view for transactions, settlements, refunds, and alerts. Real-time insights. Automated reconciliation. Less firefighting, more clarity.

AI SaaS companies from across the world are entering India. CloudHire is one more proof that it does not have to be complex.

If you’re a global company and want to serve Indian customers, Razorpay helps you go live fast. No entity. No paperwork. Compliance built in.