Every global business eyeing India sees a colossal opportunity. India’s share in global merchandise imports has more than doubled since 2005, and Foreign Direct Investment hit a record $81.04 billion in FY 2024-25.

India has become one of the world’s most exciting markets for international companies, powered by a rapidly digitising population and soaring online consumption. Today, sectors like SaaS, ed-tech, digital media, travel, and retail present enormous opportunities for global businesses. Until, of course, these businesses encounter the unique challenge of figuring out how India prefers to pay.

India’s payment ecosystem is arguably one of the most advanced and diverse in the world. You need a payment partner who is local, deeply tuned into how India transacts, and built to handle its scale and complexity.

Let’s dive in and unpack why a local partner makes all the difference.

How India Pays: What Global Businesses Need to Understand

India’s payment ecosystem is unique and heavily driven by local preferences. UPI (United Payments Interface) has become the default way people pay because it is instant, free, and works across banks and apps, making transactions quick and hassle-free. It drives 80% of digital retail payments in India.

RuPay, India’s local card network, is widely trusted and increasingly used among consumers. It’s the network most deeply integrated with UPI, allowing credit cards to be used directly through UPI apps. RuPay now accounts for nearly 16% of all credit-card spending in India, and half of that happens via UPI.

For recurring or subscription payments, eMandates are the preferred method, allowing auto-debits without manual approvals or repeated OTPs, giving consumers a convenient, predictable, and frictionless payment experience.

For global businesses, this means that offering the right local payment methods is critical. Indian consumers expect simplicity and speed at checkout, and familiar options like UPI, cards, credit cards, Netbanking, and local wallets build trust and encourage completion.

Key Challenges for Global Businesses Entering India

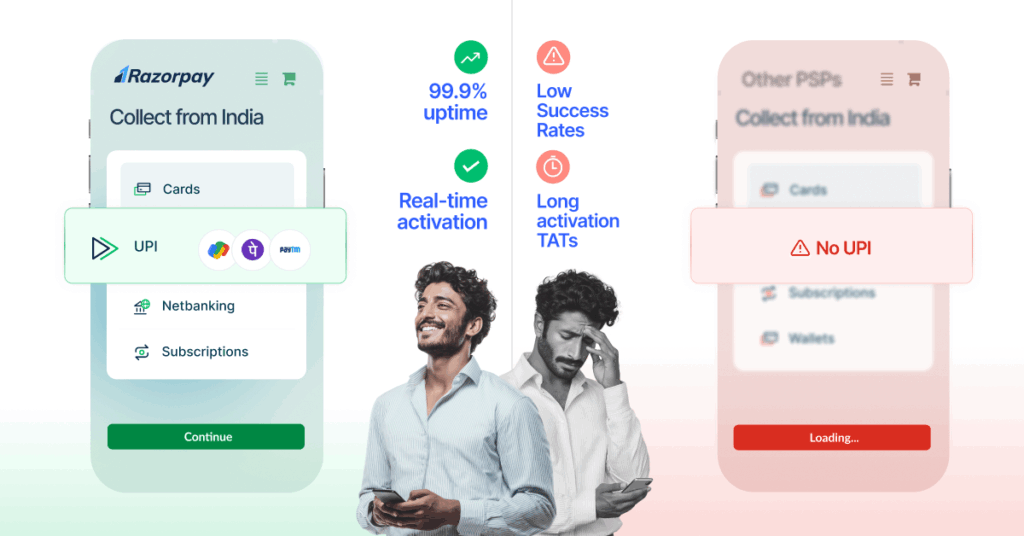

- UPI-First Market

Over 80% of online payments in India now happen through the UPI. Most global Payment Service Providers (PSPs) either don’t offer UPI as a Payment method or offer it via third-party integrations, which leads to poor success rates, failed transactions and frustrated customers. Subscriptions in India depend heavily on UPI AutoPay. PSPs without deep AutoPay support see recurring transactions fail frequently, leading to churn, revenue leakage, and inconsistent monthly billing.

- Compliance Complexity

India has a unique set of regulatory rules, including the PA CB (Payment Aggregator – Cross Border) guidelines by RBI Reserve Bank of India (RBI), Liberalised Remittance Scheme (LRS) norms, and Tax Collected at Source (TCS) requirements. Managing these manually yourself requires deep expertise and significant investment in time, energy, and resources.

- Currency Volatility and High Costs

Converting Indian Rupees (INR) to foreign currencies exposes businesses to exchange rate fluctuations. Traditional cross-border payments involve multiple intermediary banks, causing high fees, hidden costs, and settlement delays that can impact profit margins and cash flow management.

Without proper resources and knowledge, navigating India’s payment landscape can be frictional.

Hence, you need a local payment partner…

Why Razorpay is the best Partner for India Expansion

- Full access to all Indian Payment Methods

Razorpay gives global businesses a compliant gateway to India’s unique and diverse payment methods, essential for customer conversion.

- UPI and Local Wallets: Accept payments via the UPI, local wallets like Google Pay, and NetBanking from over 58 Indian banks.

- RuPay Card Acceptance: Increase conversions by offering RuPay debit and credit cards that are widely used in India.

- Recurring Payments: Facilitate recurring payments via UPI AutoPay, card mandate options, critical for subscription-based businesses in SaaS, OTT, and ed-tech categories.

Navigating Regulatory & Compliance Complexities

Razorpay removes much of the regulatory friction, allowing global businesses to operate smoothly without a local entity in India.

- RBI & FEMA Compliance : Razorpay is fully authorized under the PA–CB (Payment Aggregator Cross-Border) framework, which means all transactions are processed in strict alignment with RBI and FEMA regulations. You don’t need to build your own local infrastructure or figure out complex regulatory flows, Razorpay takes care of it.

-

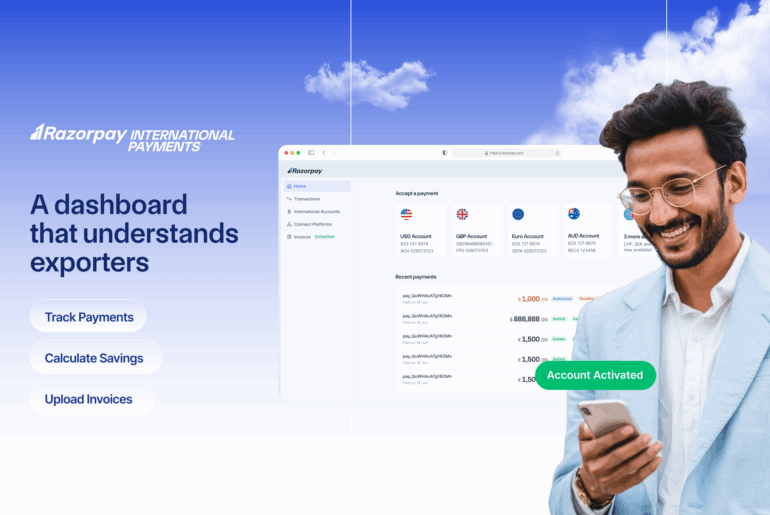

- Automated Regulatory Documentation: Key compliance documents like the Foreign Inward Remittance Certificate (FIRC) are generated automatically from Razorpay’s dashboard. What could take weeks or involve manual bank processes happens with a few clicks.

- Seamless Onboarding with Video KYC: Razorpay uses video KYC for merchant onboarding, per RBI’s PA–CB KYC rules. This means global businesses can verify their authorized signatories remotely, without physically navigating Indian KYC norms

- Data Localisation & Security: As a licensed PA in India, Razorpay complies with India’s data localisation mandates and adheres to PCI DSS Level 1 security standards. This setup safeguards sensitive transaction data within India while maintaining global-grade security.

Financial & Operational Efficiency

Razorpay streamlines money flows, making operations faster, transparent, and more predictable.

- Faster Settlements: Funds settle quickly, often within T+2 days, compared to traditional banking channels.

- Foreign Exchange Conversion: Payments collected in INR can be settled in your preferred currency at competitive, real-time foreign exchange rates and fully transparent conversion fees.

- Real-time Activation: Fast, tech-first onboarding with minimal documentation enables global businesses to activate within a few seconds.

Leverage A Network Of 100m+ Customers

With 100 million saved addresses, your customers can check out in under 9 seconds

- Enhanced Checkout Experience: Repeat customers benefit from a frictionless, pre-filled checkout flow with locally relevant payment recommendations, reducing drop-offs and boosting successful payments.

- Smarter Customer Engagement: Access to rich network insights enables personalised post-purchase communication across channels like email, SMS, and WhatsApp, helping you improve retention and customer experience.

- Operational Intelligence: With billions of transactions flowing through its network annually, Razorpay offers stronger fraud detection, better optimisation, and real-time analytics to support informed decision-making.

Payment Solutions for All Industries

Razorpay also offers tailored features and solutions that directly support the specific needs of businesses in the SaaS, ed-tech, digital media, travel, and retail sectors.

| Industry | Razorpay Solutions | How It Helps | |

| SaaS & Ed-Tech | Recurring payments across Payment methods-UPI, Cards. EMIs, Credit line available. |

|

|

| Digital Media | Payment links & pages, subscription flows, one-click checkout, revenue analytics | Enables monetisation of premium content, memberships, and micro-transactions with fast, low-friction payment experiences. | |

| Retail & Travel | Omnichannel payments, dynamic UPI QR codes, POS devices, integrated storefronts, travel booking integrations with EMI/BNPL | Provides a seamless online and offline payment experience, offering flexibility, speed, and multiple payment options for customers. | |

| Marketplaces & Platforms | Split payments, onboarding & KYC flows, escrow-like settlements, partner payouts | Simplifies marketplace compliance, automates payouts to sellers/vendors, and ensures audit-ready reconciliation.` |

To sum it up…

Entering the Indian market comes with its own set of challenges, from complex regulations to uniquely local payment preferences. But you don’t have to worry about any of it. With Razorpay as your local payment partner, all the heavy lifting is taken care of so you can focus on growing your business in India.