If you’re building a SaaS company or exporting software services from India, you’re likely focused on product development, customer acquisition, and growth. But there’s a small, crucial detail in your payment process that can make a world of difference: a purpose code. Specifically, the P0802 purpose code.

Navigating international payments can feel like a maze of regulations. You’ve closed a deal with an overseas client, the invoice is sent, and the payment is on its way. But how does the Indian banking system know that this money is for the software you sold and not something else? That’s where purpose codes come in.

For any Indian business earning revenue from abroad, understanding these codes is essential for compliance with RBI and FEMA guidelines. The P0802 code, in particular, is the key to unlocking seamless transactions, easier GST refunds, and stress-free compliance for software exporters. Let’s break down what it is and why it matters so much.

Key TakeawaysWhat is P0802? It’s an RBI-mandated code used to classify inward remittances received for software services, including consultancy, development, and SaaS subscriptions. Why is it important? It’s mandatory for FEMA compliance, generating the crucial e-FIRA (Foreign Inward Remittance Advice), and claiming GST refunds on exports. Who uses it? SaaS companies, IT service providers, software consultants, and freelancers who serve international clients. The Bottom Line: Using the correct purpose code isn’t just a regulatory formality; it ensures you get paid faster, stay compliant, and simplify your financial operations. |

What Is Purpose Code P0802?

Think of a purpose code as a label you attach to money coming into India from abroad. This label tells the Reserve Bank of India (RBI) the exact reason for the payment. Each type of service or transaction has its own unique code.

The purpose code P0802 is officially designated by the RBI for: “Remittance for Professional/Management Services or Software services.”

This is the specific code you must use when your Indian bank account receives payments from foreign clients for services like:

- Software development and implementation.

- SaaS subscriptions.

- IT consultancy and support.

- Any form of technology or software-related service exports.

Why P0802 Matters for Exporters

At first glance, it might seem like a minor administrative detail. However, the correct use of P0802 has significant implications for your business operations and financial health.

Regulatory Significance

India’s foreign exchange transactions are governed by the Foreign Exchange Management Act (FEMA). The RBI uses purpose codes to monitor these transactions and ensure they comply with national regulations. By classifying your income under P0802, you are accurately declaring the nature of your export business to the authorities, ensuring you remain fully compliant and avoid any potential red flags.

GST & FIRA Relevance

This is where the code directly impacts your bottom line. To prove that your income is from exports—making you eligible for GST benefits like refunds or zero-rated exports under a Letter of Undertaking (LUT)—you need proof.

The most critical piece of evidence is the e-FIRA (Electronic Foreign Inward Remittance Advice), a document issued by your bank confirming the receipt of foreign funds. The e-FIRA mentions the purpose code used for the transaction. If your e-FIRA clearly states P0802, it serves as undeniable proof that the payment was for software exports, making your GST filings and refund claims much smoother.

| Did You Know?

An e-FIRA isn’t just a receipt; it’s a legally recognized document that acts as a bridge between your bank and the tax authorities. It certifies that your earnings are legitimate export revenue, which is essential for availing government schemes and tax exemptions designed for exporters. |

How to Apply P0802 in Your Business Flow

Integrating the P0802 code into your workflow is straightforward. The key is to be proactive and clear in your communication.

Here’s a step-by-step breakdown:

- Submit Your Invoice: When you create an invoice for your international client, explicitly mention the purpose code. Add a line like: “Purpose Code for this remittance: P0802 (Software Services)”.

- Buyer Makes the Payment: Your client initiates the payment from their bank abroad.

- Funds Arrive in India: The payment first lands in your bank’s Nostro account (a foreign currency account).

- Bank Records the Code: When your bank processes the remittance to credit your Indian account, they will ask for or refer to the purpose code. Your instruction on the invoice makes this step seamless.

- Receive Your e-FIRA: Once the payment is credited, your bank generates an e-FIRA or a SWIFT payment advice, which will clearly mention the purpose code P0802.

- File for Compliance: Use this document as proof of export revenue for your GST filings, accounting, and any other regulatory requirements.

| Pro Tip: Always include the P0802 purpose code directly on your invoices. This simple habit minimizes back-and-forth communication with your bank and ensures your payments are processed and categorized correctly from the very beginning. |

Who Should Use P0802?

The P0802 code is designed for a specific segment of the Indian export economy. You should be using this code if you are:

- A SaaS Company: Billing international customers for monthly or annual subscriptions.

- An IT Services Firm: Exporting services like software development, cloud management, cybersecurity, or IT support.

- A Software Consultant or Freelancer: Providing specialized tech expertise to clients outside India.

- Any Business Exporting Software: Especially those operating under a LUT or claiming IGST exemptions for zero-rated exports.

It’s important to note that P0802 is generally for services not covered under the SOFTEX form, which is required for the export of physical software or software transmitted via data communication links.

Common Mistakes to Avoid

A simple mistake in coding can lead to payment delays, compliance headaches, and unnecessary queries from your bank. Here are a few common errors to watch out for:

- Wrong Coding: Using a code meant for something else. For example, using P0452 (export of goods) for a software service will create a mismatch and cause processing delays.

- Missing Purpose Code: Failing to mention the purpose code on invoices or in payment instructions. This forces the bank to follow up, delaying your access to the funds.

- Mismatch in Documentation: Ensuring the service described on your invoice (“SaaS Subscription,” “Software Development”) aligns with the P0802 code. Any discrepancy can raise questions.

Did You Know?

Getting your purpose code right isn’t just about ticking a compliance box; it’s about getting paid faster and keeping your financial records clean and audit-proof.

COMPARISON – P0807 vs. P0802

Both P0807 and P0802 fall under software-related exports, but their use cases are different. Choosing the right one depends on the nature of the work.

| Purpose Code | When to Use | Typical Services | Requires SOFTEX? |

| P0807 | Off-site software export from India | SaaS, remote development, licensing, maintenance | Yes (in most cases) |

| P0802 | Software consultancy or implementation | Advisory work, on-site deployment, custom consulting | No |

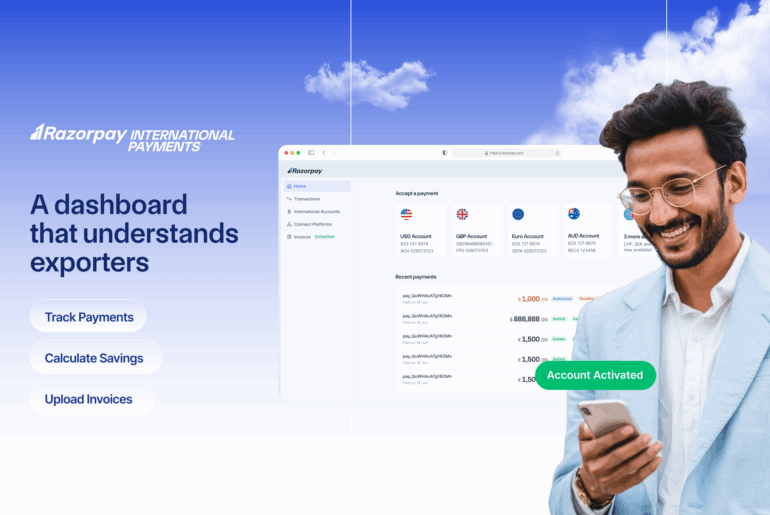

Accept Export Payments Compliantly with Razorpay International

Manually managing purpose codes, generating compliant invoices, and chasing banks for e-FIRAs can be a significant operational drag, especially as your business scales. This is where a robust payment platform becomes essential.

Razorpay International is designed to automate and simplify this entire process.

- Automated Compliance: It automatically tags your international payments with the correct purpose code like P0802, removing the risk of human error.

- Seamless Payments: Receive payments from over 100 countries in their local currencies, all mapped to the proper export categories for easy reconciliation.

- e-FIRA Ready: Razorpay provides all the necessary documentation in an e-FIRA-ready format, making your compliance and GST filing processes incredibly smooth.

- Easy Integration: Whether you use Shopify, WooCommerce, or a custom-built website, Razorpay integrates effortlessly to create compliant invoices and payment flows.

Simplify International Payments with Razorpay

Simplify your export compliance

Conclusion

For Indian software exporters, the P0802 purpose code is more than just a number. It’s a fundamental tool for ensuring regulatory compliance, simplifying bank documentation, and unlocking financial benefits like GST refunds.

By understanding its importance and integrating it correctly into your invoicing and payment workflow, you can avoid common pitfalls and focus on what you do best—building and selling world-class software. Combining this knowledge with powerful platforms like Razorpay can transform your international payment operations from a complex chore into a seamless, automated part of your business.

FAQ Questions

What does P0802 purpose code stand for?

P0802 is an RBI-designated code for inward remittances related to “Software services,” which includes software consultancy, development, implementation, and SaaS subscriptions.

When should I use P0802 instead of other codes?

Use P0802 specifically for software and IT-related services. You should not use it for exporting physical goods (P0452) or for general non-IT consultancy (S0802). The key is to match the code to the exact nature of the service you provided.

Is P0802 mandatory for SaaS export payments?

Yes, it is mandatory. All inward remittances must be classified with the correct purpose code to comply with FEMA regulations. For SaaS payments from foreign customers, P0802 is the appropriate code.

What happens if I use the wrong purpose code?

Using the wrong code can lead to several problems: your bank may put the transaction on hold and ask for clarification, the payment could be delayed or even rejected, and it can create major issues during GST audits when your e-FIRA doesn’t match your declared business activity.

How does P0802 appear in an e-FIRA or bank advice?

In an e-FIRA or a SWIFT advice document, there will be a specific field for “Purpose of Remittance” or “Purpose Code,” where “P0802” will be mentioned along with a brief description like “Software Consultancy.”