Receiving money from another country should be a simple affair. Yet for many Indian freelancers, exporters, and businesses, it often comes with a set of confusing questions. Why did a payment take five days to arrive? Why is the final credited amount slightly less than what was sent? What do terms like ‘intermediary bank’ or ‘correspondent bank’ even mean?

This feeling of uncertainty arises because international payments don’t travel in a straight line from your client’s bank to yours. They move through a carefully structured global network built for safety and compliance.

At the very heart of this system is a fundamental tool you’ve likely never dealt with directly, but which impacts every foreign payment you receive: the Nostro Account.

Understanding what a Nostro account is, how it works, and why it exists is the key to demystifying international payments. This guide will explain it all in simple terms, helping you understand the complete journey of your money from abroad to your Indian bank account.

What is a Nostro Account?

A Nostro account is a bank account that a domestic bank (like SBI in India) holds with a foreign bank (like Chase Bank in the US), denominated in the currency of that foreign country.

The term Nostro comes from the Latin word for “ours.” So, when an Indian bank refers to its Nostro account, it’s literally saying:

“This is our account that we hold with your bank.”

For example, HDFC Bank holding a US Dollar account with Citibank in New York is HDFC’s Nostro account. This account allows HDFC to handle USD transactions for its Indian customers without needing a physical branch in the United States. It’s like having a dedicated wallet for foreign currency, kept safely with a partner bank abroad.

| Did You Know? The Other Side of the Coin

What does the foreign bank (Citibank, in our example) call this account? They call it a Vostro account. Vostro is Latin for “yours.” So, from their perspective, it’s “your account held with us.” It’s the very same account, just viewed from two different perspectives. Nostro = Our account with you. Vostro = Your account with us. |

Purpose of Nostro Accounts in Business and Banking

So, why do banks go through the trouble of setting up these accounts? Nostro accounts are the backbone of international trade and finance. They serve several critical functions:

- Enabling Foreign Currency Settlements: They are the primary channel for settling cross-border transactions. When a client pays you in USD, the funds first land in your bank’s USD Nostro account.

- Facilitating Trade Finance: Exporters and importers rely on these accounts for everything from wire transfers to managing letters of credit.

- Simplifying Compliance: For Indian exporters, payments received through proper Nostro channels are essential for generating an e-FIRA (Electronic Foreign Inward Remittance Advice). This document is crucial proof of an export transaction for regulatory purposes with the RBI and for claiming tax benefits.

Nostro Account Example: A Real-Life Scenario

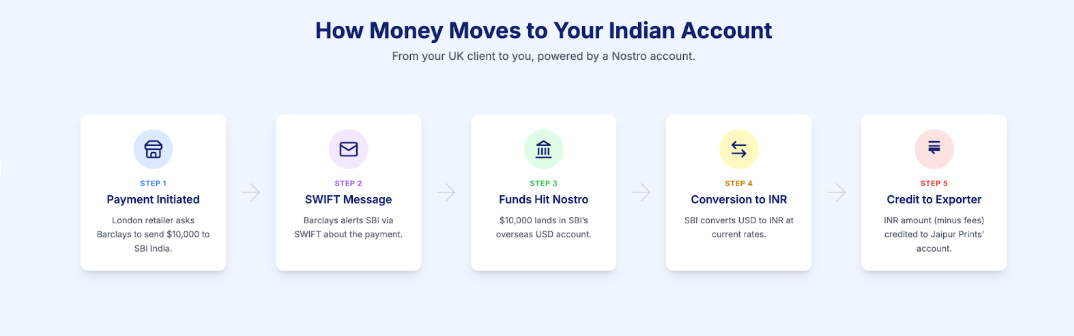

Let’s make this crystal clear with a step-by-step example.

Imagine an apparel exporter in Jaipur, “Jaipur Prints,” sells a shipment of scarves worth $10,000 to a retail store in London.

Here’s how the Nostro account makes the payment happen:

- Payment Initiation: The London retailer instructs their UK bank (say, Barclays) to send $10,000 to Jaipur Prints’ bank, which is SBI in India.

- SWIFT Message: Barclays sends a SWIFT (Society for Worldwide Interbank Financial Telecommunication) message to SBI, notifying them of the incoming payment.

- Funds Hit the Nostro Account: The $10,000 is transferred from Barclays to SBI’s Nostro account, which might be held at a correspondent bank in the UK or the US. The funds are now sitting in SBI’s USD-denominated account abroad.

- Conversion to INR: Once SBI receives confirmation that the funds are in its Nostro account, its treasury department converts the $10,000 into Indian Rupees (INR) at the prevailing exchange rate.

- Credit to Exporter: SBI then credits the final INR amount (after deducting any applicable fees) into the Jaipur Prints’ local current account in India.

Throughout this process, Jaipur Prints never had to open a UK bank account or handle foreign currency directly. Their Indian bank did all the heavy lifting using its Nostro account.

Nostro Account Charges Explained

While Nostro accounts are efficient, they aren’t free. When you receive an international payment, several charges may be deducted before the money hits your account. Understanding them helps you forecast your earnings more accurately.

Here’s a breakdown of common charges:

| Charge Type | Details |

| Maintenance Fees | Foreign banks charge Indian banks a fee to maintain the Nostro account. This is usually an internal cost, but can influence other fees. |

| Intermediary/Lifting Fees | This is the most common “hidden” fee. The foreign bank holding the Nostro account deducts a charge for processing the incoming wire. It can range from $15 to $50 per transaction. |

| Conversion Charges | This is the bank’s markup on the foreign exchange (forex) rate. The rate you get is never the same as what you see on Google; banks add a small margin to make a profit on the currency conversion. |

| SWIFT Transfer Fees | Your Indian bank will charge a fixed fee for handling the incoming remittance and processing the SWIFT transaction. This typically ranges from ₹500 to ₹1,500. |

| Pro Tip: Ask for the SWIFT Copy!

If you feel the deductions on your payment are too high, ask your bank for the MT103 SWIFT copy. This document details the entire transaction path, including any fees deducted by intermediary banks. It provides full transparency on where your money went. |

How Do Indian Exporters Use Nostro Accounts?

This is a crucial point: Indian exporters and freelancers do not open or operate Nostro accounts directly. Instead, the entire process is handled by their bank. Here’s how it works:

- An exporter provides their international client with their standard Indian bank account details and their bank’s unique SWIFT/BIC code.

- The foreign currency payment (e.g., USD, EUR) is then routed to the Indian bank’s Nostro account, which is held with a correspondent bank in that currency’s home country.

- The Indian bank handles the currency conversion, exchanging the foreign funds into Indian Rupees (INR) at the applicable rate.

- After conversion, the final INR amount is credited to the exporter’s local business account in India.

- Finally, the bank issues an electronic Foreign Inward Remittance Advice (e-FIRA) for the transaction, which is the official document confirming the receipt of export earnings for compliance purposes.

Is a Nostro Account Required for Receiving USD Payments?

Yes, absolutely. But it’s the bank’s Nostro account that’s required, not one in an exporter’s name.

Every single B2B cross-border payment that comes into India via banking channels like SWIFT must pass through a Nostro account of an RBI-authorized bank. This is a non-negotiable part of the regulated payment system, ensuring all foreign exchange transactions are tracked and compliant with FEMA (Foreign Exchange Management Act) guidelines.

Myth vs. Fact: International Payments

| Myth | Fact |

| “I need to open a US bank account to receive dollars.” | No, your Indian bank uses its own USD Nostro account to receive the funds on your behalf before converting them to INR for you. |

| “SWIFT transfers are instant.” | SWIFT is a secure messaging system, not an instant payment network. The actual funds can take 1-5 days to settle as they move between banks and Nostro accounts. |

| “The exchange rate I see on Google is the rate I’ll get.” | Banks apply a foreign exchange (forex) markup to the base rate. This is a standard part of their fee structure. |

Accept USD, EUR & GBP Payments Seamlessly – Razorpay International

Worrying about SWIFT codes, intermediary fees, and Nostro account complexities can distract you from what you do best: growing your business.

With Razorpay International, you can sidestep the banking jargon and just get paid. We handle the complexity of cross-border payments so you don’t have to. Your foreign payments simply land in your Indian bank account in INR, compliantly, securely, and fast.

Here’s what Razorpay offers Indian exporters:

- Accept Payments in 100+ Currencies: Invoice clients in their local currency, from USD and EUR to AED and SGD.

- Get Paid in INR: No need to manage foreign currency accounts. We handle the conversion and settlement directly to your Indian bank account.

- Automated Compliance: We help with auto-purpose code tagging and provide e-FIRA-ready reports, making your life easier.

- Zero Setup Hassles: Get started with no setup fee and no need to coordinate with foreign banks.

Razorpay is the ideal solution for D2C brands, freelancers, consultants, and SaaS businesses looking to go global without the operational headaches.

Conclusion

The Nostro account is a fundamental pillar of global trade, acting as the bridge that connects your Indian bank account to the rest of the world. While you may never interact with it directly, its efficiency determines how quickly and cost-effectively you get paid.

For Indian exporters, understanding this mechanism provides clarity on the cross-border payment process. However, the best part is that with modern financial platforms, you no longer need to get bogged down by the underlying banking layers. You can focus on delighting your global customers and scaling your business, confident that the payments will take care of themselves.

FAQs

-

Can individuals open a Nostro account?

No, individuals and regular businesses cannot open Nostro accounts. They are exclusively maintained by banks and authorized financial institutions to facilitate international transactions for their customers.

-

What’s the difference between a Nostro and a Vostro account?

They are the same account but viewed from different perspectives. Nostro (“ours”) is what your Indian bank calls its foreign currency account held with a bank abroad. Vostro (“yours”) is what that foreign bank calls the exact same account.

-

Do freelancers benefit from Nostro-backed payments?

Yes, immensely. When a payment platform or bank uses an efficient Nostro network, freelancers receive their international payments faster, with potentially lower intermediary fees, and with the proper documentation (like e-FIRA) needed for compliance.

-

How can I check if my funds are held in a Nostro account?

You cannot check this directly. All legitimate international wire transfers to India are routed through a bank’s Nostro account by default. If you see a “correspondent bank charge” or “intermediary bank fee” on your statement, it’s a sign that the payment passed through a Nostro account.

-

Which Indian banks have Nostro accounts?

All major AD (Authorised Dealer) Category-I banks in India, such as the State Bank of India (SBI), HDFC Bank, ICICI Bank, and Axis Bank, maintain Nostro accounts in various major currencies like USD, EUR, GBP, JPY, and more to serve their clients.