About 1% Club: Empowering India’s Financial Freedom Movement

1% Club is India’s fastest-growing finance education platform. Originally launched as a community-led edtech initiative under the Finance With Sharan brand, it has since evolved into a full-stack financial services provider, spanning education, SEBI-registered investment advisory, insurance advisory, credit card advisory, financial products, and more.

With over 5 Lac students trained and 1 Lac+ members, the company runs high-engagement, high-volume digital programs—and relies on fast, trusted payment infrastructure to deliver frictionless conversion at scale.

With over 5 Lac students trained and 1 Lac+ members, the company runs high-engagement, high-volume digital programs—and relies on fast, trusted payment infrastructure to deliver frictionless conversion at scale.

The Challenge: Managing Conversions During 5-Minute Payment Surges

For 1% Club, payments aren’t just a back-end function—they’re mission-critical. Their entire revenue model hinges on real-time conversion during masterclasses, where 80–90% of purchases happen within a 5-minute window after a product pitch.

Key challenges included:

High-Spike Transaction Windows

During a masterclass, hundreds of users rush to pay in short bursts—often within a 5-minute window. Without a payment system built to handle such peaks, even a slight lag can lead to failed checkouts, abandoned signups, and lost revenue opportunities.

The Trust Factor in Finance

When you’re guiding users on how to grow and protect their money, trust becomes non-negotiable. A secure, reliable, and familiar payment experience is key—not just for smooth checkouts, but for reinforcing credibility in a sensitive, finance-first space.

Terminal Access & Bank Integrations

A large chunk of users preferred HDFC Bank for payments. But enabling HDFC card terminals is often slow and complex. Hence, getting access to these terminals was a challenge.

The Solution: Trust, Speed, and Scale with Razorpay

From their early days on partner platforms to owning their full tech stack, 1% Club has relied exclusively on Razorpay. As their payments scaled, so did their Razorpay setup.

Real-Time High-Volume Handling (Razorpay PG)

Razorpay’s gateway consistently delivered even during payment spikes post-masterclasses. With 200–300 transactions hitting within minutes, the platform’s uptime and fail-safe UPI routing helped One Percent Club maintain seamless user experiences.

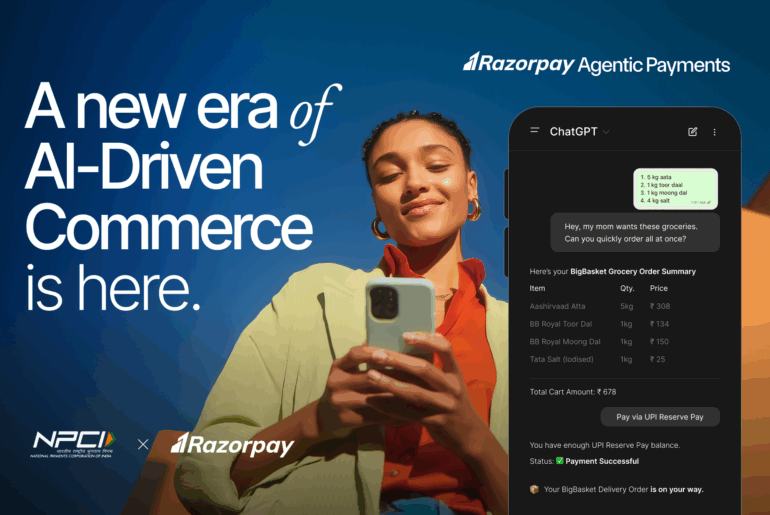

UPI-First Conversions at Scale

UPI accounts for the majority of all transactions. Razorpay’s instant validation tools and VPA accuracy features ensured faster processing, fewer retries, and higher trust among users during decision-critical moments.

Enabling Key Acquirers Like HDFC

Razorpay enabled 1% Club to activate HDFC Netbanking and Credit Card EMI, addressing demand from a large chunk of their customer base. While HDFC’s onboarding process is known to be strict, Razorpay helped expedite setup and navigate compliance.

What’s Next: From Edtech to Full-Stack Fintech

With verticals now spanning investments (SEBI RIA), insurance advisory, and credit card advisory, 1% Club is building a 360° financial services platform. Razorpay will remain central to this transition—powering secure, real-time payments as the brand expands deeper into advisory-led offerings and recurring revenue models.

Interested in Razorpay’s offerings? Chat with a product expert now.