Introduction

In 2025, as initiatives like ‘Make in India‘ expand their global outreach, India’s international trade and digital service exports are projected to grow significantly. For Indian businesses, this means more engagement in cross-border commerce, making the efficient management of B2B cross-border payments a crucial factor for success. However, complexities such as regulatory compliance, high costs, and payment delays pose significant challenges.

This guide unpacks everything Indian businesses need to know to navigate, optimize, and future-proof their B2B cross-border payments in 2025 and beyond.

Table of Contents

Key Aspects of B2B Cross-Border Payments: 2025 Snapshot

B2B cross-border payments are financial transactions between businesses located in different countries. They are more complex than domestic payments as they involve navigating different currencies, regulations, and payment networks. Here are the key aspects to understand.

A Cornerstone of International Trade

B2B cross-border payments are the fundamental mechanism that facilitates global trade. They allow Indian businesses to purchase goods from international suppliers, acquire global services, and move capital across borders seamlessly.

Navigating Inherent Complexity

Compared to domestic payments, cross-border transactions involve significant complexities. These include mandatory currency conversion, adherence to international regulations like FEMA, and potential delays due to the involvement of multiple intermediary banks.

A Substantial and Growing Market

The B2B cross-border payments market is massive. According to market data from FXC Intelligence, it is projected to reach $47.8 trillion by 2032, driven by the increasing volume of global trade.

Overcoming Common Challenges

Businesses often face challenges such as high transaction fees, volatile exchange rates, complex compliance requirements, and the risk of fraud or payment errors. Modern solutions are designed to mitigate these issues. For instance, an Indian textile exporter paying a UK marketing agency £5,000 might face an opaque exchange rate, hidden wire transfer fees, and the burden of declaring the correct RBI purpose code.

Why Indian Businesses Increasingly Rely on Cross-Border Payments

-

Facilitating Import & Export Transactions:

This is the primary use case, from paying international suppliers for raw materials to receiving payments for exported goods and services. This directly supports national initiatives like the Production Linked Incentive (PLI) schemes.

-

Managing Global Vendor & Contractor Payments:

Indian companies are increasingly hiring overseas talent and agencies, which requires a seamless way to manage international payroll.

-

Handling International SaaS Subscriptions & Licenses:

Businesses rely on global software tools and must make regular payments for subscriptions and intellectual property rights.

-

Inter-Company Fund Transfers:

Indian MNCs and startups with global offices need to efficiently manage finances between their parent companies and overseas subsidiaries.

What Are the Common Methods for B2B Cross-Border Payments?

Choosing the right payment method is critical for balancing cost, speed, and compliance. Businesses typically choose between traditional channels and modern digital solutions.

Traditional Banking Methods

These methods are well-established and often used for large, high-value transactions.

- Wire Transfers (via SWIFT): This is a long-standing method where banks use the secure SWIFT network to send payment instructions. It is highly secure but can be slower (2-5 days) and more expensive due to fees from intermediary banks.

- Automated Clearing House (ACH) Payments: An electronic network used for batch processing of transactions. International ACH can be more cost-effective than wire transfers but is generally slower.

- Credit Cards: Using corporate credit cards is a convenient option for smaller, recurring payments like software subscriptions, but it can come with high foreign transaction fees.

Modern FinTech Solutions

These platforms are designed to overcome the challenges of traditional methods.

Digital Payment Platforms (like Razorpay): These solutions offer a streamlined, online experience with faster settlement times, transparent fees, and competitive exchange rates. They often provide automated compliance and integration with accounting software, making them highly efficient.

Key Challenges Indian Businesses Face with B2B Cross-Border Payments

-

High Costs, Hidden Fees & FX Volatility Losses:

Businesses often lose money to markups on foreign exchange rates, hidden correspondent bank charges, and the impact of INR volatility.

-

Navigating Complex Regulatory Compliance:

Managing documentation for FEMA, RBI, GST, and TCS on Foreign Remittance can be a major burden. This includes handling documents like the Foreign Inward Remittance Certificate (FIRC).

-

Payment Delays, Tracking Issues & Reconciliation Nightmares:

Multi-day settlement times, a lack of real-time visibility, and difficulty matching payments to invoices create significant operational friction.

-

Security Risks & Sophisticated Fraud:

Indian businesses are increasingly targeted by Business Email Compromise (BEC) scams and phishing attempts related to international invoices.

-

Integration with Existing Accounting & ERP Systems:

Ensuring seamless data flow between payment platforms and Indian accounting software like Tally or Zoho Books is a common technical hurdle.

The Future of B2B Cross-Border Payments in India (2025-2030)

-

Deeper API-Driven Embedded Payments:

Cross-border payments are becoming an invisible, integrated part of Indian ERP, procurement, and supply chain finance platforms.

-

The Shift to Cloud-Based Payment Solutions:

Cloud technology is being rapidly adopted for cross-border payments, offering benefits like enhanced security, real-time processing, better scalability to handle high transaction volumes, and cost efficiency.

-

Wider Adoption of Global Standards like ISO 20022:

This standard improves data richness in payments, facilitating better compliance reporting and automated reconciliation. You can learn more at the official ISO 20022 website.

-

AI & ML Enhancing Security and Efficiency:

Artificial Intelligence will be used for advanced fraud detection, optimizing payment routing, and automating complex compliance for Indian businesses.

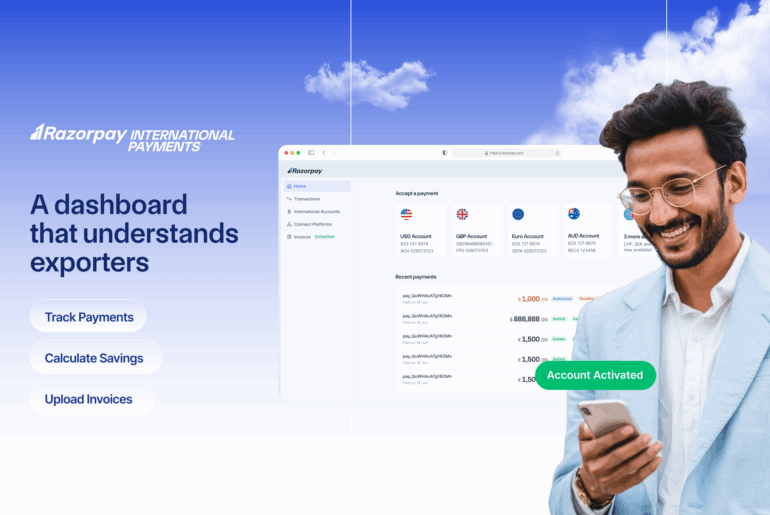

Power Global B2B Cross-Border Payments with Razorpay

Razorpay’s platform is built specifically for Indian regulatory needs, offering automated FIRC generation, competitive INR FX rates, and dedicated support. With real-time tracking, automated compliance, and seamless integration with popular Indian ERPs, Razorpay empowers Indian businesses to manage international payments efficiently.

Get Started with International Payment Gateway

FAQs

1. What are B2B cross-border payments for Indian businesses?

B2B cross-border payments are regulated financial transactions where Indian businesses send or receive funds internationally. They enable payments for imports, exports, global vendors, and SaaS subscriptions, all while requiring compliance with RBI and FEMA rules.

2. What are the biggest challenges in B2B cross-border payments for companies in India?

The biggest challenges include high costs from FX markups and hidden fees, navigating complex RBI/FEMA compliance, multi-day settlement delays with limited payment visibility, difficult reconciliation, and rising fraud risks.

3. How can Indian businesses simplify global B2B payments and FEMA compliance?

Indian businesses can simplify payments by using fintech platforms like Razorpay that automate compliance documentation, offer multi-currency accounts, integrate with accounting software, and provide real-time payment tracking to reduce manual effort and errors.

4. Are B2B cross-border payments from India safe and compliant with RBI rules?

Yes, when processed via RBI-authorized banks or regulated fintechs like Razorpay, cross-border payments are highly secure. They are designed to comply with all KYC, AML, and FEMA regulations, ensuring automated compliance and proper documentation.

5. What is the role of an AD Code in Indian cross-border payments?

The AD (Authorized Dealer) Code is a unique code that identifies the bank handling a business’s foreign exchange transactions. It is mandatory for customs clearance of goods and ensures that all payments are linked to an authorized bank for RBI compliance and reporting.

6. How does TDS/TCS apply to international B2B payments from India?

Indian businesses may need to deduct TDS (Tax Deducted at Source) on certain overseas payments, like royalties or professional fees, according to the Income Tax Act and Double Taxation Avoidance Agreements (DTAA). TCS (Tax Collected at Source) can also apply to specific foreign remittances.